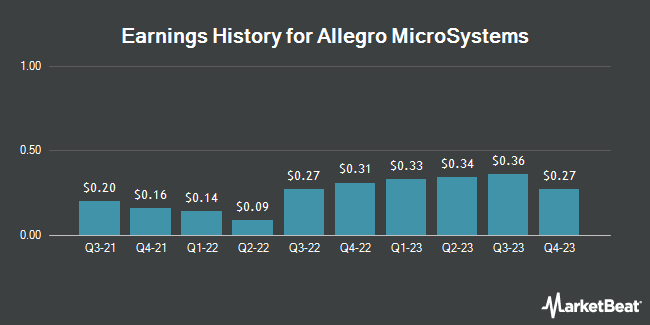

Allegro MicroSystems (NASDAQ:ALGM - Get Free Report) released its quarterly earnings results on Thursday. The company reported $0.08 EPS for the quarter, beating the consensus estimate of $0.06 by $0.02, Briefing.com reports. The business had revenue of $187.39 million for the quarter, compared to analyst estimates of $187.52 million. Allegro MicroSystems had a negative net margin of 2.96% and a positive return on equity of 8.47%. The company's quarterly revenue was down 32.0% on a year-over-year basis. During the same period in the prior year, the business earned $0.36 earnings per share. Allegro MicroSystems updated its Q3 guidance to $0.04-0.08 EPS and its Q3 2025 guidance to 0.040-0.080 EPS.

Allegro MicroSystems Trading Up 1.2 %

NASDAQ:ALGM traded up $0.26 during trading hours on Friday, reaching $21.10. 2,519,452 shares of the company were exchanged, compared to its average volume of 1,896,749. The company has a debt-to-equity ratio of 0.42, a current ratio of 4.22 and a quick ratio of 2.98. The firm has a market cap of $4.09 billion, a price-to-earnings ratio of -150.70 and a beta of 1.69. Allegro MicroSystems has a 52-week low of $19.71 and a 52-week high of $33.26. The stock has a 50 day simple moving average of $22.24 and a 200 day simple moving average of $25.91.

Analysts Set New Price Targets

Several analysts have recently commented on the stock. Needham & Company LLC lowered their price target on shares of Allegro MicroSystems from $33.00 to $30.00 and set a "buy" rating on the stock in a research report on Thursday. Mizuho set a $26.00 price objective on shares of Allegro MicroSystems in a research note on Friday, October 18th. Barclays reduced their price objective on shares of Allegro MicroSystems from $32.00 to $25.00 and set an "overweight" rating on the stock in a research note on Friday. Finally, UBS Group began coverage on shares of Allegro MicroSystems in a research note on Tuesday, September 3rd. They set a "buy" rating and a $33.00 price objective on the stock. Eight analysts have rated the stock with a buy rating, According to MarketBeat.com, Allegro MicroSystems presently has a consensus rating of "Buy" and a consensus price target of $32.13.

Check Out Our Latest Analysis on Allegro MicroSystems

Insiders Place Their Bets

In other news, major shareholder Electric Co. Ltd. Sanken sold 10,017,315 shares of the firm's stock in a transaction on Wednesday, August 7th. The shares were sold at an average price of $23.16, for a total value of $232,001,015.40. Following the transaction, the insider now owns 59,732,782 shares of the company's stock, valued at approximately $1,383,411,231.12. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. 0.50% of the stock is currently owned by insiders.

About Allegro MicroSystems

(

Get Free Report)

Allegro MicroSystems, Inc, together with its subsidiaries, designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems. Its products include magnetic sensor ICs, such as position, speed, and current sensor ICs; and power ICs comprising motor driver ICs, regulator and LED driver ICs, and isolated gate drivers.

Featured Articles

Before you consider Allegro MicroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegro MicroSystems wasn't on the list.

While Allegro MicroSystems currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.