AppFolio (NASDAQ:APPF - Free Report) had its price target lowered by KeyCorp from $300.00 to $252.00 in a report issued on Friday, Benzinga reports. KeyCorp currently has an overweight rating on the software maker's stock.

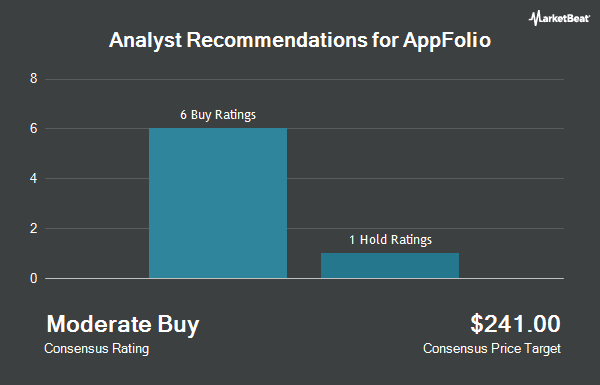

Other analysts also recently issued reports about the stock. Piper Sandler Companies reissued an "overweight" rating and set a $300.00 price objective on shares of AppFolio in a research report on Friday, July 26th. JPMorgan Chase & Co. boosted their price objective on shares of AppFolio from $260.00 to $328.00 and gave the stock an "overweight" rating in a report on Wednesday, July 17th. DA Davidson increased their target price on AppFolio from $285.00 to $300.00 and gave the company a "buy" rating in a research note on Friday, July 26th. StockNews.com cut AppFolio from a "buy" rating to a "hold" rating in a research note on Thursday, August 22nd. Finally, Piper Sandler dropped their price objective on AppFolio from $300.00 to $265.00 and set an "overweight" rating on the stock in a research report on Friday. One analyst has rated the stock with a sell rating, one has assigned a hold rating and seven have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $261.75.

Check Out Our Latest Stock Analysis on APPF

AppFolio Stock Up 10.6 %

Shares of NASDAQ APPF traded up $20.27 on Friday, reaching $212.34. 894,181 shares of the company's stock traded hands, compared to its average volume of 281,676. The company has a market cap of $7.69 billion, a price-to-earnings ratio of 103.60 and a beta of 0.81. The business's 50 day simple moving average is $223.73 and its two-hundred day simple moving average is $231.12. AppFolio has a 12 month low of $164.29 and a 12 month high of $274.56.

AppFolio (NASDAQ:APPF - Get Free Report) last released its earnings results on Thursday, October 24th. The software maker reported $1.29 EPS for the quarter, topping the consensus estimate of $1.03 by $0.26. AppFolio had a return on equity of 27.39% and a net margin of 17.32%. The business had revenue of $206.00 million for the quarter, compared to the consensus estimate of $199.11 million. During the same period in the previous year, the company posted $0.26 earnings per share. The company's revenue for the quarter was up 24.5% compared to the same quarter last year. Analysts forecast that AppFolio will post 3.04 earnings per share for the current fiscal year.

Insider Buying and Selling

In other AppFolio news, major shareholder Maurice J. Duca sold 1,296 shares of the company's stock in a transaction that occurred on Wednesday, September 25th. The stock was sold at an average price of $236.77, for a total value of $306,853.92. Following the completion of the transaction, the insider now directly owns 9,383 shares in the company, valued at $2,221,612.91. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. In other AppFolio news, major shareholder Maurice J. Duca sold 1,296 shares of the stock in a transaction dated Wednesday, September 25th. The shares were sold at an average price of $236.77, for a total transaction of $306,853.92. Following the completion of the transaction, the insider now owns 9,383 shares of the company's stock, valued at $2,221,612.91. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Matthew S. Mazza sold 2,371 shares of the firm's stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $221.22, for a total value of $524,512.62. Following the transaction, the insider now owns 39,980 shares of the company's stock, valued at approximately $8,844,375.60. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 17,852 shares of company stock worth $4,100,322. 9.15% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently modified their holdings of the company. Blue Trust Inc. raised its stake in AppFolio by 85.7% during the third quarter. Blue Trust Inc. now owns 117 shares of the software maker's stock valued at $29,000 after purchasing an additional 54 shares in the last quarter. GAMMA Investing LLC raised its position in shares of AppFolio by 589.5% during the 2nd quarter. GAMMA Investing LLC now owns 131 shares of the software maker's stock valued at $32,000 after buying an additional 112 shares in the last quarter. CWM LLC lifted its holdings in shares of AppFolio by 238.6% in the 2nd quarter. CWM LLC now owns 149 shares of the software maker's stock valued at $36,000 after acquiring an additional 105 shares during the last quarter. Advisors Asset Management Inc. grew its position in AppFolio by 291.3% in the first quarter. Advisors Asset Management Inc. now owns 180 shares of the software maker's stock worth $44,000 after acquiring an additional 134 shares in the last quarter. Finally, Northwestern Mutual Wealth Management Co. increased its stake in AppFolio by 688.9% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 213 shares of the software maker's stock worth $52,000 after acquiring an additional 186 shares during the last quarter. 62.34% of the stock is currently owned by institutional investors.

About AppFolio

(

Get Free Report)

AppFolio, Inc, together with its subsidiaries, provides cloud business management solutions for the real estate industry in the United States. The company provides a cloud-based platform that enables users to automate and optimize common workflows; tools that assist with leasing, maintenance, and accounting; and other technology and services offered by third parties.

See Also

Before you consider AppFolio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AppFolio wasn't on the list.

While AppFolio currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.