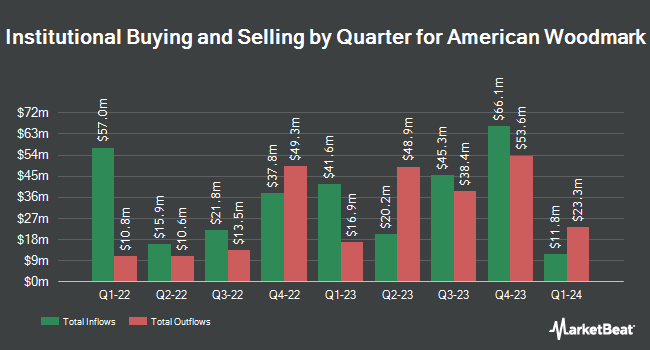

Allspring Global Investments Holdings LLC increased its position in American Woodmark Co. (NASDAQ:AMWD - Free Report) by 1,442.0% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 29,421 shares of the company's stock after buying an additional 27,513 shares during the quarter. Allspring Global Investments Holdings LLC owned 0.19% of American Woodmark worth $2,749,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. CWM LLC increased its holdings in American Woodmark by 56.7% during the 3rd quarter. CWM LLC now owns 622 shares of the company's stock valued at $58,000 after purchasing an additional 225 shares during the period. Innealta Capital LLC bought a new position in shares of American Woodmark during the second quarter valued at approximately $66,000. Picton Mahoney Asset Management purchased a new stake in American Woodmark in the second quarter worth $71,000. DekaBank Deutsche Girozentrale boosted its holdings in American Woodmark by 67.9% in the first quarter. DekaBank Deutsche Girozentrale now owns 932 shares of the company's stock valued at $94,000 after acquiring an additional 377 shares in the last quarter. Finally, EntryPoint Capital LLC increased its position in American Woodmark by 67.8% during the 1st quarter. EntryPoint Capital LLC now owns 1,562 shares of the company's stock valued at $159,000 after purchasing an additional 631 shares during the period. 95.47% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other news, CEO Michael Scott Culbreth sold 3,500 shares of American Woodmark stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $92.69, for a total transaction of $324,415.00. Following the transaction, the chief executive officer now owns 113,432 shares in the company, valued at $10,514,012.08. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. 1.30% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

AMWD has been the subject of several research analyst reports. Zelman & Associates reaffirmed a "neutral" rating on shares of American Woodmark in a research report on Wednesday, July 17th. Wolfe Research raised American Woodmark from a "peer perform" rating to an "outperform" rating and set a $110.00 price objective on the stock in a research report on Wednesday, August 14th. Loop Capital raised American Woodmark from a "hold" rating to a "buy" rating and increased their target price for the stock from $98.00 to $119.00 in a research report on Thursday, October 17th. Finally, Robert W. Baird lifted their price target on American Woodmark from $112.00 to $115.00 and gave the company an "outperform" rating in a research report on Monday, October 21st. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $108.00.

Read Our Latest Research Report on AMWD

American Woodmark Stock Up 1.0 %

Shares of American Woodmark stock traded up $0.95 during midday trading on Wednesday, hitting $92.60. The company had a trading volume of 139,233 shares, compared to its average volume of 153,121. The company has a 50 day moving average of $91.82 and a 200 day moving average of $89.88. The stock has a market capitalization of $1.44 billion, a P/E ratio of 12.84 and a beta of 1.61. American Woodmark Co. has a 52-week low of $66.01 and a 52-week high of $106.57. The company has a debt-to-equity ratio of 0.41, a quick ratio of 1.14 and a current ratio of 1.98.

American Woodmark (NASDAQ:AMWD - Get Free Report) last released its quarterly earnings data on Tuesday, August 27th. The company reported $1.89 EPS for the quarter, missing the consensus estimate of $2.37 by ($0.48). American Woodmark had a net margin of 5.97% and a return on equity of 13.51%. The business had revenue of $459.10 million for the quarter, compared to analysts' expectations of $475.37 million. During the same period last year, the business earned $2.78 earnings per share. The company's quarterly revenue was down 7.9% on a year-over-year basis.

American Woodmark Company Profile

(

Free Report)

American Woodmark Corporation manufactures and distributes kitchen, bath, office, home organization, and hardware products for the remodelling and new home construction markets in the United States. The company offers made-to-order and cash and carry products. It also provides turnkey installation services to its direct builder customers through a network of eight service centers.

Featured Stories

Before you consider American Woodmark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Woodmark wasn't on the list.

While American Woodmark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.