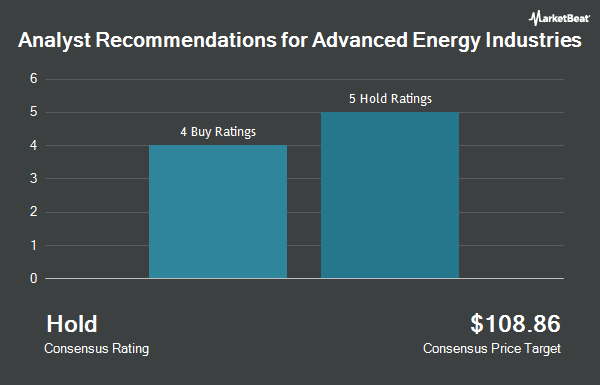

Advanced Energy Industries, Inc. (NASDAQ:AEIS - Get Free Report) has been assigned a consensus rating of "Moderate Buy" from the twelve analysts that are presently covering the stock, MarketBeat.com reports. Seven equities research analysts have rated the stock with a hold recommendation, four have assigned a buy recommendation and one has issued a strong buy recommendation on the company. The average 12 month price objective among brokerages that have issued ratings on the stock in the last year is $113.11.

AEIS has been the topic of several recent analyst reports. Robert W. Baird initiated coverage on Advanced Energy Industries in a research note on Friday, September 20th. They set an "outperform" rating and a $128.00 target price on the stock. Citigroup cut Advanced Energy Industries from a "buy" rating to a "neutral" rating and set a $113.00 price target on the stock. in a report on Monday, July 15th. Baird R W raised Advanced Energy Industries to a "strong-buy" rating in a report on Friday, September 20th. Benchmark reissued a "buy" rating and set a $117.00 price target on shares of Advanced Energy Industries in a report on Wednesday, July 31st. Finally, Stifel Nicolaus started coverage on Advanced Energy Industries in a report on Thursday, August 15th. They set a "buy" rating and a $135.00 price target on the stock.

Read Our Latest Stock Report on Advanced Energy Industries

Advanced Energy Industries Stock Up 2.4 %

NASDAQ AEIS traded up $2.64 during mid-day trading on Tuesday, reaching $111.01. The stock had a trading volume of 198,408 shares, compared to its average volume of 209,730. The company has a fifty day moving average price of $103.98 and a 200 day moving average price of $104.59. The company has a debt-to-equity ratio of 0.76, a current ratio of 5.47 and a quick ratio of 4.22. Advanced Energy Industries has a 1 year low of $81.86 and a 1 year high of $119.75. The stock has a market cap of $4.16 billion, a PE ratio of 39.84, a price-to-earnings-growth ratio of 5.41 and a beta of 1.49.

Advanced Energy Industries (NASDAQ:AEIS - Get Free Report) last issued its earnings results on Tuesday, July 30th. The electronics maker reported $0.85 EPS for the quarter, beating the consensus estimate of $0.71 by $0.14. Advanced Energy Industries had a return on equity of 10.43% and a net margin of 6.00%. The business had revenue of $364.95 million for the quarter, compared to the consensus estimate of $350.06 million. During the same period last year, the business posted $0.95 EPS. The company's revenue was down 12.2% compared to the same quarter last year. On average, research analysts expect that Advanced Energy Industries will post 2.47 earnings per share for the current year.

Advanced Energy Industries Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 6th. Shareholders of record on Monday, August 26th were paid a $0.10 dividend. This represents a $0.40 annualized dividend and a yield of 0.36%. The ex-dividend date of this dividend was Monday, August 26th. Advanced Energy Industries's payout ratio is currently 14.71%.

Institutional Trading of Advanced Energy Industries

Several institutional investors have recently added to or reduced their stakes in AEIS. Vanguard Group Inc. raised its stake in shares of Advanced Energy Industries by 1.6% during the first quarter. Vanguard Group Inc. now owns 4,543,395 shares of the electronics maker's stock valued at $463,335,000 after acquiring an additional 73,028 shares in the last quarter. Earnest Partners LLC raised its stake in Advanced Energy Industries by 13.5% in the second quarter. Earnest Partners LLC now owns 1,681,776 shares of the electronics maker's stock worth $182,910,000 after buying an additional 199,578 shares in the last quarter. Dimensional Fund Advisors LP raised its stake in Advanced Energy Industries by 1.7% in the second quarter. Dimensional Fund Advisors LP now owns 950,977 shares of the electronics maker's stock worth $103,428,000 after buying an additional 15,577 shares in the last quarter. The Manufacturers Life Insurance Company raised its stake in Advanced Energy Industries by 22.4% in the second quarter. The Manufacturers Life Insurance Company now owns 647,682 shares of the electronics maker's stock worth $70,442,000 after buying an additional 118,328 shares in the last quarter. Finally, Bank of New York Mellon Corp raised its stake in Advanced Energy Industries by 23.5% in the second quarter. Bank of New York Mellon Corp now owns 540,213 shares of the electronics maker's stock worth $58,754,000 after buying an additional 102,659 shares in the last quarter. Institutional investors own 99.67% of the company's stock.

About Advanced Energy Industries

(

Get Free ReportAdvanced Energy Industries, Inc provides precision power conversion, measurement, and control solutions in the United States and internationally. The company's plasma power products offer solutions to enable innovation for semiconductor and thin film plasma processes, such as dry etch and deposition.

Featured Articles

Before you consider Advanced Energy Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Energy Industries wasn't on the list.

While Advanced Energy Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.