China Universal Asset Management Co. Ltd. boosted its position in shares of Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY - Free Report) by 37.1% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 36,340 shares of the biopharmaceutical company's stock after purchasing an additional 9,831 shares during the period. Alnylam Pharmaceuticals makes up 1.1% of China Universal Asset Management Co. Ltd.'s holdings, making the stock its 18th biggest holding. China Universal Asset Management Co. Ltd.'s holdings in Alnylam Pharmaceuticals were worth $9,995,000 at the end of the most recent quarter.

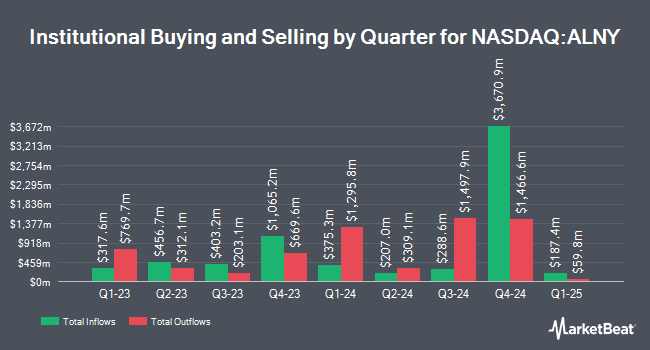

Other institutional investors also recently bought and sold shares of the company. Plato Investment Management Ltd raised its stake in shares of Alnylam Pharmaceuticals by 2,666.3% in the 1st quarter. Plato Investment Management Ltd now owns 4,509 shares of the biopharmaceutical company's stock valued at $674,000 after acquiring an additional 4,346 shares during the period. Diversified Trust Co purchased a new stake in shares of Alnylam Pharmaceuticals in the 2nd quarter valued at approximately $1,210,000. Headlands Technologies LLC purchased a new stake in shares of Alnylam Pharmaceuticals in the 1st quarter valued at approximately $471,000. Breakwater Capital Group purchased a new stake in shares of Alnylam Pharmaceuticals in the 2nd quarter valued at approximately $249,000. Finally, Price T Rowe Associates Inc. MD raised its stake in shares of Alnylam Pharmaceuticals by 5.8% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 3,685,753 shares of the biopharmaceutical company's stock valued at $550,837,000 after acquiring an additional 201,784 shares during the period. 92.97% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities research analysts have recently issued reports on the stock. Citigroup boosted their price target on shares of Alnylam Pharmaceuticals from $291.00 to $342.00 and gave the company a "buy" rating in a research note on Friday, August 2nd. HC Wainwright reiterated a "buy" rating and set a $400.00 price target on shares of Alnylam Pharmaceuticals in a report on Friday, October 18th. Chardan Capital restated a "buy" rating and issued a $300.00 target price on shares of Alnylam Pharmaceuticals in a report on Friday, October 11th. Raymond James upped their target price on shares of Alnylam Pharmaceuticals from $242.00 to $275.00 and gave the company an "outperform" rating in a report on Friday, August 2nd. Finally, The Goldman Sachs Group upgraded shares of Alnylam Pharmaceuticals from a "neutral" rating to a "buy" rating and upped their target price for the company from $198.00 to $370.00 in a report on Friday, August 16th. Six investment analysts have rated the stock with a hold rating and nineteen have given a buy rating to the stock. Based on data from MarketBeat, Alnylam Pharmaceuticals has an average rating of "Moderate Buy" and a consensus price target of $290.86.

Check Out Our Latest Analysis on Alnylam Pharmaceuticals

Insider Activity

In other news, CEO Yvonne Greenstreet sold 15,148 shares of the stock in a transaction dated Thursday, August 1st. The shares were sold at an average price of $270.00, for a total value of $4,089,960.00. Following the completion of the transaction, the chief executive officer now owns 73,441 shares in the company, valued at $19,829,070. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. In other news, CEO Yvonne Greenstreet sold 15,148 shares of the stock in a transaction dated Thursday, August 1st. The shares were sold at an average price of $270.00, for a total value of $4,089,960.00. Following the completion of the transaction, the chief executive officer now owns 73,441 shares in the company, valued at $19,829,070. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Dennis A. Ausiello sold 20,250 shares of the stock in a transaction dated Tuesday, August 6th. The shares were sold at an average price of $262.00, for a total transaction of $5,305,500.00. Following the completion of the transaction, the director now owns 136 shares of the company's stock, valued at $35,632. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 50,398 shares of company stock worth $13,595,460 in the last 90 days. 1.50% of the stock is currently owned by corporate insiders.

Alnylam Pharmaceuticals Stock Performance

Alnylam Pharmaceuticals stock traded down $2.22 during trading hours on Tuesday, reaching $284.69. 701,860 shares of the stock were exchanged, compared to its average volume of 867,404. The stock has a market cap of $36.01 billion, a P/E ratio of -107.06 and a beta of 0.39. Alnylam Pharmaceuticals, Inc. has a 52-week low of $141.98 and a 52-week high of $304.39. The firm's 50 day moving average is $274.68 and its 200 day moving average is $223.34.

Alnylam Pharmaceuticals (NASDAQ:ALNY - Get Free Report) last announced its quarterly earnings data on Thursday, August 1st. The biopharmaceutical company reported ($0.13) EPS for the quarter, topping analysts' consensus estimates of ($0.74) by $0.61. The firm had revenue of $659.83 million for the quarter, compared to analysts' expectations of $447.22 million. The firm's quarterly revenue was up 107.0% compared to the same quarter last year. During the same quarter in the previous year, the company posted ($2.21) EPS. Equities research analysts expect that Alnylam Pharmaceuticals, Inc. will post -2.73 EPS for the current fiscal year.

Alnylam Pharmaceuticals Company Profile

(

Free Report)

Alnylam Pharmaceuticals, Inc, a biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference. Its marketed products include ONPATTRO (patisiran) for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults; AMVUTTRA for the treatment of hATTR amyloidosis with polyneuropathy in adults; GIVLAARI for the treatment of adults with acute hepatic porphyria; and OXLUMO for the treatment of primary hyperoxaluria type 1.

Further Reading

Before you consider Alnylam Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alnylam Pharmaceuticals wasn't on the list.

While Alnylam Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.