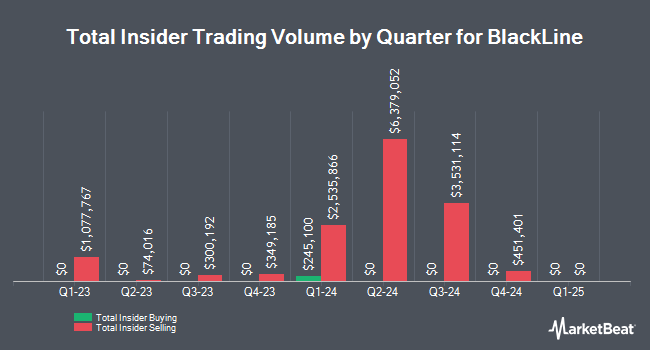

BlackLine, Inc. (NASDAQ:BL - Get Free Report) insider Karole Morgan-Prager sold 5,773 shares of the company's stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $55.14, for a total value of $318,323.22. Following the completion of the transaction, the insider now owns 113,865 shares of the company's stock, valued at approximately $6,278,516.10. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link.

Karole Morgan-Prager also recently made the following trade(s):

- On Monday, September 30th, Karole Morgan-Prager sold 10,000 shares of BlackLine stock. The shares were sold at an average price of $55.00, for a total transaction of $550,000.00.

- On Wednesday, August 7th, Karole Morgan-Prager sold 10,000 shares of BlackLine stock. The stock was sold at an average price of $50.00, for a total transaction of $500,000.00.

BlackLine Stock Performance

NASDAQ:BL traded up $0.62 during midday trading on Friday, reaching $54.51. 479,426 shares of the company traded hands, compared to its average volume of 922,452. BlackLine, Inc. has a twelve month low of $43.37 and a twelve month high of $69.31. The company has a debt-to-equity ratio of 2.74, a current ratio of 1.95 and a quick ratio of 1.95. The company has a fifty day moving average price of $50.08 and a 200 day moving average price of $52.79. The firm has a market capitalization of $3.37 billion, a price-to-earnings ratio of 234.30, a price-to-earnings-growth ratio of 12.80 and a beta of 0.89.

BlackLine (NASDAQ:BL - Get Free Report) last released its quarterly earnings results on Tuesday, August 6th. The technology company reported $0.58 EPS for the quarter, topping the consensus estimate of $0.50 by $0.08. The business had revenue of $160.51 million during the quarter, compared to analyst estimates of $158.21 million. BlackLine had a net margin of 19.46% and a return on equity of 33.96%. The company's quarterly revenue was up 11.0% on a year-over-year basis. During the same quarter in the prior year, the firm earned ($0.69) earnings per share. On average, analysts expect that BlackLine, Inc. will post 0.94 EPS for the current fiscal year.

Institutional Investors Weigh In On BlackLine

A number of hedge funds have recently made changes to their positions in the business. Fifth Third Bancorp lifted its holdings in BlackLine by 13.0% in the second quarter. Fifth Third Bancorp now owns 2,306 shares of the technology company's stock worth $112,000 after purchasing an additional 266 shares during the period. Arizona State Retirement System raised its position in shares of BlackLine by 2.3% during the 2nd quarter. Arizona State Retirement System now owns 14,638 shares of the technology company's stock worth $709,000 after buying an additional 325 shares in the last quarter. Covestor Ltd lifted its stake in shares of BlackLine by 29.4% in the 1st quarter. Covestor Ltd now owns 1,495 shares of the technology company's stock worth $97,000 after acquiring an additional 340 shares during the period. Whittier Trust Co. boosted its holdings in shares of BlackLine by 9.7% in the first quarter. Whittier Trust Co. now owns 4,699 shares of the technology company's stock valued at $303,000 after acquiring an additional 414 shares in the last quarter. Finally, YHB Investment Advisors Inc. acquired a new position in shares of BlackLine during the first quarter valued at approximately $33,000. Institutional investors own 95.13% of the company's stock.

Analysts Set New Price Targets

Several analysts have recently weighed in on the company. JPMorgan Chase & Co. lowered their target price on BlackLine from $50.00 to $47.00 and set an "underweight" rating for the company in a research note on Wednesday, August 7th. Piper Sandler dropped their price objective on BlackLine from $55.00 to $51.00 and set a "neutral" rating on the stock in a report on Wednesday, August 7th. Morgan Stanley upgraded BlackLine from an "equal weight" rating to an "overweight" rating and increased their target price for the company from $60.00 to $70.00 in a research note on Monday. Citigroup dropped their price target on shares of BlackLine from $62.00 to $54.00 and set a "neutral" rating for the company in a research note on Friday, June 28th. Finally, BTIG Research reduced their price objective on shares of BlackLine from $71.00 to $65.00 and set a "buy" rating on the stock in a research note on Wednesday, August 7th. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating and four have given a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $59.90.

Get Our Latest Research Report on BlackLine

BlackLine Company Profile

(

Get Free Report)

BlackLine, Inc provides cloud-based solutions to automate and streamline accounting and finance operations worldwide. It offers financial close management solutions, such as account reconciliations that provides a centralized workspace for users to collaborate on account reconciliations; transaction matching that analyzes and reconciles individual transactions; task management to create and manage processes and task lists; and financial reporting analytics that enables analysis and validation of financial data.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BlackLine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackLine wasn't on the list.

While BlackLine currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.