Impax Asset Management Group plc lessened its stake in Altair Engineering Inc. (NASDAQ:ALTR - Free Report) by 3.3% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,360,221 shares of the software's stock after selling 46,433 shares during the quarter. Impax Asset Management Group plc owned about 1.64% of Altair Engineering worth $129,088,000 at the end of the most recent reporting period.

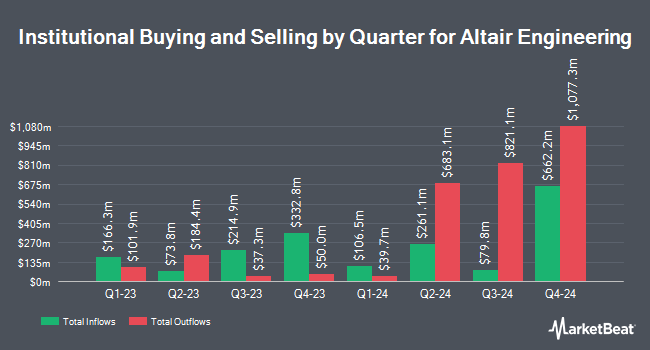

Other institutional investors and hedge funds have also recently bought and sold shares of the company. New York State Teachers Retirement System boosted its stake in shares of Altair Engineering by 1.2% in the third quarter. New York State Teachers Retirement System now owns 8,500 shares of the software's stock valued at $812,000 after purchasing an additional 100 shares during the period. ProShare Advisors LLC lifted its holdings in Altair Engineering by 1.6% in the 2nd quarter. ProShare Advisors LLC now owns 10,219 shares of the software's stock worth $1,002,000 after buying an additional 160 shares in the last quarter. Ballentine Partners LLC boosted its position in Altair Engineering by 8.5% in the 3rd quarter. Ballentine Partners LLC now owns 2,236 shares of the software's stock valued at $214,000 after buying an additional 175 shares during the last quarter. GAMMA Investing LLC grew its stake in shares of Altair Engineering by 81.7% during the second quarter. GAMMA Investing LLC now owns 418 shares of the software's stock valued at $41,000 after acquiring an additional 188 shares in the last quarter. Finally, FSC Wealth Advisors LLC increased its holdings in Altair Engineering by 41.3% during the 2nd quarter. FSC Wealth Advisors LLC now owns 832 shares of the software's stock worth $82,000 after purchasing an additional 243 shares during the last quarter. Hedge funds and other institutional investors own 63.38% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on ALTR. Needham & Company LLC restated a "hold" rating and issued a $100.00 price target on shares of Altair Engineering in a research note on Thursday, October 31st. Rosenblatt Securities increased their price target on shares of Altair Engineering from $88.00 to $113.00 and gave the stock a "neutral" rating in a research report on Thursday, October 31st. Royal Bank of Canada boosted their price objective on Altair Engineering from $90.00 to $113.00 and gave the company a "sector perform" rating in a report on Thursday, October 31st. JPMorgan Chase & Co. downgraded Altair Engineering from an "overweight" rating to a "neutral" rating and set a $95.00 target price on the stock. in a report on Monday, July 15th. Finally, William Blair reiterated a "market perform" rating on shares of Altair Engineering in a report on Thursday, October 31st. One analyst has rated the stock with a sell rating, six have assigned a hold rating and one has given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $100.71.

Check Out Our Latest Stock Report on ALTR

Altair Engineering Stock Performance

Shares of NASDAQ:ALTR traded up $0.53 during trading on Tuesday, hitting $104.52. 3,153,497 shares of the company traded hands, compared to its average volume of 535,127. The stock has a market capitalization of $8.87 billion, a price-to-earnings ratio of 275.05, a PEG ratio of 13.28 and a beta of 1.44. Altair Engineering Inc. has a one year low of $65.25 and a one year high of $113.12. The company has a quick ratio of 3.27, a current ratio of 3.27 and a debt-to-equity ratio of 0.27. The business's fifty day moving average is $94.57 and its 200-day moving average is $91.85.

Insider Buying and Selling

In other Altair Engineering news, CEO James Ralph Scapa sold 13,000 shares of the firm's stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $89.04, for a total value of $1,157,520.00. Following the sale, the chief executive officer now directly owns 134,045 shares in the company, valued at approximately $11,935,366.80. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In other Altair Engineering news, CEO James Ralph Scapa sold 13,000 shares of the firm's stock in a transaction that occurred on Wednesday, August 28th. The shares were sold at an average price of $89.04, for a total value of $1,157,520.00. Following the sale, the chief executive officer now owns 134,045 shares in the company, valued at approximately $11,935,366.80. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, major shareholder Christ Revocable Trust sold 100,000 shares of the business's stock in a transaction that occurred on Wednesday, October 23rd. The stock was sold at an average price of $106.57, for a total value of $10,657,000.00. The disclosure for this sale can be found here. Insiders sold a total of 359,740 shares of company stock worth $35,425,466 in the last three months. 21.75% of the stock is owned by insiders.

Altair Engineering Profile

(

Free Report)

Altair Engineering Inc, together with its subsidiaries, provides software and cloud solutions in the areas of simulation and design, high-performance computing, data analytics, and artificial intelligence in the United States and internationally. It operates in two segments, Software and Client Engineering Services.

Featured Articles

Before you consider Altair Engineering, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altair Engineering wasn't on the list.

While Altair Engineering currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.