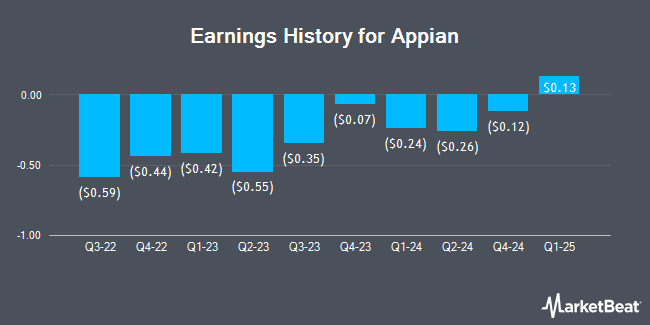

Appian (NASDAQ:APPN - Get Free Report) is scheduled to release its earnings data before the market opens on Thursday, November 7th. Analysts expect Appian to post earnings of ($0.09) per share for the quarter. Persons that are interested in registering for the company's earnings conference call can do so using this link.

Appian (NASDAQ:APPN - Get Free Report) last announced its earnings results on Thursday, August 1st. The company reported ($0.26) earnings per share for the quarter, beating analysts' consensus estimates of ($0.31) by $0.05. The business had revenue of $146.50 million during the quarter, compared to analyst estimates of $142.87 million. Appian had a negative net margin of 18.80% and a negative return on equity of 532.05%. The company's quarterly revenue was up 14.7% compared to the same quarter last year. During the same period in the previous year, the business earned ($0.55) EPS. On average, analysts expect Appian to post $-1 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Appian Stock Up 1.3 %

APPN traded up $0.45 during mid-day trading on Thursday, reaching $35.75. 500,345 shares of the company traded hands, compared to its average volume of 546,502. The stock has a market capitalization of $2.58 billion, a P/E ratio of -24.32 and a beta of 1.57. The company's fifty day moving average price is $32.47 and its 200-day moving average price is $32.10. Appian has a 52-week low of $26.28 and a 52-week high of $42.99.

Insiders Place Their Bets

In other Appian news, major shareholder Abdiel Capital Advisors, Lp purchased 75,000 shares of the business's stock in a transaction on Friday, August 9th. The stock was acquired at an average price of $28.15 per share, for a total transaction of $2,111,250.00. Following the purchase, the insider now owns 8,380,847 shares of the company's stock, valued at approximately $235,920,843.05. This represents a 0.00 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. In the last quarter, insiders acquired 1,044,276 shares of company stock worth $31,165,851. Corporate insiders own 44.00% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have weighed in on APPN. KeyCorp lowered shares of Appian from an "overweight" rating to a "sector weight" rating in a research note on Friday, August 2nd. William Blair lowered Appian from an "outperform" rating to a "market perform" rating in a research note on Thursday, August 1st. Barclays reduced their price objective on Appian from $32.00 to $29.00 and set an "underweight" rating for the company in a research note on Monday, August 5th. DA Davidson restated a "neutral" rating and issued a $33.00 price objective on shares of Appian in a research note on Monday, October 14th. Finally, The Goldman Sachs Group reduced their price objective on Appian from $47.00 to $41.00 and set a "buy" rating for the company in a research note on Friday, August 2nd. One investment analyst has rated the stock with a sell rating, four have assigned a hold rating and one has given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $39.20.

View Our Latest Stock Report on Appian

Appian Company Profile

(

Get Free Report)

Appian Corporation, a software company that provides low-code design platform in the United States, Mexico, Portugal, and internationally. The company's platform offers artificial intelligence, process automation, data fabric, and process mining. It provides The Appian Platform, an integrated automation platform that enables organizations to design, automate, and optimize mission-critical business processes.

Read More

Before you consider Appian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Appian wasn't on the list.

While Appian currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.