Investment analysts at StockNews.com started coverage on shares of bluebird bio (NASDAQ:BLUE - Get Free Report) in a note issued to investors on Saturday. The firm set a "sell" rating on the biotechnology company's stock.

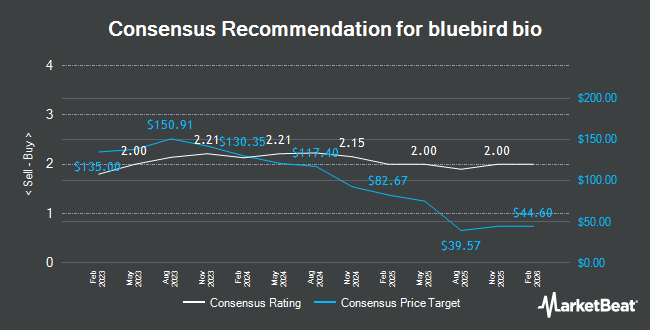

Other equities research analysts have also issued research reports about the stock. Robert W. Baird dropped their price objective on shares of bluebird bio from $7.00 to $6.00 and set an "outperform" rating on the stock in a research note on Thursday, August 15th. Wells Fargo & Company cut their price target on bluebird bio from $3.00 to $2.00 and set an "equal weight" rating on the stock in a report on Wednesday, September 25th. Cantor Fitzgerald restated a "neutral" rating on shares of bluebird bio in a research report on Monday, September 16th. Royal Bank of Canada reaffirmed a "sector perform" rating and issued a $4.00 target price on shares of bluebird bio in a research report on Thursday, August 15th. Finally, Barclays reduced their price target on shares of bluebird bio from $8.00 to $4.00 and set an "overweight" rating for the company in a report on Thursday, August 15th. Two equities research analysts have rated the stock with a sell rating, seven have assigned a hold rating and four have issued a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $4.63.

View Our Latest Research Report on BLUE

bluebird bio Stock Performance

Shares of BLUE stock remained flat at $0.47 during trading hours on Friday. 3,469,988 shares of the stock traded hands, compared to its average volume of 7,450,646. The company has a market cap of $90.36 million, a PE ratio of -0.21 and a beta of 0.75. bluebird bio has a twelve month low of $0.45 and a twelve month high of $5.53. The firm has a 50 day moving average price of $0.52 and a 200-day moving average price of $0.82. The company has a debt-to-equity ratio of 0.37, a current ratio of 0.68 and a quick ratio of 0.57.

bluebird bio (NASDAQ:BLUE - Get Free Report) last released its earnings results on Friday, September 13th. The biotechnology company reported ($0.36) EPS for the quarter. The firm had revenue of $18.57 million for the quarter. bluebird bio had a negative return on equity of 207.25% and a negative net margin of 567.29%. As a group, analysts anticipate that bluebird bio will post -1.41 EPS for the current fiscal year.

Institutional Trading of bluebird bio

A number of hedge funds and other institutional investors have recently made changes to their positions in the stock. Allegheny Financial Group LTD acquired a new position in shares of bluebird bio during the 2nd quarter valued at $25,000. Sequoia Financial Advisors LLC raised its position in bluebird bio by 48.0% in the first quarter. Sequoia Financial Advisors LLC now owns 40,085 shares of the biotechnology company's stock worth $51,000 after acquiring an additional 13,000 shares in the last quarter. Bayesian Capital Management LP acquired a new stake in bluebird bio in the 1st quarter valued at about $52,000. Price T Rowe Associates Inc. MD boosted its position in shares of bluebird bio by 113.7% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 54,714 shares of the biotechnology company's stock valued at $71,000 after purchasing an additional 29,113 shares in the last quarter. Finally, SG Americas Securities LLC grew its stake in shares of bluebird bio by 458.8% in the 1st quarter. SG Americas Securities LLC now owns 80,032 shares of the biotechnology company's stock worth $102,000 after purchasing an additional 65,710 shares during the last quarter. 87.43% of the stock is currently owned by institutional investors.

bluebird bio Company Profile

(

Get Free Report)

bluebird bio, Inc, a biotechnology company, researches, develops, and commercializes gene therapies for severe genetic diseases. Its product candidates for severe genetic diseases include ZYNTEGLO (betibeglogene autotemcel) for the treatment of transfusion-dependent ß-thalassemia; lovotibeglogene autotemcel for the treatment of sickle cell disease (SCD); and SKYSONA (elivaldogene autotemcel) to treat cerebral adrenoleukodystrophy.

Recommended Stories

Before you consider bluebird bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and bluebird bio wasn't on the list.

While bluebird bio currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.