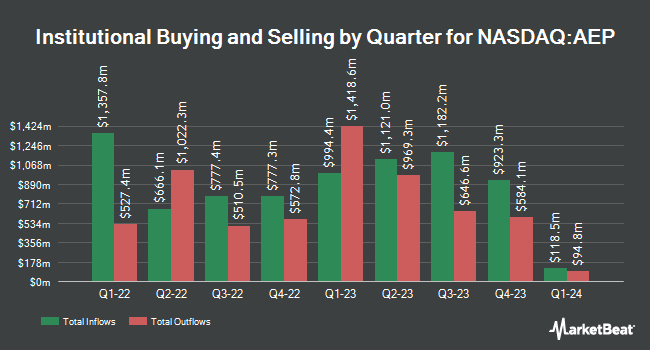

New York State Common Retirement Fund lessened its holdings in shares of American Electric Power Company, Inc. (NASDAQ:AEP - Free Report) by 6.8% in the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 572,870 shares of the company's stock after selling 42,059 shares during the quarter. New York State Common Retirement Fund owned 0.11% of American Electric Power worth $58,776,000 as of its most recent filing with the SEC.

Other hedge funds have also recently bought and sold shares of the company. HHM Wealth Advisors LLC boosted its position in shares of American Electric Power by 57.2% in the second quarter. HHM Wealth Advisors LLC now owns 283 shares of the company's stock worth $25,000 after buying an additional 103 shares during the period. LRI Investments LLC grew its position in American Electric Power by 935.9% in the second quarter. LRI Investments LLC now owns 404 shares of the company's stock valued at $35,000 after acquiring an additional 365 shares in the last quarter. Briaud Financial Planning Inc raised its stake in shares of American Electric Power by 52.1% during the second quarter. Briaud Financial Planning Inc now owns 438 shares of the company's stock valued at $38,000 after purchasing an additional 150 shares during the period. Naples Money Management LLC acquired a new position in shares of American Electric Power during the second quarter worth $44,000. Finally, Opal Wealth Advisors LLC purchased a new position in shares of American Electric Power in the second quarter valued at $48,000. Hedge funds and other institutional investors own 75.24% of the company's stock.

American Electric Power Stock Performance

Shares of NASDAQ:AEP traded down $1.50 during trading on Friday, reaching $97.25. 3,807,230 shares of the company's stock traded hands, compared to its average volume of 3,119,251. The company has a debt-to-equity ratio of 1.53, a current ratio of 0.65 and a quick ratio of 0.48. The company has a 50 day moving average of $100.68 and a 200-day moving average of $94.45. American Electric Power Company, Inc. has a 12 month low of $74.97 and a 12 month high of $105.18. The stock has a market capitalization of $51.75 billion, a P/E ratio of 19.37, a price-to-earnings-growth ratio of 2.78 and a beta of 0.55.

American Electric Power (NASDAQ:AEP - Get Free Report) last announced its quarterly earnings results on Tuesday, July 30th. The company reported $1.25 earnings per share for the quarter, topping analysts' consensus estimates of $1.23 by $0.02. The business had revenue of $4.60 billion for the quarter, compared to analysts' expectations of $4.74 billion. American Electric Power had a return on equity of 11.31% and a net margin of 13.52%. The business's quarterly revenue was up 4.5% on a year-over-year basis. During the same period in the prior year, the firm earned $1.13 EPS. On average, equities analysts expect that American Electric Power Company, Inc. will post 5.6 EPS for the current year.

American Electric Power Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Friday, November 8th will be paid a $0.93 dividend. This represents a $3.72 dividend on an annualized basis and a yield of 3.83%. This is a boost from American Electric Power's previous quarterly dividend of $0.88. The ex-dividend date of this dividend is Friday, November 8th. American Electric Power's dividend payout ratio (DPR) is presently 74.10%.

Analyst Ratings Changes

Several equities research analysts recently issued reports on AEP shares. JPMorgan Chase & Co. lifted their price target on shares of American Electric Power from $108.00 to $112.00 and gave the stock an "overweight" rating in a research note on Friday, October 18th. Guggenheim boosted their price target on American Electric Power from $81.00 to $83.00 and gave the stock a "neutral" rating in a research note on Monday, July 22nd. BMO Capital Markets raised their price objective on American Electric Power from $109.00 to $114.00 and gave the company an "outperform" rating in a research note on Thursday, October 3rd. Scotiabank upped their target price on American Electric Power from $99.00 to $108.00 and gave the company a "sector outperform" rating in a research report on Tuesday, August 20th. Finally, Barclays raised their price target on shares of American Electric Power from $96.00 to $100.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 15th. Two investment analysts have rated the stock with a sell rating, seven have given a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, American Electric Power currently has a consensus rating of "Hold" and an average price target of $98.43.

View Our Latest Stock Report on AEP

American Electric Power Company Profile

(

Free Report)

American Electric Power Company, Inc, an electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States. It operates through Vertically Integrated Utilities, Transmission and Distribution Utilities, AEP Transmission Holdco, and Generation & Marketing segments.

See Also

Before you consider American Electric Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Electric Power wasn't on the list.

While American Electric Power currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.