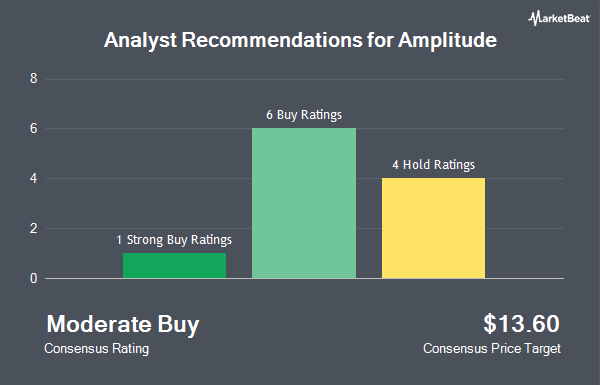

Shares of Amplitude, Inc. (NASDAQ:AMPL - Get Free Report) have been assigned a consensus recommendation of "Reduce" from the seven analysts that are currently covering the stock, MarketBeat Ratings reports. One equities research analyst has rated the stock with a sell recommendation and six have issued a hold recommendation on the company. The average twelve-month price objective among brokerages that have issued ratings on the stock in the last year is $10.33.

AMPL has been the subject of a number of recent analyst reports. Piper Sandler lowered their price target on Amplitude from $11.00 to $9.00 and set a "neutral" rating for the company in a research report on Friday, July 12th. Robert W. Baird lowered their price target on Amplitude from $12.00 to $10.00 and set a "neutral" rating for the company in a research report on Friday, August 9th. Finally, UBS Group reduced their target price on Amplitude from $11.00 to $9.00 and set a "neutral" rating on the stock in a report on Friday, August 9th.

Get Our Latest Research Report on AMPL

Amplitude Stock Up 2.6 %

Shares of NASDAQ AMPL traded up $0.23 during midday trading on Tuesday, reaching $9.24. The company had a trading volume of 188,718 shares, compared to its average volume of 518,380. The firm's fifty day moving average price is $8.81 and its 200-day moving average price is $8.83. The stock has a market cap of $1.13 billion, a PE ratio of -12.66 and a beta of 1.33. Amplitude has a one year low of $7.37 and a one year high of $14.42.

Amplitude (NASDAQ:AMPL - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The company reported ($0.19) EPS for the quarter, missing analysts' consensus estimates of ($0.01) by ($0.18). The business had revenue of $73.30 million for the quarter, compared to the consensus estimate of $71.98 million. Amplitude had a negative net margin of 28.19% and a negative return on equity of 27.58%. The company's revenue for the quarter was up 8.2% on a year-over-year basis. During the same period in the previous year, the company earned ($0.17) EPS. As a group, equities research analysts expect that Amplitude will post -0.65 EPS for the current year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently made changes to their positions in the company. Horrell Capital Management Inc. purchased a new stake in shares of Amplitude in the 3rd quarter worth approximately $1,597,000. Allspring Global Investments Holdings LLC grew its stake in shares of Amplitude by 418.2% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 66,592 shares of the company's stock worth $597,000 after buying an additional 53,741 shares during the last quarter. Blue Trust Inc. grew its stake in shares of Amplitude by 13.5% in the 3rd quarter. Blue Trust Inc. now owns 19,518 shares of the company's stock worth $174,000 after buying an additional 2,324 shares during the last quarter. Creative Planning grew its stake in shares of Amplitude by 152.4% in the 3rd quarter. Creative Planning now owns 26,166 shares of the company's stock worth $235,000 after buying an additional 15,800 shares during the last quarter. Finally, Inspire Investing LLC grew its stake in shares of Amplitude by 16.3% in the 3rd quarter. Inspire Investing LLC now owns 46,088 shares of the company's stock worth $413,000 after buying an additional 6,464 shares during the last quarter. Hedge funds and other institutional investors own 73.20% of the company's stock.

Amplitude Company Profile

(

Get Free ReportAmplitude, Inc, together with its subsidiaries, provides a digital analytics platform that analyzes customer behavior in the United States and internationally. It offers Amplitude Analytics, which provides real-time product data and reconstructed user visits; Amplitude Experiment, a solution that allows teams to test new capabilities and safely roll out new features; Amplitude CDP, an insight-driven solution that encompasses the data infrastructure, audience management, and data streaming capabilities; and Amplitude Session Replay used by product, marketing, and data teams to understand user behavior, diagnose product issues, and improve product outcomes.

Recommended Stories

Before you consider Amplitude, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amplitude wasn't on the list.

While Amplitude currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.