Allegiant Travel (NASDAQ:ALGT - Get Free Report) had its target price boosted by research analysts at TD Cowen from $42.00 to $50.00 in a report issued on Friday, MarketBeat.com reports. The firm currently has a "hold" rating on the transportation company's stock. TD Cowen's target price points to a potential downside of 20.65% from the stock's previous close.

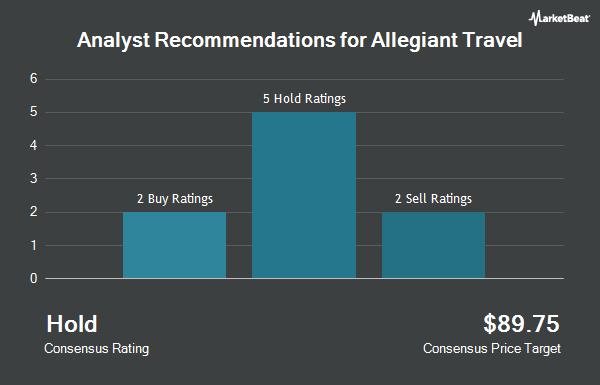

Other equities research analysts have also recently issued research reports about the company. Barclays cut their target price on Allegiant Travel from $55.00 to $45.00 and set an "equal weight" rating on the stock in a research note on Wednesday, July 10th. Morgan Stanley cut their price objective on shares of Allegiant Travel from $95.00 to $87.00 and set an "equal weight" rating on the stock in a research report on Monday, July 8th. Deutsche Bank Aktiengesellschaft downgraded shares of Allegiant Travel from a "buy" rating to a "hold" rating and decreased their target price for the company from $75.00 to $53.00 in a research report on Monday, July 8th. Susquehanna boosted their price target on shares of Allegiant Travel from $40.00 to $55.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 9th. Finally, Evercore ISI increased their price objective on shares of Allegiant Travel from $60.00 to $65.00 and gave the stock an "in-line" rating in a research note on Thursday, October 3rd. Two analysts have rated the stock with a sell rating, six have given a hold rating and one has issued a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $64.13.

Get Our Latest Research Report on ALGT

Allegiant Travel Stock Down 3.1 %

Shares of ALGT stock traded down $2.00 during trading hours on Friday, hitting $63.01. 644,402 shares of the company were exchanged, compared to its average volume of 367,845. The company has a market capitalization of $1.15 billion, a PE ratio of -42.01, a PEG ratio of 4.11 and a beta of 1.65. Allegiant Travel has a 52 week low of $36.08 and a 52 week high of $85.91. The business has a 50 day moving average of $51.72 and a two-hundred day moving average of $50.96. The company has a current ratio of 0.74, a quick ratio of 0.71 and a debt-to-equity ratio of 1.30.

Allegiant Travel (NASDAQ:ALGT - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The transportation company reported ($2.02) earnings per share (EPS) for the quarter, missing the consensus estimate of ($1.85) by ($0.17). The firm had revenue of $562.20 million during the quarter, compared to analyst estimates of $561.24 million. Allegiant Travel had a negative net margin of 1.04% and a positive return on equity of 0.63%. Analysts anticipate that Allegiant Travel will post 1.27 earnings per share for the current fiscal year.

Insider Transactions at Allegiant Travel

In other Allegiant Travel news, Director Gary Ellmer sold 1,000 shares of the business's stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $45.00, for a total transaction of $45,000.00. Following the transaction, the director now owns 7,490 shares of the company's stock, valued at $337,050. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other Allegiant Travel news, Director Gary Ellmer sold 1,000 shares of the firm's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $45.00, for a total transaction of $45,000.00. Following the completion of the sale, the director now owns 7,490 shares of the company's stock, valued at $337,050. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, COO Keny Frank Wilper sold 635 shares of Allegiant Travel stock in a transaction on Wednesday, October 23rd. The stock was sold at an average price of $62.69, for a total transaction of $39,808.15. Following the transaction, the chief operating officer now directly owns 16,353 shares of the company's stock, valued at approximately $1,025,169.57. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 2,334 shares of company stock worth $117,158 in the last ninety days. Insiders own 15.80% of the company's stock.

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of ALGT. Donald Smith & CO. Inc. grew its position in shares of Allegiant Travel by 166.7% in the second quarter. Donald Smith & CO. Inc. now owns 826,326 shares of the transportation company's stock valued at $41,506,000 after purchasing an additional 516,545 shares during the last quarter. U S Global Investors Inc. boosted its stake in Allegiant Travel by 51.9% in the 3rd quarter. U S Global Investors Inc. now owns 741,429 shares of the transportation company's stock valued at $40,823,000 after purchasing an additional 253,198 shares during the period. Clearbridge Investments LLC acquired a new position in Allegiant Travel in the 2nd quarter valued at $8,959,000. Millennium Management LLC increased its position in Allegiant Travel by 779.8% during the 2nd quarter. Millennium Management LLC now owns 169,459 shares of the transportation company's stock worth $8,512,000 after buying an additional 150,197 shares during the period. Finally, International Assets Investment Management LLC bought a new position in Allegiant Travel during the 3rd quarter worth $63,540,000. 85.81% of the stock is owned by institutional investors.

Allegiant Travel Company Profile

(

Get Free Report)

Allegiant Travel Company, a leisure travel company, provides travel services and products to residents of under-served cities in the United States. The company offers scheduled air transportation on limited-frequency, nonstop flights between under-served cities and leisure destinations. As of February 1, 2024, it operated a fleet of 126 Airbus A320 series aircraft.

See Also

Before you consider Allegiant Travel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegiant Travel wasn't on the list.

While Allegiant Travel currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.