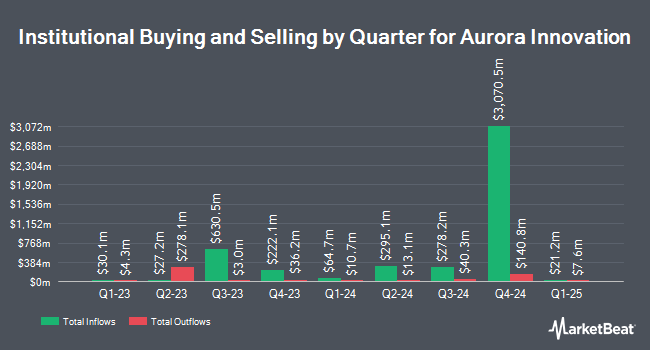

The Manufacturers Life Insurance Company increased its position in shares of Aurora Innovation, Inc. (NASDAQ:AUR - Free Report) by 67.9% during the second quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 500,535 shares of the company's stock after buying an additional 202,413 shares during the quarter. The Manufacturers Life Insurance Company's holdings in Aurora Innovation were worth $1,386,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Employees Retirement System of Texas boosted its position in shares of Aurora Innovation by 581.2% during the 2nd quarter. Employees Retirement System of Texas now owns 262,442 shares of the company's stock valued at $727,000 after acquiring an additional 223,913 shares in the last quarter. Xponance Inc. grew its stake in shares of Aurora Innovation by 147.4% in the 2nd quarter. Xponance Inc. now owns 53,168 shares of the company's stock valued at $147,000 after purchasing an additional 31,678 shares during the period. Profund Advisors LLC acquired a new position in shares of Aurora Innovation in the 2nd quarter worth approximately $46,000. Public Employees Retirement Association of Colorado bought a new position in shares of Aurora Innovation during the 2nd quarter worth approximately $214,000. Finally, Vanguard Personalized Indexing Management LLC acquired a new stake in Aurora Innovation in the 2nd quarter valued at $51,000. 44.71% of the stock is currently owned by institutional investors.

Aurora Innovation Price Performance

Shares of AUR stock traded up $0.03 on Friday, reaching $5.75. 5,592,790 shares of the stock were exchanged, compared to its average volume of 8,692,460. The stock has a 50 day moving average price of $4.60 and a 200 day moving average price of $3.57. The stock has a market cap of $8.93 billion, a PE ratio of -10.45 and a beta of 2.80. Aurora Innovation, Inc. has a one year low of $1.60 and a one year high of $6.79.

Aurora Innovation (NASDAQ:AUR - Get Free Report) last released its quarterly earnings data on Wednesday, July 31st. The company reported ($0.12) EPS for the quarter, beating analysts' consensus estimates of ($0.13) by $0.01.

Analyst Ratings Changes

Separately, Canaccord Genuity Group reiterated a "buy" rating and set a $7.00 price objective on shares of Aurora Innovation in a research note on Monday, September 30th.

View Our Latest Report on AUR

Aurora Innovation Company Profile

(

Free Report)

Aurora Innovation, Inc operates as a self-driving technology company in the United States. It focuses on developing Aurora Driver, a platform that brings a suite of self-driving hardware, software, and data services together to adapt and interoperate vehicles. The company was founded in 2017 and is headquartered in Pittsburgh, Pennsylvania.

Featured Articles

Before you consider Aurora Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aurora Innovation wasn't on the list.

While Aurora Innovation currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.