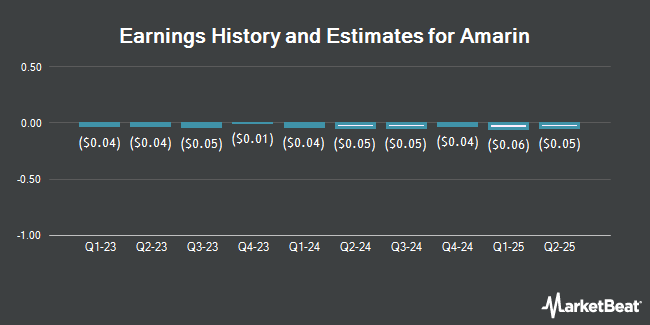

Amarin Co. plc (NASDAQ:AMRN - Free Report) - Investment analysts at Zacks Research boosted their FY2025 earnings estimates for shares of Amarin in a report released on Tuesday, October 1st. Zacks Research analyst R. Department now expects that the biopharmaceutical company will post earnings of ($0.19) per share for the year, up from their previous forecast of ($0.20). The consensus estimate for Amarin's current full-year earnings is ($0.18) per share.

Several other equities research analysts have also issued reports on AMRN. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Amarin in a report on Tuesday, June 18th. StockNews.com cut shares of Amarin from a "buy" rating to a "hold" rating in a research note on Thursday, July 4th.

View Our Latest Stock Report on Amarin

Amarin Stock Up 2.1 %

Shares of NASDAQ:AMRN traded up $0.01 during trading on Friday, reaching $0.61. 1,381,721 shares of the company traded hands, compared to its average volume of 1,612,683. Amarin has a 52 week low of $0.57 and a 52 week high of $1.37. The firm has a market capitalization of $248.79 million, a PE ratio of -5.16 and a beta of 1.92. The company's 50 day moving average is $0.63 and its two-hundred day moving average is $0.76.

Hedge Funds Weigh In On Amarin

Institutional investors and hedge funds have recently modified their holdings of the business. BNP Paribas Financial Markets increased its stake in Amarin by 104.8% in the first quarter. BNP Paribas Financial Markets now owns 932,173 shares of the biopharmaceutical company's stock valued at $830,000 after purchasing an additional 476,996 shares in the last quarter. GSA Capital Partners LLP raised its position in Amarin by 74.4% in the 1st quarter. GSA Capital Partners LLP now owns 1,482,540 shares of the biopharmaceutical company's stock valued at $1,321,000 after buying an additional 632,497 shares during the last quarter. Waterfront Wealth Inc. lifted its stake in Amarin by 63.7% during the 2nd quarter. Waterfront Wealth Inc. now owns 860,613 shares of the biopharmaceutical company's stock valued at $592,000 after acquiring an additional 334,969 shares in the last quarter. Significant Wealth Partners LLC lifted its position in shares of Amarin by 128.7% during the first quarter. Significant Wealth Partners LLC now owns 34,582 shares of the biopharmaceutical company's stock valued at $31,000 after purchasing an additional 19,461 shares in the last quarter. Finally, Longitude Cayman Ltd. lifted its position in shares of Amarin by 1.5% during the 2nd quarter. Longitude Cayman Ltd. now owns 2,390,000 shares of the biopharmaceutical company's stock worth $1,649,000 after buying an additional 35,000 shares in the last quarter. 22.25% of the stock is currently owned by institutional investors.

Insider Buying and Selling at Amarin

In related news, CEO Aaron Berg acquired 160,000 shares of the stock in a transaction dated Friday, August 2nd. The stock was bought at an average cost of $0.64 per share, for a total transaction of $102,400.00. Following the completion of the transaction, the chief executive officer now directly owns 805,380 shares of the company's stock, valued at $515,443.20. The trade was a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Corporate insiders own 1.96% of the company's stock.

About Amarin

(

Get Free Report)

Amarin Corporation plc, a pharmaceutical company, engages in the development and commercialization of therapeutics for the treatment of cardiovascular diseases in the United States, European countries, Canada, Lebanon, and the United Arab Emirates. The company offers VASCEPA, a prescription-only omega-3 fatty acid product, used as an adjunct to diet for reducing triglyceride levels in adult patients with severe hypertriglyceridemia.

See Also

Before you consider Amarin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amarin wasn't on the list.

While Amarin currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.