Roman Butler Fullerton & Co. increased its position in ADMA Biologics, Inc. (NASDAQ:ADMA - Free Report) by 241.6% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 107,626 shares of the biotechnology company's stock after buying an additional 76,121 shares during the quarter. Roman Butler Fullerton & Co.'s holdings in ADMA Biologics were worth $2,151,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

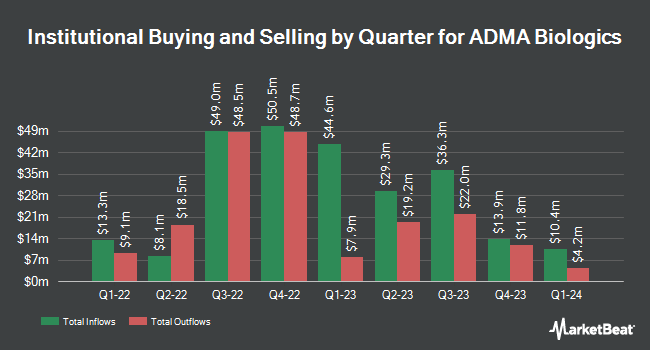

A number of other institutional investors also recently made changes to their positions in ADMA. Quest Partners LLC bought a new stake in ADMA Biologics during the 2nd quarter valued at $29,000. EntryPoint Capital LLC purchased a new position in shares of ADMA Biologics in the first quarter valued at about $31,000. USA Financial Formulas raised its stake in shares of ADMA Biologics by 8.6% during the third quarter. USA Financial Formulas now owns 6,817 shares of the biotechnology company's stock valued at $136,000 after acquiring an additional 539 shares during the last quarter. CWM LLC boosted its holdings in shares of ADMA Biologics by 114.2% during the second quarter. CWM LLC now owns 8,192 shares of the biotechnology company's stock worth $92,000 after purchasing an additional 4,367 shares during the period. Finally, Acadian Asset Management LLC purchased a new stake in shares of ADMA Biologics during the second quarter worth about $93,000. Hedge funds and other institutional investors own 75.68% of the company's stock.

ADMA Biologics Stock Down 1.3 %

ADMA traded down $0.26 on Monday, hitting $19.11. The company had a trading volume of 4,528,865 shares, compared to its average volume of 3,638,878. The stock has a fifty day simple moving average of $17.85 and a 200-day simple moving average of $13.46. The company has a debt-to-equity ratio of 0.74, a current ratio of 6.87 and a quick ratio of 2.80. The firm has a market capitalization of $4.45 billion, a P/E ratio of 138.36 and a beta of 0.64. ADMA Biologics, Inc. has a 52-week low of $3.54 and a 52-week high of $21.13.

ADMA Biologics (NASDAQ:ADMA - Get Free Report) last issued its quarterly earnings results on Thursday, August 8th. The biotechnology company reported $0.13 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.08 by $0.05. The company had revenue of $107.20 million during the quarter, compared to analyst estimates of $86.44 million. ADMA Biologics had a net margin of 10.53% and a return on equity of 38.79%. ADMA Biologics's quarterly revenue was up 78.4% compared to the same quarter last year. During the same period last year, the business earned ($0.02) EPS. As a group, equities analysts expect that ADMA Biologics, Inc. will post 0.49 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of research firms have commented on ADMA. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $20.00 price target on shares of ADMA Biologics in a research report on Friday, September 20th. HC Wainwright restated a "buy" rating and set a $18.00 target price on shares of ADMA Biologics in a report on Monday, October 14th. One research analyst has rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Buy" and a consensus price target of $15.50.

Read Our Latest Report on ADMA Biologics

Insider Buying and Selling

In other ADMA Biologics news, Director Young Kwon sold 60,000 shares of ADMA Biologics stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $18.26, for a total transaction of $1,095,600.00. Following the completion of the transaction, the director now owns 241,441 shares in the company, valued at approximately $4,408,712.66. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other ADMA Biologics news, Director Young Kwon sold 60,000 shares of the firm's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $18.26, for a total transaction of $1,095,600.00. Following the completion of the sale, the director now directly owns 241,441 shares in the company, valued at approximately $4,408,712.66. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Lawrence P. Guiheen sold 9,000 shares of ADMA Biologics stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $18.47, for a total transaction of $166,230.00. Following the completion of the transaction, the director now directly owns 153,941 shares of the company's stock, valued at $2,843,290.27. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 466,900 shares of company stock worth $8,224,121 in the last 90 days. Insiders own 3.70% of the company's stock.

ADMA Biologics Profile

(

Free Report)

ADMA Biologics, Inc, a biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally. The company offers BIVIGAM, an intravenous immune globulin (IVIG) product indicated for the treatment of primary humoral immunodeficiency (PI); ASCENIV, an IVIG product for the treatment of PI; and Nabi-HB for the treatment of acute exposure to blood containing Hepatitis B surface antigen and other listed exposures to Hepatitis B.

Recommended Stories

Before you consider ADMA Biologics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADMA Biologics wasn't on the list.

While ADMA Biologics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.