Andersons (NASDAQ:ANDE - Get Free Report) will release its earnings data after the market closes on Monday, November 4th. Persons that are interested in participating in the company's earnings conference call can do so using this link.

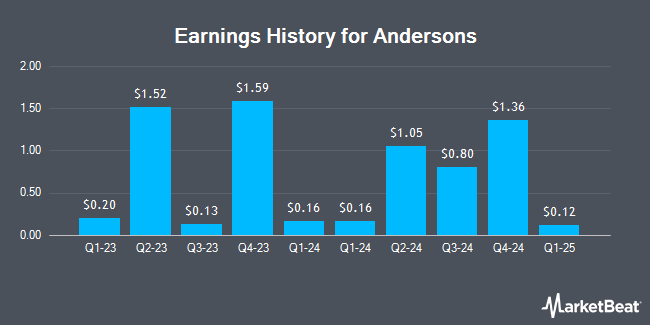

Andersons (NASDAQ:ANDE - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The basic materials company reported $1.05 earnings per share for the quarter, missing the consensus estimate of $1.09 by ($0.04). Andersons had a return on equity of 6.99% and a net margin of 0.83%. The firm had revenue of $2.80 billion for the quarter, compared to analyst estimates of $3.20 billion. During the same period in the prior year, the company earned $1.52 earnings per share. The firm's quarterly revenue was down 30.5% on a year-over-year basis.

Andersons Stock Up 1.4 %

ANDE stock traded up $0.67 during midday trading on Monday, hitting $47.25. The company's stock had a trading volume of 78,187 shares, compared to its average volume of 168,267. The company's fifty day moving average price is $48.82 and its 200 day moving average price is $50.65. Andersons has a twelve month low of $44.65 and a twelve month high of $61.46. The company has a debt-to-equity ratio of 0.36, a current ratio of 2.07 and a quick ratio of 1.44. The stock has a market capitalization of $1.61 billion, a P/E ratio of 13.35 and a beta of 0.57.

Andersons Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, October 22nd. Investors of record on Tuesday, October 1st were issued a dividend of $0.19 per share. The ex-dividend date was Tuesday, October 1st. This represents a $0.76 annualized dividend and a yield of 1.61%. Andersons's payout ratio is presently 21.47%.

Analyst Upgrades and Downgrades

Separately, StockNews.com raised shares of Andersons from a "hold" rating to a "buy" rating in a research report on Thursday.

Read Our Latest Stock Analysis on ANDE

Andersons Company Profile

(

Get Free Report)

The Andersons, Inc operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally. It operates through three segments: Trade, Renewables, and Nutrient & Industrial. The company's Trade segment operates grain elevators; stores commodities; and provides grain marketing, risk management, and origination services, as well as sells commodities, such as corn, soybeans, wheat, oats, ethanol, and corn oil.

Featured Articles

Before you consider Andersons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Andersons wasn't on the list.

While Andersons currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.