Sanctuary Advisors LLC purchased a new stake in shares of American Woodmark Co. (NASDAQ:AMWD - Free Report) in the 2nd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 5,315 shares of the company's stock, valued at approximately $418,000.

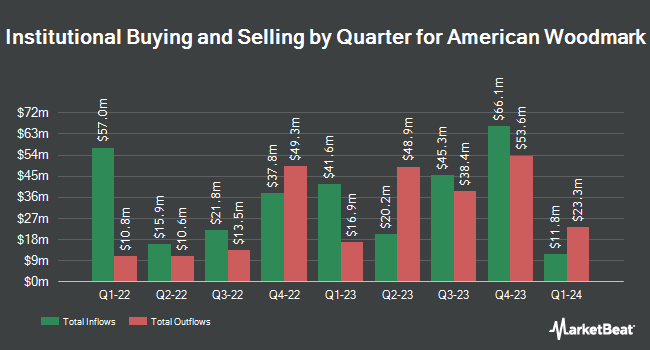

Other institutional investors also recently bought and sold shares of the company. Virtu Financial LLC bought a new position in shares of American Woodmark in the fourth quarter worth approximately $311,000. Vanguard Group Inc. lifted its position in American Woodmark by 4.6% in the 4th quarter. Vanguard Group Inc. now owns 1,691,081 shares of the company's stock valued at $157,017,000 after acquiring an additional 74,371 shares in the last quarter. Guidance Capital Inc. purchased a new stake in American Woodmark during the 1st quarter valued at $445,000. Allspring Global Investments Holdings LLC increased its holdings in shares of American Woodmark by 3,400.0% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 2,520 shares of the company's stock worth $256,000 after purchasing an additional 2,448 shares in the last quarter. Finally, BNP Paribas Financial Markets raised its stake in shares of American Woodmark by 31.7% in the first quarter. BNP Paribas Financial Markets now owns 10,210 shares of the company's stock worth $1,038,000 after purchasing an additional 2,457 shares during the last quarter. 95.47% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research firms recently commented on AMWD. Loop Capital raised American Woodmark from a "hold" rating to a "buy" rating and increased their price objective for the company from $98.00 to $119.00 in a research report on Thursday. Robert W. Baird reduced their price target on shares of American Woodmark from $116.00 to $112.00 and set an "outperform" rating for the company in a research note on Wednesday, August 28th. Zelman & Associates restated a "neutral" rating on shares of American Woodmark in a research report on Wednesday, July 17th. Finally, Wolfe Research upgraded shares of American Woodmark from a "peer perform" rating to an "outperform" rating and set a $110.00 target price on the stock in a report on Wednesday, August 14th. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, American Woodmark has a consensus rating of "Moderate Buy" and an average price target of $107.25.

View Our Latest Analysis on AMWD

Insider Buying and Selling

In other American Woodmark news, CEO Michael Scott Culbreth sold 3,500 shares of the business's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $92.69, for a total transaction of $324,415.00. Following the completion of the sale, the chief executive officer now owns 113,432 shares of the company's stock, valued at approximately $10,514,012.08. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. 1.30% of the stock is owned by insiders.

American Woodmark Stock Performance

Shares of NASDAQ AMWD traded up $3.57 during midday trading on Thursday, hitting $99.69. 217,872 shares of the company's stock traded hands, compared to its average volume of 153,962. The firm has a fifty day moving average of $91.05 and a 200 day moving average of $90.18. American Woodmark Co. has a 1 year low of $65.01 and a 1 year high of $106.57. The company has a debt-to-equity ratio of 0.41, a quick ratio of 1.14 and a current ratio of 1.98. The stock has a market capitalization of $1.55 billion, a price-to-earnings ratio of 13.96 and a beta of 1.61.

American Woodmark (NASDAQ:AMWD - Get Free Report) last announced its earnings results on Tuesday, August 27th. The company reported $1.89 EPS for the quarter, missing analysts' consensus estimates of $2.37 by ($0.48). American Woodmark had a net margin of 5.97% and a return on equity of 13.51%. The business had revenue of $459.10 million for the quarter, compared to analysts' expectations of $475.37 million. During the same period in the prior year, the company posted $2.78 earnings per share. The firm's quarterly revenue was down 7.9% on a year-over-year basis.

American Woodmark Company Profile

(

Free Report)

American Woodmark Corporation manufactures and distributes kitchen, bath, office, home organization, and hardware products for the remodelling and new home construction markets in the United States. The company offers made-to-order and cash and carry products. It also provides turnkey installation services to its direct builder customers through a network of eight service centers.

Read More

Before you consider American Woodmark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Woodmark wasn't on the list.

While American Woodmark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.