Alkami Technology (NASDAQ:ALKT - Get Free Report) had its target price boosted by equities research analysts at Barclays from $35.00 to $41.00 in a research note issued to investors on Thursday, Benzinga reports. The firm currently has an "equal weight" rating on the stock. Barclays's price target points to a potential upside of 11.99% from the company's previous close.

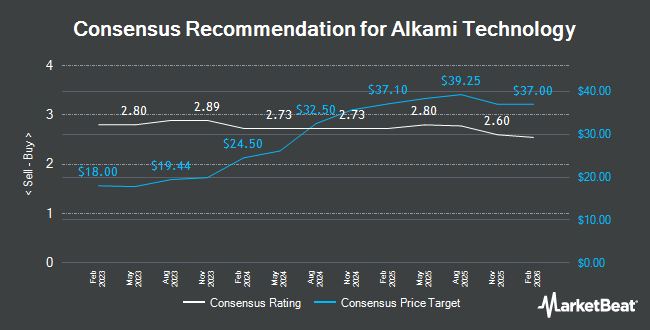

ALKT has been the subject of a number of other research reports. The Goldman Sachs Group lifted their price objective on shares of Alkami Technology from $28.00 to $34.00 and gave the company a "neutral" rating in a report on Thursday, August 1st. JMP Securities lifted their price objective on shares of Alkami Technology from $38.00 to $41.00 and gave the company a "market outperform" rating in a report on Tuesday. Needham & Company LLC boosted their price target on shares of Alkami Technology from $43.00 to $54.00 and gave the stock a "buy" rating in a report on Thursday. Craig Hallum boosted their price target on shares of Alkami Technology from $38.00 to $45.00 and gave the stock a "buy" rating in a report on Thursday. Finally, Lake Street Capital boosted their price target on shares of Alkami Technology from $30.00 to $36.00 and gave the stock a "buy" rating in a report on Thursday, August 1st. Three investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat, Alkami Technology currently has a consensus rating of "Moderate Buy" and an average price target of $36.89.

Get Our Latest Analysis on ALKT

Alkami Technology Trading Down 4.1 %

Shares of Alkami Technology stock traded down $1.57 on Thursday, reaching $36.61. The company had a trading volume of 1,250,013 shares, compared to its average volume of 454,396. The firm's 50 day moving average price is $33.11 and its two-hundred day moving average price is $30.10. The firm has a market cap of $3.62 billion, a PE ratio of -67.80 and a beta of 0.46. Alkami Technology has a 52-week low of $17.32 and a 52-week high of $41.36. The company has a debt-to-equity ratio of 0.05, a quick ratio of 3.75 and a current ratio of 3.75.

Alkami Technology (NASDAQ:ALKT - Get Free Report) last released its quarterly earnings results on Wednesday, July 31st. The company reported $0.05 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.03 by $0.02. The business had revenue of $82.16 million for the quarter, compared to the consensus estimate of $81.32 million. Alkami Technology had a negative net margin of 17.47% and a negative return on equity of 13.43%. The business's revenue was up 24.9% on a year-over-year basis. During the same period in the previous year, the firm earned ($0.17) EPS. Sell-side analysts predict that Alkami Technology will post -0.36 earnings per share for the current fiscal year.

Insider Activity

In related news, CEO Alex Shootman sold 37,758 shares of the stock in a transaction on Monday, September 9th. The shares were sold at an average price of $29.75, for a total transaction of $1,123,300.50. Following the completion of the sale, the chief executive officer now owns 1,056,207 shares in the company, valued at $31,422,158.25. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. In related news, CEO Alex Shootman sold 37,758 shares of the stock in a transaction on Monday, September 9th. The shares were sold at an average price of $29.75, for a total transaction of $1,123,300.50. Following the completion of the sale, the chief executive officer now owns 1,056,207 shares in the company, valued at $31,422,158.25. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Atlantic Genpar (Bermu General sold 1,666,667 shares of the stock in a transaction on Monday, August 12th. The stock was sold at an average price of $31.17, for a total transaction of $51,950,010.39. Following the sale, the director now owns 15,555,049 shares of the company's stock, valued at approximately $484,850,877.33. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 3,648,416 shares of company stock worth $113,920,758. Corporate insiders own 38.00% of the company's stock.

Institutional Trading of Alkami Technology

Several hedge funds have recently made changes to their positions in the company. nVerses Capital LLC lifted its stake in shares of Alkami Technology by 16.1% in the 3rd quarter. nVerses Capital LLC now owns 3,600 shares of the company's stock worth $114,000 after acquiring an additional 500 shares during the period. Harbor Capital Advisors Inc. lifted its stake in shares of Alkami Technology by 12.7% in the 3rd quarter. Harbor Capital Advisors Inc. now owns 6,112 shares of the company's stock worth $193,000 after acquiring an additional 691 shares during the period. Park Place Capital Corp acquired a new stake in shares of Alkami Technology in the 3rd quarter worth $28,000. Blue Trust Inc. lifted its stake in shares of Alkami Technology by 507.0% in the 3rd quarter. Blue Trust Inc. now owns 1,214 shares of the company's stock worth $38,000 after acquiring an additional 1,014 shares during the period. Finally, Swiss National Bank lifted its stake in shares of Alkami Technology by 1.3% in the first quarter. Swiss National Bank now owns 84,700 shares of the company's stock valued at $2,081,000 after purchasing an additional 1,100 shares during the period. Institutional investors and hedge funds own 54.97% of the company's stock.

About Alkami Technology

(

Get Free Report)

Alkami Technology, Inc offers cloud-based digital banking solutions in the United States. The company's Alkami Platform allows financial institutions to onboard and engage new users, accelerate revenues, and enhance operational efficiency, with the support of a proprietary, cloud-based, and multi-tenant architecture.

See Also

Before you consider Alkami Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkami Technology wasn't on the list.

While Alkami Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.