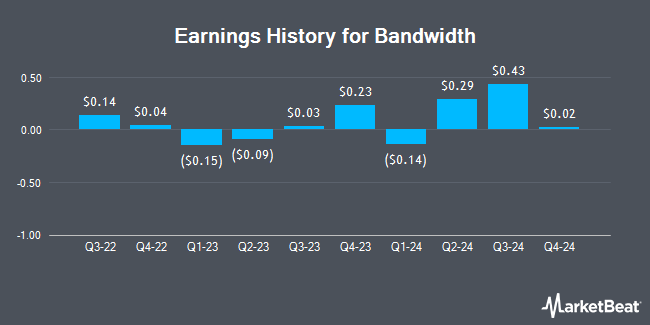

Bandwidth (NASDAQ:BAND - Get Free Report) released its earnings results on Thursday. The company reported $0.43 EPS for the quarter, topping analysts' consensus estimates of $0.32 by $0.11, Briefing.com reports. Bandwidth had a negative net margin of 2.23% and a negative return on equity of 0.91%. The company had revenue of $193.90 million for the quarter, compared to analysts' expectations of $182.05 million. During the same quarter last year, the business earned $0.03 EPS. The firm's revenue was up 27.6% compared to the same quarter last year. Bandwidth updated its FY 2024 guidance to EPS and its Q4 2024 guidance to EPS.

Bandwidth Price Performance

BAND traded down $0.80 during trading hours on Friday, hitting $18.70. The company's stock had a trading volume of 434,547 shares, compared to its average volume of 263,182. The business's 50-day moving average price is $17.50 and its 200-day moving average price is $18.29. Bandwidth has a 12 month low of $10.22 and a 12 month high of $25.02. The stock has a market cap of $510.51 million, a price-to-earnings ratio of -20.11 and a beta of 1.50. The company has a current ratio of 1.16, a quick ratio of 1.16 and a debt-to-equity ratio of 0.91.

Wall Street Analyst Weigh In

BAND has been the topic of a number of recent analyst reports. JMP Securities restated a "market outperform" rating and set a $36.00 target price on shares of Bandwidth in a research note on Tuesday, August 27th. Robert W. Baird lifted their price objective on shares of Bandwidth from $19.00 to $22.00 and gave the company a "neutral" rating in a research report on Friday. Barclays reduced their price objective on shares of Bandwidth from $28.00 to $25.00 and set an "overweight" rating on the stock in a research report on Friday, August 2nd. Finally, Needham & Company LLC reiterated a "hold" rating on shares of Bandwidth in a research report on Friday. One research analyst has rated the stock with a sell rating, three have given a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $26.14.

View Our Latest Analysis on Bandwidth

Insider Buying and Selling

In related news, CFO Daryl Raiford sold 4,350 shares of the business's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $16.97, for a total value of $73,819.50. Following the sale, the chief financial officer now owns 71,546 shares in the company, valued at approximately $1,214,135.62. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Over the last 90 days, insiders have sold 8,525 shares of company stock worth $146,548. Insiders own 6.20% of the company's stock.

About Bandwidth

(

Get Free Report)

Bandwidth is a leading enterprise cloud communications company. Companies like Cisco, Google, Microsoft, RingCentral, Uber, and Zoom use Bandwidth's APIs to easily embed voice, messaging, and emergency services into software and applications. Bandwidth is the first and only CPaaS provider offering a robust selection of communications APIs built around their own IP voice network.

Featured Articles

Before you consider Bandwidth, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bandwidth wasn't on the list.

While Bandwidth currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.