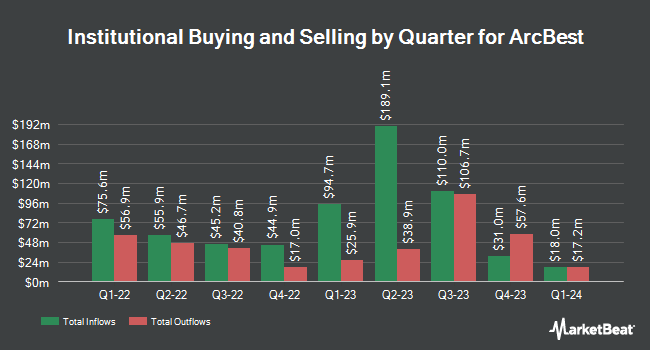

Allspring Global Investments Holdings LLC trimmed its stake in ArcBest Co. (NASDAQ:ARCB - Free Report) by 18.9% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 37,520 shares of the transportation company's stock after selling 8,768 shares during the period. Allspring Global Investments Holdings LLC owned about 0.16% of ArcBest worth $4,069,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other large investors also recently added to or reduced their stakes in the stock. Quarry LP lifted its position in shares of ArcBest by 120.7% in the 2nd quarter. Quarry LP now owns 245 shares of the transportation company's stock worth $26,000 after purchasing an additional 134 shares during the period. Innealta Capital LLC purchased a new stake in shares of ArcBest in the 2nd quarter worth approximately $33,000. Quest Partners LLC purchased a new stake in shares of ArcBest in the 2nd quarter worth approximately $36,000. Cultivar Capital Inc. purchased a new stake in shares of ArcBest in the 2nd quarter worth approximately $43,000. Finally, Mather Group LLC. purchased a new stake in shares of ArcBest in the 2nd quarter worth approximately $46,000. 99.27% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at ArcBest

In other ArcBest news, Director Salvatore A. Abbate acquired 1,000 shares of the business's stock in a transaction dated Monday, August 12th. The shares were purchased at an average price of $103.93 per share, for a total transaction of $103,930.00. Following the completion of the purchase, the director now directly owns 3,650 shares of the company's stock, valued at $379,344.50. The trade was a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 1.65% of the company's stock.

Analysts Set New Price Targets

ARCB has been the subject of several research reports. Stephens reaffirmed an "overweight" rating and issued a $130.00 price target on shares of ArcBest in a research report on Wednesday, September 4th. Wolfe Research cut shares of ArcBest from an "outperform" rating to a "peer perform" rating in a research report on Wednesday, October 9th. Morgan Stanley decreased their target price on shares of ArcBest from $180.00 to $176.00 and set an "overweight" rating for the company in a research report on Monday, July 8th. Citigroup began coverage on shares of ArcBest in a research report on Wednesday, October 9th. They set a "neutral" rating and a $111.00 target price for the company. Finally, Bank of America decreased their target price on shares of ArcBest from $102.00 to $99.00 and set an "underperform" rating for the company in a research report on Wednesday, September 4th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating and six have assigned a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $126.92.

Get Our Latest Stock Analysis on ArcBest

ArcBest Stock Performance

ArcBest stock traded down $1.57 during mid-day trading on Tuesday, reaching $104.37. 157,615 shares of the company traded hands, compared to its average volume of 283,626. The company has a debt-to-equity ratio of 0.12, a current ratio of 1.19 and a quick ratio of 1.19. ArcBest Co. has a fifty-two week low of $94.76 and a fifty-two week high of $153.60. The company has a market capitalization of $2.45 billion, a price-to-earnings ratio of 21.31, a price-to-earnings-growth ratio of 1.28 and a beta of 1.46. The firm's fifty day moving average is $105.02 and its two-hundred day moving average is $111.16.

ArcBest (NASDAQ:ARCB - Get Free Report) last released its quarterly earnings data on Friday, August 2nd. The transportation company reported $1.98 earnings per share for the quarter, missing analysts' consensus estimates of $2.03 by ($0.05). The business had revenue of $1.08 billion during the quarter, compared to analyst estimates of $1.06 billion. ArcBest had a return on equity of 15.98% and a net margin of 2.96%. The firm's revenue was down 2.4% compared to the same quarter last year. During the same quarter in the previous year, the company earned $1.54 EPS. On average, equities research analysts expect that ArcBest Co. will post 7.06 earnings per share for the current fiscal year.

About ArcBest

(

Free Report)

ArcBest Corporation, an integrated logistics company, engages in the provision of ground, air, and ocean transportation solutions. It operates through two segments: Asset-Based and Asset-Light. The Asset-Based segment provides less-than-truckload (LTL) services, that transports general commodities, such as food, textiles, apparel, furniture, appliances, chemicals, non-bulk petroleum products, rubber, plastics, metal and metal products, wood, glass, automotive parts, machinery, and miscellaneous manufactured products.

Featured Stories

Before you consider ArcBest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcBest wasn't on the list.

While ArcBest currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.