Asure Software (NASDAQ:ASUR - Get Free Report)'s stock had its "outperform" rating reiterated by research analysts at Barrington Research in a research note issued on Tuesday, Benzinga reports. They presently have a $17.00 price target on the technology company's stock. Barrington Research's target price points to a potential upside of 77.08% from the company's current price.

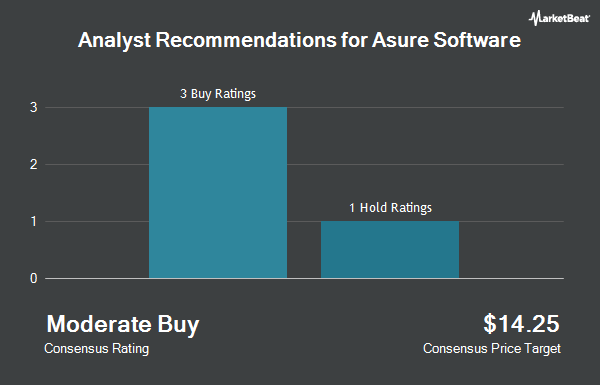

Several other analysts have also issued reports on ASUR. Needham & Company LLC restated a "buy" rating and set a $20.00 target price on shares of Asure Software in a research report on Friday, August 2nd. Stephens started coverage on shares of Asure Software in a research report on Wednesday, October 16th. They set an "overweight" rating and a $13.00 price objective for the company. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat, Asure Software has an average rating of "Moderate Buy" and a consensus target price of $13.33.

Check Out Our Latest Analysis on Asure Software

Asure Software Stock Performance

ASUR traded down $0.06 during mid-day trading on Tuesday, reaching $9.60. 40,223 shares of the company traded hands, compared to its average volume of 155,146. The company's fifty day moving average price is $8.77 and its 200-day moving average price is $8.32. The stock has a market capitalization of $247.80 million, a P/E ratio of -22.33, a P/E/G ratio of 0.92 and a beta of 0.55. The company has a quick ratio of 1.11, a current ratio of 1.11 and a debt-to-equity ratio of 0.03. Asure Software has a 52-week low of $6.30 and a 52-week high of $10.52.

Asure Software (NASDAQ:ASUR - Get Free Report) last posted its quarterly earnings data on Thursday, August 1st. The technology company reported $0.04 EPS for the quarter, missing analysts' consensus estimates of $0.07 by ($0.03). The firm had revenue of $28.04 million for the quarter, compared to analysts' expectations of $28.56 million. Asure Software had a negative net margin of 9.07% and a positive return on equity of 3.75%. On average, sell-side analysts expect that Asure Software will post 0.49 EPS for the current year.

Insiders Place Their Bets

In related news, Director Daniel M. Gill sold 5,000 shares of Asure Software stock in a transaction on Thursday, August 29th. The shares were sold at an average price of $8.69, for a total transaction of $43,450.00. Following the transaction, the director now owns 28,165 shares in the company, valued at approximately $244,753.85. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. In other news, CRO Eyal Goldstein sold 10,000 shares of the business's stock in a transaction on Tuesday, August 20th. The shares were sold at an average price of $8.44, for a total value of $84,400.00. Following the transaction, the executive now owns 239,243 shares of the company's stock, valued at approximately $2,019,210.92. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Daniel M. Gill sold 5,000 shares of the company's stock in a transaction on Thursday, August 29th. The stock was sold at an average price of $8.69, for a total transaction of $43,450.00. Following the transaction, the director now owns 28,165 shares of the company's stock, valued at approximately $244,753.85. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 8.90% of the company's stock.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Whittier Trust Co. bought a new position in Asure Software during the third quarter valued at approximately $4,140,000. Swedbank AB boosted its position in shares of Asure Software by 7.1% during the 3rd quarter. Swedbank AB now owns 750,000 shares of the technology company's stock valued at $6,788,000 after acquiring an additional 50,000 shares during the last quarter. Pacific Ridge Capital Partners LLC boosted its position in shares of Asure Software by 7.9% during the 2nd quarter. Pacific Ridge Capital Partners LLC now owns 754,016 shares of the technology company's stock valued at $6,334,000 after acquiring an additional 55,123 shares during the last quarter. First Eagle Investment Management LLC grew its holdings in shares of Asure Software by 34.6% in the second quarter. First Eagle Investment Management LLC now owns 378,901 shares of the technology company's stock valued at $3,183,000 after purchasing an additional 97,404 shares in the last quarter. Finally, Perritt Capital Management Inc increased its position in Asure Software by 25.4% in the second quarter. Perritt Capital Management Inc now owns 43,877 shares of the technology company's stock worth $369,000 after purchasing an additional 8,877 shares during the last quarter. Institutional investors own 71.58% of the company's stock.

Asure Software Company Profile

(

Get Free Report)

Asure Software, Inc engages in the provision of cloud-based Human Capital Management (HCM) software solutions in the United States. It provides its human resources (HR) tool as Software-as-a-Service that helps various small and medium-sized businesses to build productive workforce to help them stay compliant and allocate resources to grow their business.

See Also

Before you consider Asure Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Asure Software wasn't on the list.

While Asure Software currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.