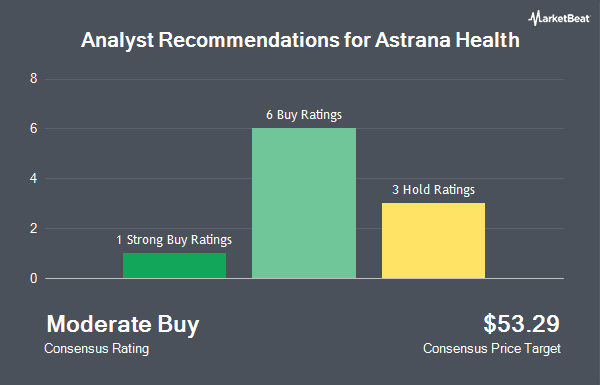

Astrana Health, Inc. (NASDAQ:ASTH - Get Free Report) has earned a consensus rating of "Buy" from the eight research firms that are presently covering the firm, Marketbeat Ratings reports. One equities research analyst has rated the stock with a hold recommendation, six have assigned a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $62.00.

A number of research analysts have commented on the stock. BTIG Research raised their target price on shares of Astrana Health from $60.00 to $70.00 and gave the company a "buy" rating in a research report on Thursday, October 3rd. Robert W. Baird increased their target price on Astrana Health from $54.00 to $67.00 and gave the company an "outperform" rating in a research report on Thursday, August 15th. KeyCorp assumed coverage on Astrana Health in a research report on Friday, October 11th. They issued a "sector weight" rating for the company. TD Cowen began coverage on Astrana Health in a research note on Monday, October 14th. They issued a "buy" rating and a $66.00 target price on the stock. Finally, Truist Financial boosted their price objective on shares of Astrana Health from $50.00 to $59.00 and gave the stock a "buy" rating in a research note on Friday, August 9th.

Check Out Our Latest Research Report on Astrana Health

Astrana Health Stock Performance

Shares of NASDAQ:ASTH traded up $0.40 during mid-day trading on Monday, reaching $56.08. 131,376 shares of the company traded hands, compared to its average volume of 197,315. Astrana Health has a 52 week low of $28.86 and a 52 week high of $63.20. The firm has a market cap of $3.14 billion, a PE ratio of 42.48, a PEG ratio of 2.20 and a beta of 1.21. The company's 50 day moving average price is $54.09 and its 200-day moving average price is $46.42. The company has a debt-to-equity ratio of 0.62, a current ratio of 1.84 and a quick ratio of 1.84.

Astrana Health (NASDAQ:ASTH - Get Free Report) last announced its quarterly earnings data on Wednesday, August 7th. The company reported $0.40 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.39 by $0.01. The business had revenue of $486.30 million during the quarter, compared to analyst estimates of $440.68 million. Astrana Health had a net margin of 4.30% and a return on equity of 10.71%. The company's revenue was up 39.7% on a year-over-year basis. During the same period last year, the firm posted $0.28 EPS. On average, equities analysts expect that Astrana Health will post 1.33 EPS for the current fiscal year.

Hedge Funds Weigh In On Astrana Health

Several hedge funds and other institutional investors have recently modified their holdings of the business. SteelPeak Wealth LLC acquired a new position in Astrana Health in the 3rd quarter valued at about $39,398,000. NorthCrest Asset Manangement LLC acquired a new position in Astrana Health in the third quarter valued at about $26,704,000. New York State Teachers Retirement System acquired a new stake in shares of Astrana Health during the third quarter valued at about $2,515,000. State of Alaska Department of Revenue purchased a new stake in shares of Astrana Health in the 3rd quarter valued at approximately $1,373,000. Finally, Louisiana State Employees Retirement System purchased a new position in shares of Astrana Health during the 3rd quarter worth approximately $1,165,000. 52.77% of the stock is owned by hedge funds and other institutional investors.

Astrana Health Company Profile

(

Get Free ReportAstrana Health, Inc, Inc, a physician-centric technology-powered healthcare management company, provides medical care services in the United States. It operates through three segments: Care Partners, Care Delivery, and Care Enablement. The company is leveraging its proprietary population health management and healthcare delivery platform, operates an integrated, value-based healthcare model which empowers the providers in its network to deliver care to its patients.

Featured Articles

Before you consider Astrana Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astrana Health wasn't on the list.

While Astrana Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.