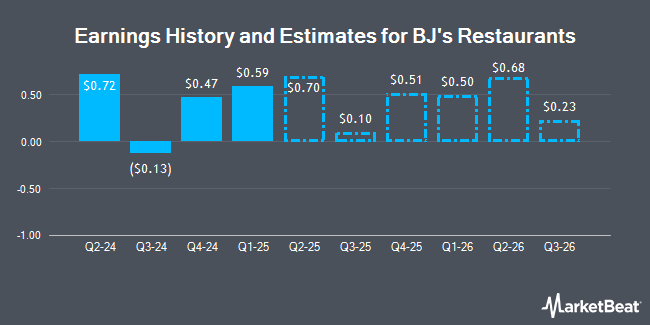

BJ's Restaurants, Inc. (NASDAQ:BJRI - Free Report) - Equities researchers at William Blair boosted their FY2024 earnings per share (EPS) estimates for BJ's Restaurants in a research note issued on Wednesday, October 23rd. William Blair analyst S. Zackfia now anticipates that the restaurant operator will post earnings of $1.38 per share for the year, up from their prior estimate of $1.34. The consensus estimate for BJ's Restaurants' current full-year earnings is $1.42 per share. William Blair also issued estimates for BJ's Restaurants' Q4 2024 earnings at $0.36 EPS.

Several other research firms have also recently commented on BJRI. Benchmark cut shares of BJ's Restaurants from a "buy" rating to a "hold" rating in a research note on Friday, July 26th. Wedbush reaffirmed an "outperform" rating and set a $43.00 price objective on shares of BJ's Restaurants in a report on Thursday, August 29th. Finally, Barclays dropped their target price on BJ's Restaurants from $36.00 to $35.00 and set an "underweight" rating for the company in a research report on Friday, July 26th. One research analyst has rated the stock with a sell rating, four have issued a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $38.43.

Get Our Latest Analysis on BJRI

BJ's Restaurants Price Performance

BJRI traded up $0.10 during midday trading on Friday, hitting $35.87. The company had a trading volume of 259,360 shares, compared to its average volume of 386,873. BJ's Restaurants has a twelve month low of $22.35 and a twelve month high of $38.87. The company has a market capitalization of $838.75 million, a PE ratio of 35.87, a P/E/G ratio of 1.66 and a beta of 2.12. The company has a debt-to-equity ratio of 0.16, a quick ratio of 0.27 and a current ratio of 0.35. The firm's 50-day simple moving average is $32.34 and its 200-day simple moving average is $33.34.

BJ's Restaurants (NASDAQ:BJRI - Get Free Report) last released its quarterly earnings results on Thursday, July 25th. The restaurant operator reported $0.72 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.51 by $0.21. BJ's Restaurants had a return on equity of 7.83% and a net margin of 2.19%. The business had revenue of $349.93 million during the quarter, compared to analysts' expectations of $349.18 million. During the same period in the previous year, the business posted $0.50 earnings per share. The firm's revenue for the quarter was up .1% compared to the same quarter last year.

Hedge Funds Weigh In On BJ's Restaurants

A number of hedge funds and other institutional investors have recently made changes to their positions in BJRI. 272 Capital LP acquired a new position in shares of BJ's Restaurants in the second quarter valued at approximately $1,173,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. grew its position in BJ's Restaurants by 21.0% in the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 296,176 shares of the restaurant operator's stock valued at $10,716,000 after purchasing an additional 51,364 shares in the last quarter. Rothschild Investment LLC bought a new stake in BJ's Restaurants during the 2nd quarter worth about $3,250,000. nVerses Capital LLC acquired a new position in shares of BJ's Restaurants during the 2nd quarter worth about $187,000. Finally, Panagora Asset Management Inc. grew its holdings in shares of BJ's Restaurants by 6.2% in the 2nd quarter. Panagora Asset Management Inc. now owns 142,622 shares of the restaurant operator's stock valued at $4,949,000 after acquiring an additional 8,323 shares in the last quarter. 99.95% of the stock is owned by institutional investors.

Insider Transactions at BJ's Restaurants

In related news, CEO C Bradford Richmond acquired 2,500 shares of the company's stock in a transaction that occurred on Friday, September 6th. The stock was acquired at an average price of $29.40 per share, for a total transaction of $73,500.00. Following the completion of the acquisition, the chief executive officer now owns 16,905 shares of the company's stock, valued at $497,007. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a legal filing with the SEC, which is available at the SEC website. 4.90% of the stock is owned by corporate insiders.

About BJ's Restaurants

(

Get Free Report)

BJ's Restaurants, Inc owns and operates casual dining restaurants in the United States. Its restaurants offer pizzas, craft and other beers, appetizers, entrées, pastas, sandwiches, specialty salads, and desserts under brand name Pizookie. The company was formerly known as Chicago Pizza & Brewery, Inc and changed its name to BJ's Restaurants, Inc in August 2004.

Read More

Before you consider BJ's Restaurants, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Restaurants wasn't on the list.

While BJ's Restaurants currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.