AnaptysBio (NASDAQ:ANAB - Get Free Report)'s stock had its "buy" rating restated by HC Wainwright in a research note issued on Thursday, Benzinga reports. They currently have a $55.00 target price on the biotechnology company's stock. HC Wainwright's price target indicates a potential upside of 154.28% from the company's current price.

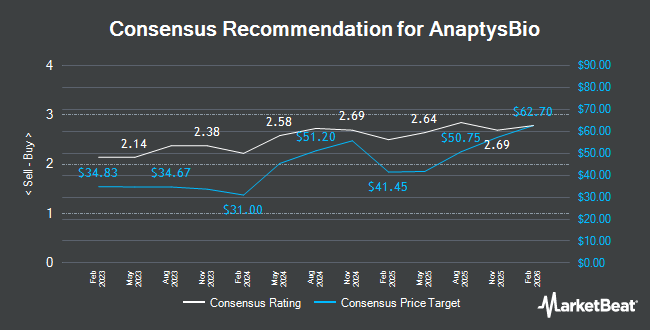

ANAB has been the topic of several other research reports. Wedbush restated an "outperform" rating and set a $42.00 price objective on shares of AnaptysBio in a report on Thursday, September 26th. UBS Group lifted their target price on AnaptysBio from $23.00 to $33.00 and gave the company a "neutral" rating in a report on Wednesday. Guggenheim lifted their target price on AnaptysBio from $75.00 to $90.00 and gave the company a "buy" rating in a report on Monday, October 21st. JPMorgan Chase & Co. lifted their target price on AnaptysBio from $69.00 to $75.00 and gave the company an "overweight" rating in a report on Wednesday, August 7th. Finally, Truist Financial lifted their target price on AnaptysBio from $20.00 to $30.00 and gave the company a "hold" rating in a report on Thursday, August 15th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating and ten have assigned a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $55.73.

Get Our Latest Research Report on ANAB

AnaptysBio Stock Down 2.5 %

Shares of ANAB stock traded down $0.55 during mid-day trading on Thursday, hitting $21.63. 784,575 shares of the company's stock were exchanged, compared to its average volume of 342,852. AnaptysBio has a fifty-two week low of $13.36 and a fifty-two week high of $41.31. The stock has a 50-day simple moving average of $34.60 and a two-hundred day simple moving average of $29.82. The stock has a market cap of $590.91 million, a price-to-earnings ratio of -3.52 and a beta of -0.29.

AnaptysBio (NASDAQ:ANAB - Get Free Report) last posted its quarterly earnings data on Monday, August 5th. The biotechnology company reported ($1.71) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.89) by ($0.82). AnaptysBio had a negative return on equity of 255.68% and a negative net margin of 558.25%. The business had revenue of $10.97 million for the quarter, compared to analyst estimates of $25.85 million. As a group, analysts anticipate that AnaptysBio will post -6.84 earnings per share for the current fiscal year.

Insider Transactions at AnaptysBio

In other AnaptysBio news, major shareholder Ecor1 Capital, Llc bought 273,972 shares of the company's stock in a transaction dated Wednesday, August 14th. The shares were acquired at an average cost of $36.50 per share, with a total value of $9,999,978.00. Following the completion of the transaction, the insider now owns 7,794,996 shares in the company, valued at $284,517,354. The trade was a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, insider Paul F. Lizzul sold 1,500 shares of AnaptysBio stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $38.67, for a total transaction of $58,005.00. Following the sale, the insider now directly owns 15,398 shares of the company's stock, valued at approximately $595,440.66. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, major shareholder Ecor1 Capital, Llc bought 273,972 shares of the company's stock in a transaction dated Wednesday, August 14th. The shares were acquired at an average cost of $36.50 per share, for a total transaction of $9,999,978.00. Following the completion of the transaction, the insider now owns 7,794,996 shares of the company's stock, valued at approximately $284,517,354. The trade was a 0.00 % increase in their position. The disclosure for this purchase can be found here. Over the last ninety days, insiders have sold 22,440 shares of company stock valued at $892,936. 33.70% of the stock is currently owned by insiders.

Institutional Trading of AnaptysBio

Hedge funds and other institutional investors have recently modified their holdings of the business. Values First Advisors Inc. purchased a new stake in shares of AnaptysBio during the third quarter worth about $49,000. nVerses Capital LLC increased its holdings in AnaptysBio by 700.0% in the third quarter. nVerses Capital LLC now owns 1,600 shares of the biotechnology company's stock valued at $54,000 after buying an additional 1,400 shares during the last quarter. Allspring Global Investments Holdings LLC bought a new stake in AnaptysBio in the first quarter valued at about $38,000. Headlands Technologies LLC increased its holdings in AnaptysBio by 444.8% in the second quarter. Headlands Technologies LLC now owns 3,552 shares of the biotechnology company's stock valued at $89,000 after buying an additional 2,900 shares during the last quarter. Finally, China Universal Asset Management Co. Ltd. increased its holdings in AnaptysBio by 81.0% in the third quarter. China Universal Asset Management Co. Ltd. now owns 5,808 shares of the biotechnology company's stock valued at $195,000 after buying an additional 2,600 shares during the last quarter.

About AnaptysBio

(

Get Free Report)

AnaptysBio, Inc, a clinical-stage biotechnology company, focuses in delivering immunology therapeutics. Its products include Rosnilimab, an IgG1 antibody that targets PD-1+ T cells, resulting in their agonism or depletion, broadly impacting pathogenic drivers of autoimmune and inflammatory diseases; and ANB032, a non-depleting antibody that binds to the BTLA checkpoint receptor and inhibits activated T cell proliferation; ANB033, a novel anti-CD122 antagonist antibody that targets the shared common beta subunit of the receptors for IL-15 and IL-2; ANB101, a BDCA2 modulator antibody that specifically targets plasmacytoid dendritic cells (pDCs); and Imsidolimab, an antibody that inhibits the interleukin-36 receptor, which is in the Phase 3 development for the treatment of generalized pustular psoriasis.

Recommended Stories

Before you consider AnaptysBio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AnaptysBio wasn't on the list.

While AnaptysBio currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.