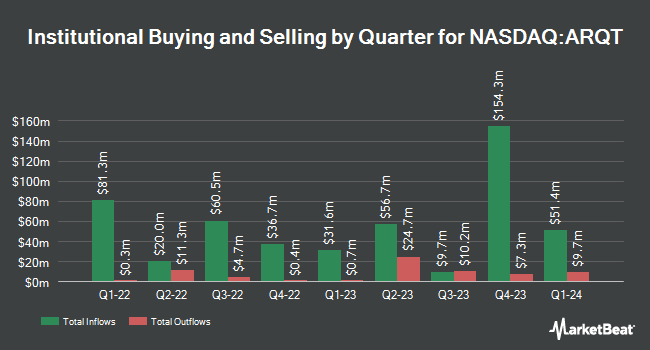

SG Americas Securities LLC lowered its stake in Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT - Free Report) by 61.3% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 38,333 shares of the company's stock after selling 60,828 shares during the quarter. SG Americas Securities LLC's holdings in Arcutis Biotherapeutics were worth $356,000 at the end of the most recent quarter.

A number of other large investors have also added to or reduced their stakes in ARQT. Perceptive Advisors LLC grew its stake in shares of Arcutis Biotherapeutics by 107.8% during the 2nd quarter. Perceptive Advisors LLC now owns 1,558,500 shares of the company's stock valued at $14,494,000 after purchasing an additional 808,500 shares during the period. Capital Impact Advisors LLC bought a new stake in Arcutis Biotherapeutics during the second quarter valued at approximately $606,000. Algert Global LLC bought a new stake in Arcutis Biotherapeutics during the second quarter valued at approximately $97,000. The Manufacturers Life Insurance Company increased its holdings in Arcutis Biotherapeutics by 31.0% during the second quarter. The Manufacturers Life Insurance Company now owns 40,323 shares of the company's stock valued at $375,000 after buying an additional 9,537 shares during the last quarter. Finally, Millennium Management LLC raised its position in Arcutis Biotherapeutics by 35.3% in the second quarter. Millennium Management LLC now owns 512,696 shares of the company's stock worth $4,768,000 after acquiring an additional 133,645 shares during the period.

Insiders Place Their Bets

In other Arcutis Biotherapeutics news, SVP Larry Todd Edwards sold 3,725 shares of Arcutis Biotherapeutics stock in a transaction on Wednesday, October 2nd. The shares were sold at an average price of $10.01, for a total value of $37,287.25. Following the sale, the senior vice president now directly owns 136,635 shares in the company, valued at approximately $1,367,716.35. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. In other Arcutis Biotherapeutics news, SVP Larry Todd Edwards sold 3,725 shares of the firm's stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $10.01, for a total transaction of $37,287.25. Following the completion of the transaction, the senior vice president now owns 136,635 shares in the company, valued at $1,367,716.35. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CFO David Joseph Topper sold 11,626 shares of Arcutis Biotherapeutics stock in a transaction that occurred on Tuesday, September 24th. The stock was sold at an average price of $9.48, for a total value of $110,214.48. Following the completion of the sale, the chief financial officer now directly owns 158,374 shares in the company, valued at approximately $1,501,385.52. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 52,299 shares of company stock worth $507,911 in the last three months. 9.50% of the stock is owned by company insiders.

Arcutis Biotherapeutics Price Performance

Shares of ARQT traded down $0.77 during trading hours on Friday, reaching $8.72. 2,647,710 shares of the stock traded hands, compared to its average volume of 3,330,472. The company has a market cap of $1.01 billion, a P/E ratio of -2.98 and a beta of 1.17. The company has a current ratio of 8.46, a quick ratio of 8.19 and a debt-to-equity ratio of 1.09. The company's 50-day moving average price is $9.86 and its two-hundred day moving average price is $9.48. Arcutis Biotherapeutics, Inc. has a 52-week low of $1.76 and a 52-week high of $13.17.

Arcutis Biotherapeutics (NASDAQ:ARQT - Get Free Report) last released its quarterly earnings data on Wednesday, August 14th. The company reported ($0.42) earnings per share for the quarter, topping analysts' consensus estimates of ($0.48) by $0.06. The firm had revenue of $30.86 million during the quarter, compared to analyst estimates of $31.00 million. Arcutis Biotherapeutics had a negative return on equity of 145.41% and a negative net margin of 150.51%. During the same quarter in the prior year, the company posted ($1.16) earnings per share. On average, analysts anticipate that Arcutis Biotherapeutics, Inc. will post -1.56 earnings per share for the current year.

Wall Street Analyst Weigh In

ARQT has been the subject of a number of recent research reports. Needham & Company LLC reissued a "buy" rating and set a $18.00 price objective on shares of Arcutis Biotherapeutics in a research report on Thursday, August 15th. Jefferies Financial Group started coverage on Arcutis Biotherapeutics in a report on Wednesday, August 28th. They set a "buy" rating and a $15.00 price target for the company. Two equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat.com, Arcutis Biotherapeutics currently has a consensus rating of "Moderate Buy" and an average price target of $13.33.

Get Our Latest Analysis on ARQT

Arcutis Biotherapeutics Company Profile

(

Free Report)

Arcutis Biotherapeutics, Inc, a biopharmaceutical company, focuses on developing and commercializing treatments for dermatological diseases. Its lead product candidate is ARQ-151, a topical roflumilast cream that has completed Phase III clinical trials for the treatment of plaque psoriasis and atopic dermatitis.

Further Reading

Before you consider Arcutis Biotherapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcutis Biotherapeutics wasn't on the list.

While Arcutis Biotherapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.