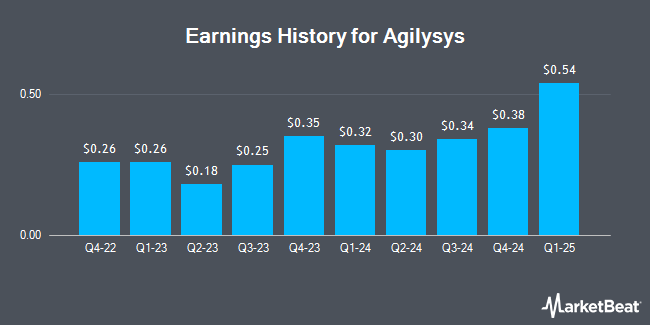

Agilysys (NASDAQ:AGYS - Get Free Report) issued its quarterly earnings data on Monday. The software maker reported $0.34 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.30 by $0.04, Briefing.com reports. The business had revenue of $68.30 million during the quarter, compared to analyst estimates of $67.54 million. Agilysys had a net margin of 40.32% and a return on equity of 12.75%. The firm's quarterly revenue was up 16.6% on a year-over-year basis. During the same quarter last year, the business earned $0.25 EPS.

Agilysys Stock Down 4.2 %

NASDAQ AGYS traded down $4.26 on Wednesday, reaching $98.25. The company had a trading volume of 285,326 shares, compared to its average volume of 214,303. The stock has a market capitalization of $2.74 billion, a P/E ratio of 28.32 and a beta of 0.83. The company's fifty day moving average is $109.04 and its 200 day moving average is $101.70. Agilysys has a 52-week low of $73.52 and a 52-week high of $125.73.

Insiders Place Their Bets

In other Agilysys news, insider Chris J. Robertson sold 4,000 shares of Agilysys stock in a transaction that occurred on Wednesday, August 28th. The shares were sold at an average price of $108.83, for a total transaction of $435,320.00. Following the transaction, the insider now owns 22,888 shares of the company's stock, valued at $2,490,901.04. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. In other news, insider Chris J. Robertson sold 4,000 shares of Agilysys stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $108.83, for a total transaction of $435,320.00. Following the sale, the insider now directly owns 22,888 shares in the company, valued at $2,490,901.04. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Ramesh Srinivasan sold 10,000 shares of the stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $102.03, for a total transaction of $1,020,300.00. Following the transaction, the chief executive officer now owns 738,367 shares of the company's stock, valued at approximately $75,335,585.01. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 35,000 shares of company stock valued at $3,734,810 in the last three months. 19.30% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

A number of research firms have commented on AGYS. Northland Securities reiterated an "outperform" rating and issued a $145.00 price target (up previously from $132.00) on shares of Agilysys in a research report on Tuesday. Needham & Company LLC reissued a "buy" rating and set a $125.00 target price on shares of Agilysys in a research note on Tuesday. Oppenheimer upped their price target on shares of Agilysys from $100.00 to $120.00 and gave the company an "outperform" rating in a research report on Friday, July 19th. StockNews.com raised Agilysys from a "hold" rating to a "buy" rating in a research report on Wednesday, October 23rd. Finally, BTIG Research upped their target price on Agilysys from $118.00 to $124.00 and gave the company a "buy" rating in a research report on Tuesday. Seven analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus price target of $127.80.

Get Our Latest Analysis on AGYS

About Agilysys

(

Get Free Report)

Agilysys, Inc operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India. It offers software solutions fully integrated with third party hardware and operating systems; cloud applications, support, and maintenance; subscription and maintenance; and professional services.

Read More

Before you consider Agilysys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agilysys wasn't on the list.

While Agilysys currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.