Needham & Company LLC reissued their hold rating on shares of Altair Engineering (NASDAQ:ALTR - Free Report) in a research note released on Thursday, Benzinga reports. Needham & Company LLC currently has a $100.00 price objective on the software's stock.

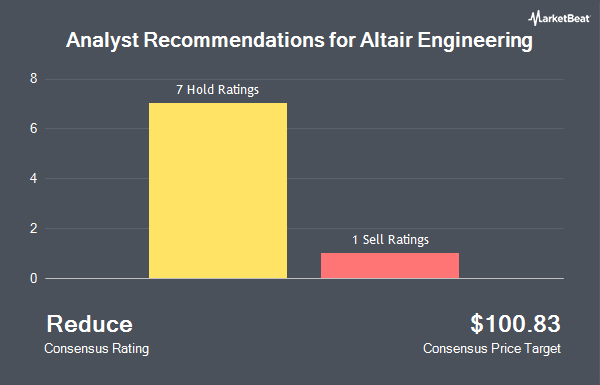

A number of other equities analysts have also recently issued reports on the company. Loop Capital restated a "hold" rating and set a $113.00 target price on shares of Altair Engineering in a report on Thursday. William Blair restated a "market perform" rating on shares of Altair Engineering in a report on Thursday. The Goldman Sachs Group cut Altair Engineering from a "neutral" rating to a "sell" rating and reduced their target price for the stock from $85.00 to $71.00 in a report on Friday, August 2nd. JPMorgan Chase & Co. cut Altair Engineering from an "overweight" rating to a "neutral" rating and set a $95.00 target price on the stock. in a report on Monday, July 15th. Finally, Rosenblatt Securities raised their target price on Altair Engineering from $88.00 to $113.00 and gave the stock a "neutral" rating in a report on Thursday. One analyst has rated the stock with a sell rating, six have given a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat, Altair Engineering currently has a consensus rating of "Hold" and an average target price of $100.71.

Check Out Our Latest Stock Report on ALTR

Altair Engineering Trading Down 4.3 %

Altair Engineering stock traded down $4.64 during mid-day trading on Thursday, hitting $103.99. The stock had a trading volume of 6,329,526 shares, compared to its average volume of 508,939. The stock has a 50-day simple moving average of $93.72 and a two-hundred day simple moving average of $91.29. The stock has a market capitalization of $8.63 billion, a PE ratio of 1,155.44, a P/E/G ratio of 12.15 and a beta of 1.45. Altair Engineering has a 12 month low of $57.59 and a 12 month high of $113.12. The company has a current ratio of 3.14, a quick ratio of 3.14 and a debt-to-equity ratio of 0.29.

Altair Engineering (NASDAQ:ALTR - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The software reported $0.09 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.02 by $0.07. The business had revenue of $151.45 million for the quarter, compared to analysts' expectations of $146.55 million. Altair Engineering had a return on equity of 6.89% and a net margin of 4.26%. As a group, sell-side analysts forecast that Altair Engineering will post 0.65 EPS for the current year.

Insider Activity

In related news, major shareholder Jrs Investments Llc sold 6,500 shares of Altair Engineering stock in a transaction that occurred on Wednesday, August 28th. The stock was sold at an average price of $89.04, for a total value of $578,760.00. The sale was disclosed in a document filed with the SEC, which is available at this link. In related news, Director Teresa A. Harris sold 620 shares of Altair Engineering stock in a transaction that occurred on Tuesday, August 6th. The stock was sold at an average price of $82.57, for a total value of $51,193.40. Following the sale, the director now owns 21,242 shares of the company's stock, valued at approximately $1,753,951.94. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, major shareholder Jrs Investments Llc sold 6,500 shares of the business's stock in a transaction that occurred on Wednesday, August 28th. The stock was sold at an average price of $89.04, for a total value of $578,760.00. The disclosure for this sale can be found here. Insiders have sold 360,360 shares of company stock worth $35,476,660 in the last 90 days. Corporate insiders own 21.75% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the stock. Blue Trust Inc. increased its position in shares of Altair Engineering by 572.1% during the 3rd quarter. Blue Trust Inc. now owns 289 shares of the software's stock worth $28,000 after purchasing an additional 246 shares during the last quarter. GAMMA Investing LLC increased its holdings in shares of Altair Engineering by 81.7% during the 2nd quarter. GAMMA Investing LLC now owns 418 shares of the software's stock worth $41,000 after acquiring an additional 188 shares during the last quarter. FSC Wealth Advisors LLC increased its holdings in shares of Altair Engineering by 41.3% during the 2nd quarter. FSC Wealth Advisors LLC now owns 832 shares of the software's stock worth $82,000 after acquiring an additional 243 shares during the last quarter. Van ECK Associates Corp increased its holdings in shares of Altair Engineering by 41.7% during the 2nd quarter. Van ECK Associates Corp now owns 1,057 shares of the software's stock worth $104,000 after acquiring an additional 311 shares during the last quarter. Finally, SG Americas Securities LLC acquired a new position in shares of Altair Engineering during the 1st quarter worth approximately $177,000. Institutional investors and hedge funds own 63.38% of the company's stock.

Altair Engineering Company Profile

(

Get Free Report)

Altair Engineering Inc, together with its subsidiaries, provides software and cloud solutions in the areas of simulation and design, high-performance computing, data analytics, and artificial intelligence in the United States and internationally. It operates in two segments, Software and Client Engineering Services.

Further Reading

Before you consider Altair Engineering, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altair Engineering wasn't on the list.

While Altair Engineering currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.