Horrell Capital Management Inc. acquired a new stake in AvidXchange Holdings, Inc. (NASDAQ:AVDX - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 275,000 shares of the company's stock, valued at approximately $2,230,000. Horrell Capital Management Inc. owned 0.13% of AvidXchange at the end of the most recent reporting period.

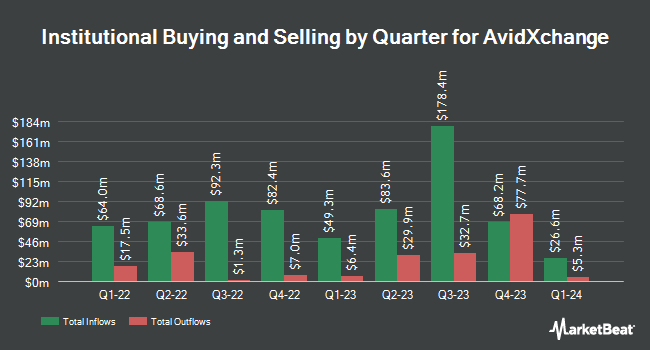

A number of other hedge funds and other institutional investors have also modified their holdings of AVDX. Allspring Global Investments Holdings LLC purchased a new stake in shares of AvidXchange during the third quarter worth about $38,000. CWM LLC increased its position in shares of AvidXchange by 7,259.8% during the third quarter. CWM LLC now owns 6,771 shares of the company's stock worth $55,000 after acquiring an additional 6,679 shares during the last quarter. Advisors Asset Management Inc. increased its position in shares of AvidXchange by 96.3% during the first quarter. Advisors Asset Management Inc. now owns 4,309 shares of the company's stock worth $57,000 after acquiring an additional 2,114 shares during the last quarter. nVerses Capital LLC purchased a new stake in shares of AvidXchange during the second quarter worth about $66,000. Finally, Arbor Investment Advisors LLC acquired a new position in AvidXchange in the third quarter worth about $98,000. 80.58% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other AvidXchange news, insider Ryan Stahl sold 7,427 shares of the company's stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $8.58, for a total value of $63,723.66. Following the completion of the sale, the insider now directly owns 369,603 shares in the company, valued at $3,171,193.74. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In other news, insider Ryan Stahl sold 7,427 shares of the stock in a transaction on Wednesday, October 16th. The stock was sold at an average price of $8.58, for a total transaction of $63,723.66. Following the completion of the sale, the insider now owns 369,603 shares in the company, valued at approximately $3,171,193.74. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, President Daniel Drees sold 20,069 shares of the stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of $7.98, for a total value of $160,150.62. Following the sale, the president now owns 753,644 shares of the company's stock, valued at $6,014,079.12. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 166,386 shares of company stock worth $1,343,044 over the last ninety days. Company insiders own 10.30% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms recently commented on AVDX. BMO Capital Markets decreased their price target on AvidXchange from $13.00 to $10.00 and set a "market perform" rating for the company in a research note on Thursday, August 1st. Susquehanna decreased their price target on AvidXchange from $16.00 to $14.00 and set a "positive" rating for the company in a research note on Thursday, August 1st. KeyCorp decreased their price target on AvidXchange from $15.00 to $12.00 and set an "overweight" rating for the company in a research note on Thursday, August 1st. Compass Point assumed coverage on AvidXchange in a research note on Wednesday, September 4th. They issued a "neutral" rating and a $8.00 target price for the company. Finally, Robert W. Baird decreased their target price on AvidXchange from $16.00 to $14.00 and set an "outperform" rating for the company in a research note on Thursday, August 1st. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $10.57.

Check Out Our Latest Report on AvidXchange

AvidXchange Stock Performance

AVDX stock traded down $0.03 on Tuesday, reaching $8.38. The company's stock had a trading volume of 2,006,151 shares, compared to its average volume of 2,053,835. AvidXchange Holdings, Inc. has a 52 week low of $6.88 and a 52 week high of $13.56. The company has a market capitalization of $1.73 billion, a P/E ratio of -55.87 and a beta of 1.01. The firm has a fifty day moving average of $8.01 and a two-hundred day moving average of $9.97. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.36 and a quick ratio of 1.36.

AvidXchange (NASDAQ:AVDX - Get Free Report) last released its earnings results on Wednesday, July 31st. The company reported $0.05 earnings per share for the quarter, topping analysts' consensus estimates of $0.04 by $0.01. The firm had revenue of $105.30 million during the quarter, compared to the consensus estimate of $107.13 million. AvidXchange had a negative return on equity of 0.23% and a negative net margin of 3.18%. The firm's revenue for the quarter was up 15.6% compared to the same quarter last year. During the same period in the prior year, the firm posted ($0.05) earnings per share. As a group, analysts predict that AvidXchange Holdings, Inc. will post 0.03 EPS for the current fiscal year.

About AvidXchange

(

Free Report)

AvidXchange Holdings, Inc provides accounts payable (AP) automation software and payment solutions for middle market businesses and their suppliers in North America. The company offers AP automation software, a SaaS-based solution that automates and digitizes capture, review, approval, and payment of invoices for buyers; the AvidPay network that connects two-sided payments with buyers and suppliers; and the AvidXchange Supplier Hub, which provides supplier insights to cash flow, tools for in-network invoices and payments, and early payment feature.

Featured Articles

Before you consider AvidXchange, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvidXchange wasn't on the list.

While AvidXchange currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.