Amplitude (NASDAQ:AMPL - Get Free Report) will be releasing its earnings data after the market closes on Thursday, November 7th. Analysts expect Amplitude to post earnings of $0.00 per share for the quarter. Persons that wish to register for the company's earnings conference call can do so using this link.

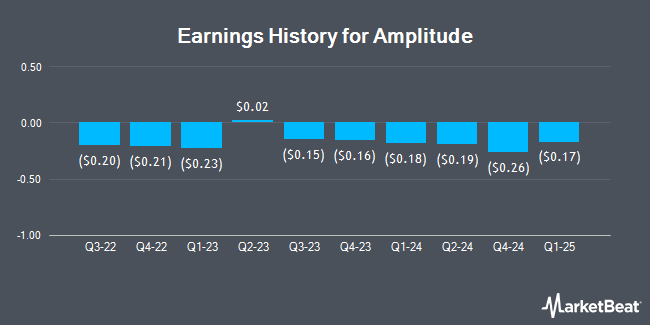

Amplitude (NASDAQ:AMPL - Get Free Report) last issued its quarterly earnings data on Thursday, August 8th. The company reported ($0.19) earnings per share for the quarter, missing the consensus estimate of ($0.01) by ($0.18). The company had revenue of $73.30 million for the quarter, compared to the consensus estimate of $71.98 million. Amplitude had a negative net margin of 28.19% and a negative return on equity of 27.58%. Amplitude's revenue was up 8.2% on a year-over-year basis. During the same quarter last year, the business posted ($0.17) earnings per share. On average, analysts expect Amplitude to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Amplitude Stock Performance

AMPL traded down $0.22 during mid-day trading on Thursday, reaching $8.99. 360,219 shares of the stock were exchanged, compared to its average volume of 517,229. Amplitude has a 1 year low of $7.37 and a 1 year high of $14.42. The stock has a market capitalization of $1.11 billion, a PE ratio of -13.22 and a beta of 1.33. The company has a 50 day moving average price of $8.82 and a two-hundred day moving average price of $8.83.

Wall Street Analyst Weigh In

Several research firms have commented on AMPL. Piper Sandler decreased their price objective on shares of Amplitude from $11.00 to $9.00 and set a "neutral" rating for the company in a research note on Friday, July 12th. UBS Group decreased their price target on Amplitude from $11.00 to $9.00 and set a "neutral" rating for the company in a research report on Friday, August 9th. Finally, Robert W. Baird dropped their price target on Amplitude from $12.00 to $10.00 and set a "neutral" rating on the stock in a report on Friday, August 9th. One analyst has rated the stock with a sell rating and six have given a hold rating to the company. According to MarketBeat, Amplitude currently has an average rating of "Hold" and an average price target of $10.33.

View Our Latest Analysis on AMPL

Amplitude Company Profile

(

Get Free Report)

Amplitude, Inc, together with its subsidiaries, provides a digital analytics platform that analyzes customer behavior in the United States and internationally. It offers Amplitude Analytics, which provides real-time product data and reconstructed user visits; Amplitude Experiment, a solution that allows teams to test new capabilities and safely roll out new features; Amplitude CDP, an insight-driven solution that encompasses the data infrastructure, audience management, and data streaming capabilities; and Amplitude Session Replay used by product, marketing, and data teams to understand user behavior, diagnose product issues, and improve product outcomes.

Recommended Stories

Before you consider Amplitude, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amplitude wasn't on the list.

While Amplitude currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.