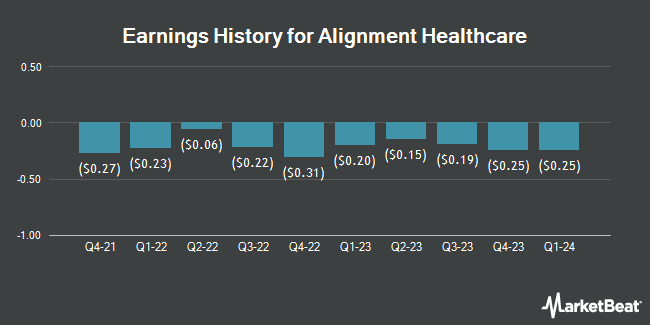

Alignment Healthcare (NASDAQ:ALHC - Get Free Report) issued its earnings results on Tuesday. The company reported ($0.14) EPS for the quarter, hitting the consensus estimate of ($0.14), Briefing.com reports. Alignment Healthcare had a negative return on equity of 101.10% and a negative net margin of 6.85%. The business had revenue of $692.43 million during the quarter, compared to the consensus estimate of $662.11 million. During the same quarter last year, the company earned ($0.19) EPS. The firm's revenue was up 51.6% compared to the same quarter last year. Alignment Healthcare updated its FY 2024 guidance to EPS and its Q4 2024 guidance to EPS.

Alignment Healthcare Trading Up 0.2 %

Shares of NASDAQ ALHC traded up $0.02 during mid-day trading on Wednesday, hitting $11.73. The stock had a trading volume of 2,522,282 shares, compared to its average volume of 1,021,335. The firm has a market cap of $2.24 billion, a P/E ratio of -15.35 and a beta of 1.47. Alignment Healthcare has a 1 year low of $4.46 and a 1 year high of $12.36. The company has a debt-to-equity ratio of 1.70, a quick ratio of 1.61 and a current ratio of 1.61. The business has a 50 day moving average price of $10.62 and a two-hundred day moving average price of $8.69.

Insider Buying and Selling at Alignment Healthcare

In other Alignment Healthcare news, insider Dawn Christine Maroney sold 7,074 shares of the company's stock in a transaction that occurred on Thursday, August 22nd. The stock was sold at an average price of $9.02, for a total transaction of $63,807.48. Following the completion of the transaction, the insider now owns 1,789,023 shares of the company's stock, valued at $16,136,987.46. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. In other news, CFO Robert Thomas Freeman sold 8,561 shares of the company's stock in a transaction dated Wednesday, September 11th. The shares were sold at an average price of $10.01, for a total value of $85,695.61. Following the sale, the chief financial officer now directly owns 399,429 shares of the company's stock, valued at $3,998,284.29. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Dawn Christine Maroney sold 7,074 shares of Alignment Healthcare stock in a transaction dated Thursday, August 22nd. The shares were sold at an average price of $9.02, for a total transaction of $63,807.48. Following the transaction, the insider now directly owns 1,789,023 shares of the company's stock, valued at approximately $16,136,987.46. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 314,940 shares of company stock worth $3,487,014. 6.60% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

A number of analysts recently weighed in on ALHC shares. Stifel Nicolaus upped their target price on shares of Alignment Healthcare from $9.00 to $12.00 and gave the stock a "buy" rating in a report on Friday, July 26th. KeyCorp initiated coverage on shares of Alignment Healthcare in a report on Friday, October 11th. They issued a "sector weight" rating on the stock. UBS Group lifted their price objective on Alignment Healthcare from $9.00 to $12.00 and gave the company a "neutral" rating in a research note on Wednesday. Barclays upped their target price on Alignment Healthcare from $7.00 to $8.00 and gave the stock an "underweight" rating in a research note on Wednesday. Finally, Piper Sandler reissued an "overweight" rating and issued a $10.00 price target (up previously from $8.00) on shares of Alignment Healthcare in a research note on Tuesday, August 6th. One equities research analyst has rated the stock with a sell rating, three have assigned a hold rating, six have given a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $10.33.

Read Our Latest Stock Report on ALHC

Alignment Healthcare Company Profile

(

Get Free Report)

Alignment Healthcare, Inc, a tech-enabled Medicare advantage company, operates consumer-centric health care platform for seniors in the United States. It provides customized health care designed to meet the needs of a diverse array of seniors through its Medicare advantage plans. The company was founded in 2013 and is based in Orange, California.

Read More

Before you consider Alignment Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alignment Healthcare wasn't on the list.

While Alignment Healthcare currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.