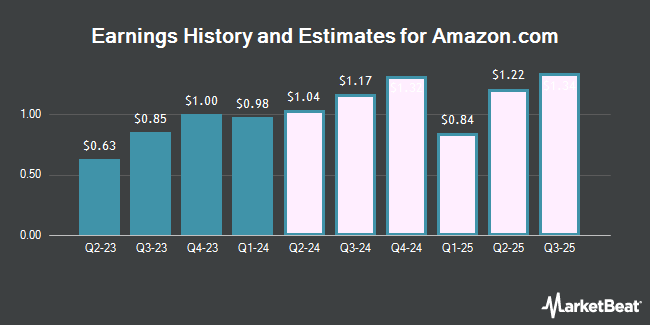

Amazon.com, Inc. (NASDAQ:AMZN - Free Report) - Equities researchers at Seaport Res Ptn issued their Q1 2025 EPS estimates for Amazon.com in a research note issued on Thursday, October 31st. Seaport Res Ptn analyst A. Kessler anticipates that the e-commerce giant will earn $1.43 per share for the quarter. The consensus estimate for Amazon.com's current full-year earnings is $4.84 per share. Seaport Res Ptn also issued estimates for Amazon.com's Q2 2025 earnings at $1.38 EPS, Q3 2025 earnings at $1.55 EPS and Q4 2025 earnings at $1.68 EPS.

Amazon.com (NASDAQ:AMZN - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The e-commerce giant reported $1.43 EPS for the quarter, beating the consensus estimate of $1.14 by $0.29. Amazon.com had a net margin of 8.04% and a return on equity of 23.46%. The firm had revenue of $158.88 billion during the quarter, compared to analyst estimates of $157.28 billion. During the same quarter last year, the business posted $0.85 EPS. The company's revenue for the quarter was up 11.0% on a year-over-year basis.

AMZN has been the subject of several other reports. UBS Group increased their price objective on Amazon.com from $220.00 to $223.00 and gave the company a "buy" rating in a report on Monday, October 28th. Truist Financial lifted their price objective on Amazon.com from $265.00 to $270.00 and gave the stock a "buy" rating in a report on Friday. Stifel Nicolaus upped their price objective on shares of Amazon.com from $224.00 to $245.00 and gave the company a "buy" rating in a report on Friday. Benchmark lifted their target price on shares of Amazon.com from $200.00 to $215.00 and gave the stock a "buy" rating in a research note on Friday. Finally, JMP Securities upped their price target on shares of Amazon.com from $265.00 to $285.00 and gave the company a "market outperform" rating in a research note on Friday. Two equities research analysts have rated the stock with a hold rating, forty have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $246.48.

View Our Latest Research Report on AMZN

Amazon.com Stock Performance

AMZN traded down $2.15 during trading on Monday, hitting $195.78. 38,347,250 shares of the company traded hands, compared to its average volume of 41,316,223. The stock's fifty day moving average is $184.82 and its 200 day moving average is $183.77. The company has a quick ratio of 0.88, a current ratio of 1.10 and a debt-to-equity ratio of 0.23. Amazon.com has a one year low of $138.36 and a one year high of $201.20. The firm has a market cap of $2.05 trillion, a P/E ratio of 41.92, a price-to-earnings-growth ratio of 1.42 and a beta of 1.14.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in AMZN. Vanguard Group Inc. lifted its stake in shares of Amazon.com by 1.9% during the 1st quarter. Vanguard Group Inc. now owns 785,811,114 shares of the e-commerce giant's stock valued at $141,744,609,000 after buying an additional 14,724,687 shares in the last quarter. Capital Research Global Investors lifted its position in shares of Amazon.com by 8.5% in the first quarter. Capital Research Global Investors now owns 86,982,857 shares of the e-commerce giant's stock valued at $15,689,968,000 after acquiring an additional 6,810,145 shares in the last quarter. Legal & General Group Plc boosted its stake in shares of Amazon.com by 1.5% in the second quarter. Legal & General Group Plc now owns 69,686,374 shares of the e-commerce giant's stock worth $13,466,933,000 after acquiring an additional 1,042,177 shares during the period. Bank of New York Mellon Corp raised its stake in Amazon.com by 0.4% during the 2nd quarter. Bank of New York Mellon Corp now owns 67,745,972 shares of the e-commerce giant's stock valued at $13,091,909,000 after purchasing an additional 289,532 shares during the period. Finally, Jennison Associates LLC boosted its stake in Amazon.com by 0.5% in the 1st quarter. Jennison Associates LLC now owns 56,666,183 shares of the e-commerce giant's stock worth $10,221,446,000 after purchasing an additional 295,132 shares during the period. 72.20% of the stock is currently owned by institutional investors.

Insider Transactions at Amazon.com

In related news, CEO Andrew R. Jassy sold 20,784 shares of the business's stock in a transaction that occurred on Wednesday, August 21st. The shares were sold at an average price of $180.77, for a total transaction of $3,757,123.68. Following the completion of the sale, the chief executive officer now directly owns 2,056,534 shares in the company, valued at approximately $371,759,651.18. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. In related news, SVP David Zapolsky sold 2,190 shares of Amazon.com stock in a transaction on Tuesday, September 24th. The stock was sold at an average price of $195.00, for a total transaction of $427,050.00. Following the transaction, the senior vice president now directly owns 62,420 shares in the company, valued at approximately $12,171,900. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Andrew R. Jassy sold 20,784 shares of the business's stock in a transaction dated Wednesday, August 21st. The shares were sold at an average price of $180.77, for a total value of $3,757,123.68. Following the sale, the chief executive officer now directly owns 2,056,534 shares of the company's stock, valued at $371,759,651.18. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 50,855 shares of company stock worth $9,215,048 in the last quarter. Company insiders own 10.80% of the company's stock.

About Amazon.com

(

Get Free Report)

Amazon.com, Inc engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Echo, Ring, Blink, and eero; and develops and produces media content.

Featured Stories

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report