Needham & Company LLC reissued their buy rating on shares of Bicycle Therapeutics (NASDAQ:BCYC - Free Report) in a research report report published on Thursday morning, Benzinga reports. Needham & Company LLC currently has a $38.00 price target on the stock.

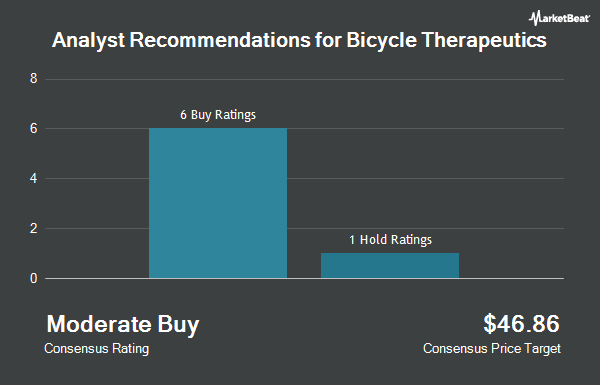

BCYC has been the subject of a number of other reports. Cantor Fitzgerald reiterated an "overweight" rating on shares of Bicycle Therapeutics in a research note on Monday, September 9th. HC Wainwright reaffirmed a "buy" rating and set a $55.00 target price on shares of Bicycle Therapeutics in a report on Thursday. Royal Bank of Canada began coverage on Bicycle Therapeutics in a report on Friday, September 6th. They issued an "outperform" rating and a $35.00 price target for the company. Oppenheimer restated an "outperform" rating and set a $48.00 price objective on shares of Bicycle Therapeutics in a research note on Wednesday, August 7th. Finally, B. Riley lowered shares of Bicycle Therapeutics from a "buy" rating to a "neutral" rating and lowered their target price for the company from $33.00 to $28.00 in a research note on Wednesday, August 7th. Two research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $44.56.

Get Our Latest Report on Bicycle Therapeutics

Bicycle Therapeutics Stock Down 2.2 %

BCYC stock traded down $0.55 during midday trading on Thursday, hitting $24.77. 146,106 shares of the company's stock were exchanged, compared to its average volume of 352,040. The firm has a 50 day moving average price of $23.97 and a 200-day moving average price of $23.04. Bicycle Therapeutics has a 12-month low of $12.54 and a 12-month high of $28.67. The stock has a market capitalization of $1.06 billion, a price-to-earnings ratio of -5.69 and a beta of 0.89. The company has a current ratio of 14.77, a quick ratio of 14.77 and a debt-to-equity ratio of 0.01.

Bicycle Therapeutics (NASDAQ:BCYC - Get Free Report) last issued its quarterly earnings results on Tuesday, August 6th. The company reported ($0.77) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($1.10) by $0.33. Bicycle Therapeutics had a negative net margin of 417.88% and a negative return on equity of 32.80%. The business had revenue of $9.36 million during the quarter, compared to analyst estimates of $6.13 million. The company's revenue for the quarter was down 17.9% on a year-over-year basis. On average, analysts anticipate that Bicycle Therapeutics will post -3.17 EPS for the current year.

Insider Activity at Bicycle Therapeutics

In other Bicycle Therapeutics news, CEO Kevin Lee sold 3,212 shares of the stock in a transaction on Thursday, October 3rd. The stock was sold at an average price of $22.26, for a total transaction of $71,499.12. Following the completion of the transaction, the chief executive officer now directly owns 380,864 shares of the company's stock, valued at approximately $8,478,032.64. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders have sold 4,584 shares of company stock worth $102,040 over the last quarter. 8.50% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Bicycle Therapeutics

A number of institutional investors have recently modified their holdings of BCYC. GAMMA Investing LLC raised its stake in Bicycle Therapeutics by 105.1% during the 3rd quarter. GAMMA Investing LLC now owns 2,026 shares of the company's stock valued at $46,000 after purchasing an additional 1,038 shares during the last quarter. PNC Financial Services Group Inc. acquired a new stake in Bicycle Therapeutics during the fourth quarter worth about $137,000. PDS Planning Inc acquired a new position in Bicycle Therapeutics in the 1st quarter valued at approximately $210,000. XTX Topco Ltd bought a new stake in shares of Bicycle Therapeutics in the 2nd quarter worth approximately $206,000. Finally, Natixis Advisors LLC bought a new stake in shares of Bicycle Therapeutics in the 2nd quarter worth approximately $261,000. Institutional investors own 86.15% of the company's stock.

Bicycle Therapeutics Company Profile

(

Get Free Report)

Bicycle Therapeutics plc, a clinical-stage biopharmaceutical company, develops a class of medicines for diseases that are underserved by existing therapeutics in the United States and the United Kingdom. Its product pipeline comprising BT8009, a bicycle toxin conjugate (BTC) which is in phase I/II/III clinical trial for the treatment of high nectin-4 expressing tumors; BT5528, a BTC which is in phase I/II clinical trial for the treatment of Ephrin type A receptor 2 expressing tumor; BT7480, a Bicycle TICA molecule which is in phase I/II targeting Nectin-4 and agonizing CD137; and BT7455, a Bicycle TICA molecule targeting Ephrin type A receptor 2 and CD137 and is in preclinical trial.

Featured Articles

Before you consider Bicycle Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bicycle Therapeutics wasn't on the list.

While Bicycle Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.