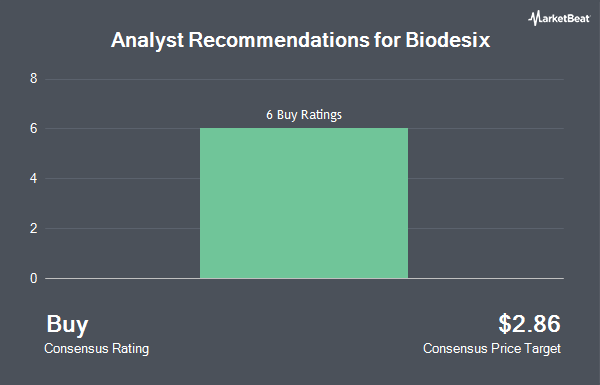

Biodesix, Inc. (NASDAQ:BDSX - Get Free Report) has been given a consensus recommendation of "Buy" by the seven analysts that are presently covering the firm, Marketbeat reports. Seven research analysts have rated the stock with a buy rating. The average 1-year price objective among brokerages that have issued ratings on the stock in the last year is $3.06.

A number of analysts recently weighed in on the stock. Scotiabank initiated coverage on shares of Biodesix in a report on Monday, September 16th. They issued a "sector outperform" rating and a $3.00 price target for the company. Craig Hallum initiated coverage on Biodesix in a research report on Friday, July 26th. They set a "buy" rating and a $3.00 target price for the company.

Read Our Latest Stock Report on Biodesix

Biodesix Price Performance

Shares of Biodesix stock traded down $0.04 during trading on Wednesday, hitting $1.64. 97,408 shares of the company's stock traded hands, compared to its average volume of 147,401. The company has a debt-to-equity ratio of 0.99, a current ratio of 3.28 and a quick ratio of 3.28. The firm's fifty day moving average price is $1.75 and its 200 day moving average price is $1.58. The company has a market cap of $188.09 million, a PE ratio of -2.96 and a beta of 1.22. Biodesix has a twelve month low of $1.15 and a twelve month high of $2.21.

Biodesix (NASDAQ:BDSX - Get Free Report) last announced its earnings results on Wednesday, August 7th. The company reported ($0.08) EPS for the quarter, topping the consensus estimate of ($0.09) by $0.01. Biodesix had a negative return on equity of 505.95% and a negative net margin of 73.08%. The business had revenue of $17.93 million for the quarter, compared to the consensus estimate of $16.05 million. During the same period in the previous year, the business earned ($0.17) EPS. Analysts forecast that Biodesix will post -0.36 earnings per share for the current year.

Hedge Funds Weigh In On Biodesix

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. CVI Holdings LLC acquired a new stake in shares of Biodesix in the 2nd quarter valued at approximately $59,000. Oracle Investment Management Inc. raised its holdings in Biodesix by 44.8% in the fourth quarter. Oracle Investment Management Inc. now owns 60,939 shares of the company's stock worth $112,000 after purchasing an additional 18,863 shares during the period. Opaleye Management Inc. boosted its position in shares of Biodesix by 7.7% during the first quarter. Opaleye Management Inc. now owns 534,657 shares of the company's stock worth $765,000 after purchasing an additional 38,157 shares in the last quarter. Essex Investment Management Co. LLC grew its holdings in shares of Biodesix by 1.4% in the 1st quarter. Essex Investment Management Co. LLC now owns 925,614 shares of the company's stock valued at $1,324,000 after buying an additional 12,669 shares during the period. Finally, Farallon Capital Management LLC bought a new stake in shares of Biodesix in the 2nd quarter valued at $2,874,000. Institutional investors own 20.96% of the company's stock.

About Biodesix

(

Get Free ReportBiodesix, Inc operates as a data-driven diagnostic solutions company in the United States. The company offers blood-based lung tests, including Nodify XL2 and Nodify CDT tests, together marketed as part of Nodify Lung Nodule Risk Assessment testing strategy, to assess the risk of lung cancer and help in identifying the appropriate treatment pathway and help physicians in reclassifying risk of malignancy in patients with suspicious lung nodules.

Read More

Before you consider Biodesix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Biodesix wasn't on the list.

While Biodesix currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.