Cannon Global Investment Management LLC purchased a new position in shares of ANSYS, Inc. (NASDAQ:ANSS - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 4,400 shares of the software maker's stock, valued at approximately $1,402,000. ANSYS accounts for about 2.2% of Cannon Global Investment Management LLC's portfolio, making the stock its 8th biggest holding.

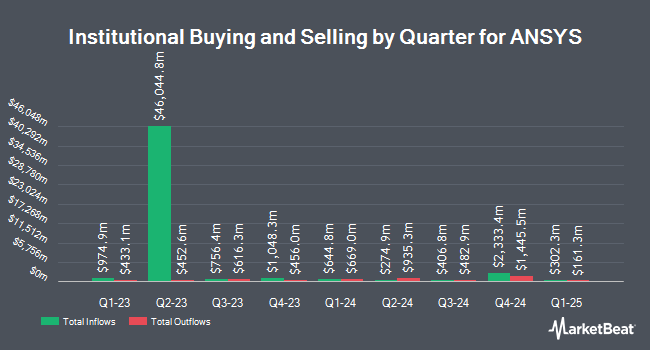

A number of other hedge funds have also bought and sold shares of ANSS. Vanguard Group Inc. raised its position in ANSYS by 0.7% during the first quarter. Vanguard Group Inc. now owns 10,234,642 shares of the software maker's stock valued at $3,553,058,000 after purchasing an additional 73,585 shares in the last quarter. Earnest Partners LLC raised its position in ANSYS by 2.5% during the second quarter. Earnest Partners LLC now owns 607,029 shares of the software maker's stock valued at $195,160,000 after purchasing an additional 15,012 shares in the last quarter. DekaBank Deutsche Girozentrale raised its position in ANSYS by 4.6% during the second quarter. DekaBank Deutsche Girozentrale now owns 522,613 shares of the software maker's stock valued at $167,985,000 after purchasing an additional 22,836 shares in the last quarter. Sei Investments Co. raised its position in ANSYS by 1.6% during the second quarter. Sei Investments Co. now owns 423,892 shares of the software maker's stock valued at $136,281,000 after purchasing an additional 6,867 shares in the last quarter. Finally, CCLA Investment Management raised its position in ANSYS by 1.1% during the second quarter. CCLA Investment Management now owns 398,560 shares of the software maker's stock valued at $128,081,000 after purchasing an additional 4,200 shares in the last quarter. 92.39% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several brokerages have commented on ANSS. StockNews.com upgraded shares of ANSYS from a "hold" rating to a "buy" rating in a research report on Tuesday, October 29th. Rosenblatt Securities lowered their price objective on shares of ANSYS from $345.00 to $335.00 and set a "neutral" rating for the company in a research report on Tuesday, August 6th. Two investment analysts have rated the stock with a sell rating, five have assigned a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat, ANSYS presently has an average rating of "Hold" and a consensus target price of $318.33.

Get Our Latest Stock Report on ANSS

Insiders Place Their Bets

In related news, Director Glenda Dorchak sold 152 shares of the company's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $313.61, for a total transaction of $47,668.72. Following the sale, the director now owns 3,630 shares in the company, valued at $1,138,404.30. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 0.46% of the company's stock.

ANSYS Price Performance

Shares of NASDAQ:ANSS traded up $3.34 during trading on Friday, hitting $323.75. 558,471 shares of the company were exchanged, compared to its average volume of 348,937. The business's 50 day moving average is $320.18 and its 200-day moving average is $321.48. The company has a market capitalization of $28.29 billion, a P/E ratio of 57.20, a price-to-earnings-growth ratio of 6.87 and a beta of 1.11. The company has a quick ratio of 2.95, a current ratio of 2.95 and a debt-to-equity ratio of 0.13. ANSYS, Inc. has a 1-year low of $258.01 and a 1-year high of $364.31.

ANSYS (NASDAQ:ANSS - Get Free Report) last released its quarterly earnings results on Wednesday, July 31st. The software maker reported $2.50 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.92 by $0.58. ANSYS had a net margin of 21.30% and a return on equity of 11.51%. The firm had revenue of $594.14 million during the quarter, compared to analyst estimates of $550.30 million. During the same quarter last year, the business earned $1.06 EPS. The company's revenue was up 19.6% compared to the same quarter last year. Equities analysts forecast that ANSYS, Inc. will post 7.32 earnings per share for the current year.

About ANSYS

(

Free Report)

ANSYS, Inc develops and markets engineering simulation software and services for engineers, designers, researchers, and students in the United States, Japan, Germany, China, Hong Kong, South Korea, rest of Europe, the Middle East, Africa, and internationally. It offers structural analysis product suite that provides simulation tools for product design and optimization; the Ansys Mechanical product, an element analysis software; LS-DYNA solver for multiphysics simulation; and power analysis and optimization software suite.

Read More

Before you consider ANSYS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ANSYS wasn't on the list.

While ANSYS currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.