Astera Labs (NASDAQ:ALAB - Get Free Report) updated its fourth quarter 2024 earnings guidance on Monday. The company provided earnings per share guidance of 0.250-0.260 for the period, compared to the consensus earnings per share estimate of 0.180. The company issued revenue guidance of $126.0 million-$130.0 million, compared to the consensus revenue estimate of $108.4 million. Astera Labs also updated its Q4 guidance to $0.25-$0.26 EPS.

Wall Street Analyst Weigh In

ALAB has been the subject of a number of research analyst reports. Barclays cut their price objective on Astera Labs from $85.00 to $70.00 and set an "overweight" rating for the company in a research report on Wednesday, August 7th. Deutsche Bank Aktiengesellschaft cut their price target on Astera Labs from $85.00 to $60.00 and set a "buy" rating for the company in a report on Wednesday, August 7th. Needham & Company LLC reaffirmed a "buy" rating and set a $65.00 price objective on shares of Astera Labs in a report on Wednesday, October 9th. Stifel Nicolaus cut their target price on shares of Astera Labs from $87.00 to $80.00 and set a "buy" rating for the company in a report on Monday, August 5th. Finally, Morgan Stanley boosted their price target on shares of Astera Labs from $55.00 to $74.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 9th. Eleven research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock presently has a consensus rating of "Buy" and an average price target of $73.09.

View Our Latest Stock Report on Astera Labs

Astera Labs Price Performance

ALAB stock traded down $3.00 during trading on Monday, reaching $69.65. 5,239,463 shares of the company traded hands, compared to its average volume of 2,749,148. The business has a 50 day simple moving average of $54.35 and a 200 day simple moving average of $57.90. Astera Labs has a 12 month low of $36.22 and a 12 month high of $95.21.

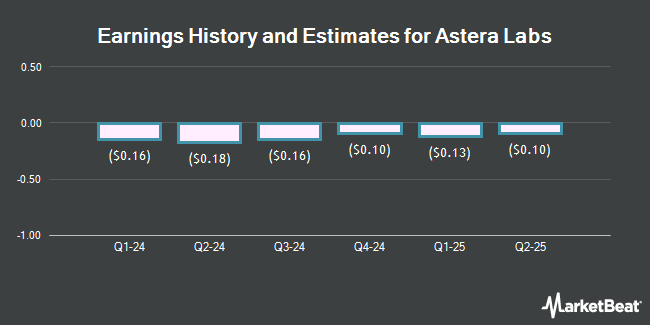

Astera Labs (NASDAQ:ALAB - Get Free Report) last released its quarterly earnings results on Tuesday, August 6th. The company reported $0.13 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.11 by $0.02. The firm had revenue of $76.90 million during the quarter, compared to analysts' expectations of $72.41 million. The firm's quarterly revenue was up 17.8% compared to the same quarter last year. Research analysts predict that Astera Labs will post -0.54 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, General Counsel Philip Mazzara sold 42,090 shares of the company's stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $40.43, for a total value of $1,701,698.70. Following the sale, the general counsel now owns 333,474 shares in the company, valued at $13,482,353.82. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In other Astera Labs news, General Counsel Philip Mazzara sold 42,090 shares of the company's stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $40.43, for a total value of $1,701,698.70. Following the sale, the general counsel now directly owns 333,474 shares of the company's stock, valued at approximately $13,482,353.82. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Sanjay Gajendra sold 110,000 shares of Astera Labs stock in a transaction dated Friday, October 11th. The shares were sold at an average price of $69.47, for a total value of $7,641,700.00. Following the transaction, the insider now owns 835,000 shares of the company's stock, valued at $58,007,450. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 564,458 shares of company stock worth $31,970,841 in the last 90 days.

About Astera Labs

(

Get Free Report)

Astera Labs, Inc designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform is comprised of a portfolio of data, network, and memory connectivity products, which are built on a unifying software-defined architecture that enables customers to deploy and operate high performance cloud and AI infrastructure at scale.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Astera Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astera Labs wasn't on the list.

While Astera Labs currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.