Vanguard Group Inc. lifted its holdings in shares of Akebia Therapeutics, Inc. (NASDAQ:AKBA - Free Report) by 8.1% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The firm owned 8,225,972 shares of the biopharmaceutical company's stock after buying an additional 618,500 shares during the period. Vanguard Group Inc. owned approximately 3.93% of Akebia Therapeutics worth $15,054,000 at the end of the most recent quarter.

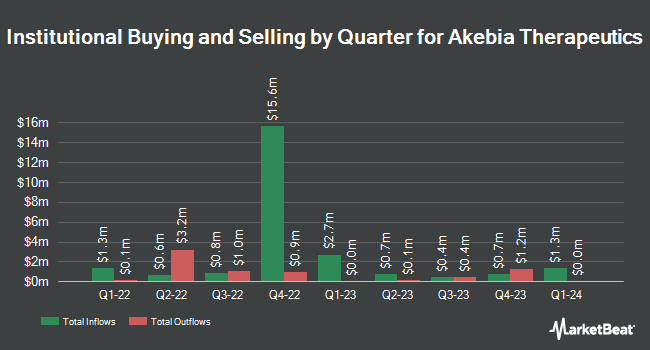

A number of other hedge funds and other institutional investors have also recently bought and sold shares of AKBA. Eagle Wealth Strategies LLC acquired a new position in Akebia Therapeutics in the fourth quarter valued at $25,000. Archer Investment Corp bought a new position in Akebia Therapeutics during the fourth quarter worth $25,000. Mackenzie Financial Corp raised its position in shares of Akebia Therapeutics by 37.6% during the 4th quarter. Mackenzie Financial Corp now owns 23,159 shares of the biopharmaceutical company's stock worth $29,000 after purchasing an additional 6,330 shares during the period. Raymond James & Associates boosted its holdings in shares of Akebia Therapeutics by 48.0% during the fourth quarter. Raymond James & Associates now owns 29,917 shares of the biopharmaceutical company's stock valued at $37,000 after acquiring an additional 9,696 shares during the period. Finally, Compass Ion Advisors LLC acquired a new stake in Akebia Therapeutics in the 1st quarter valued at approximately $46,000. 33.92% of the stock is currently owned by hedge funds and other institutional investors.

Akebia Therapeutics Stock Performance

AKBA traded up $0.11 during trading on Tuesday, reaching $1.34. 2,335,085 shares of the company's stock were exchanged, compared to its average volume of 3,672,094. The company's fifty day moving average price is $1.15 and its 200-day moving average price is $1.37. Akebia Therapeutics, Inc. has a fifty-two week low of $0.78 and a fifty-two week high of $2.48. The firm has a market capitalization of $280.86 million, a PE ratio of -5.83 and a beta of 0.77.

Akebia Therapeutics (NASDAQ:AKBA - Get Free Report) last posted its quarterly earnings results on Thursday, August 8th. The biopharmaceutical company reported ($0.04) earnings per share for the quarter, topping the consensus estimate of ($0.06) by $0.02. The company had revenue of $43.65 million for the quarter, compared to analyst estimates of $45.61 million. During the same period last year, the firm earned ($0.06) EPS. Research analysts forecast that Akebia Therapeutics, Inc. will post -0.28 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several equities research analysts have recently commented on the company. StockNews.com downgraded Akebia Therapeutics from a "buy" rating to a "hold" rating in a report on Monday, April 29th. HC Wainwright raised their target price on Akebia Therapeutics from $6.00 to $7.50 and gave the company a "buy" rating in a report on Monday.

Read Our Latest Stock Report on Akebia Therapeutics

Akebia Therapeutics Company Profile

(

Free Report)

Akebia Therapeutics, Inc, a biopharmaceutical company, focuses on the development and commercialization of therapeutics for patients with kidney diseases. The company's lead product investigational product candidate is Vafseo (vadadustat), an oral hypoxia-inducible factor prolyl hydroxylase, which is in Phase III development for the treatment of anemia due to chronic kidney disease (CKD) in dialysis-dependent and non-dialysis dependent patients.

Read More

Before you consider Akebia Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akebia Therapeutics wasn't on the list.

While Akebia Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.