CWM LLC lifted its position in shares of Bruker Co. (NASDAQ:BRKR - Free Report) by 191.9% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 13,942 shares of the medical research company's stock after acquiring an additional 9,165 shares during the period. CWM LLC's holdings in Bruker were worth $963,000 as of its most recent filing with the Securities and Exchange Commission.

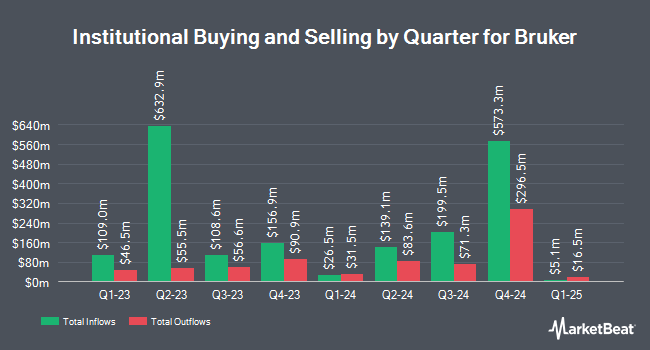

A number of other hedge funds have also added to or reduced their stakes in BRKR. TD Asset Management Inc boosted its stake in shares of Bruker by 7.4% in the 1st quarter. TD Asset Management Inc now owns 1,788,763 shares of the medical research company's stock valued at $168,036,000 after purchasing an additional 123,984 shares in the last quarter. Congress Asset Management Co. MA boosted its position in Bruker by 3.5% in the first quarter. Congress Asset Management Co. MA now owns 1,414,362 shares of the medical research company's stock valued at $132,865,000 after buying an additional 47,301 shares in the last quarter. Marshall Wace LLP grew its stake in shares of Bruker by 127.8% during the second quarter. Marshall Wace LLP now owns 1,389,537 shares of the medical research company's stock worth $88,666,000 after buying an additional 779,549 shares during the last quarter. Dimensional Fund Advisors LP lifted its stake in shares of Bruker by 8.6% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,277,273 shares of the medical research company's stock valued at $81,508,000 after acquiring an additional 101,539 shares during the last quarter. Finally, Bank of New York Mellon Corp boosted its holdings in shares of Bruker by 3.0% during the 2nd quarter. Bank of New York Mellon Corp now owns 966,069 shares of the medical research company's stock valued at $61,645,000 after acquiring an additional 27,870 shares in the last quarter. 79.52% of the stock is owned by institutional investors.

Bruker Trading Up 3.2 %

NASDAQ BRKR traded up $1.96 during trading hours on Friday, hitting $62.45. 1,274,207 shares of the company's stock were exchanged, compared to its average volume of 1,049,151. The firm has a market cap of $9.08 billion, a price-to-earnings ratio of 22.71, a PEG ratio of 2.52 and a beta of 1.18. The stock has a 50-day simple moving average of $65.10 and a 200 day simple moving average of $69.16. The company has a current ratio of 1.65, a quick ratio of 0.75 and a debt-to-equity ratio of 1.18. Bruker Co. has a 1-year low of $53.79 and a 1-year high of $94.86.

Bruker (NASDAQ:BRKR - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The medical research company reported $0.52 EPS for the quarter, hitting the consensus estimate of $0.52. Bruker had a net margin of 11.29% and a return on equity of 24.92%. The company had revenue of $800.70 million during the quarter, compared to the consensus estimate of $799.44 million. During the same quarter last year, the firm posted $0.50 EPS. The company's quarterly revenue was up 17.4% on a year-over-year basis. On average, equities analysts forecast that Bruker Co. will post 2.61 EPS for the current fiscal year.

Bruker Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 16th. Stockholders of record on Monday, September 2nd were given a dividend of $0.05 per share. The ex-dividend date of this dividend was Friday, August 30th. This represents a $0.20 dividend on an annualized basis and a dividend yield of 0.32%. Bruker's dividend payout ratio (DPR) is presently 7.27%.

Analyst Ratings Changes

Several equities analysts have commented on BRKR shares. The Goldman Sachs Group dropped their target price on Bruker from $72.00 to $60.00 and set a "sell" rating for the company in a research report on Tuesday, July 9th. Wolfe Research downgraded shares of Bruker from an "outperform" rating to a "peer perform" rating in a research report on Monday, September 30th. Wells Fargo & Company began coverage on shares of Bruker in a report on Tuesday, August 27th. They set an "overweight" rating and a $78.00 target price on the stock. Barclays assumed coverage on shares of Bruker in a research note on Tuesday. They set an "overweight" rating and a $75.00 price target for the company. Finally, Citigroup decreased their price objective on Bruker from $95.00 to $80.00 and set a "buy" rating for the company in a report on Wednesday, July 10th. One analyst has rated the stock with a sell rating, four have given a hold rating and seven have given a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $80.82.

View Our Latest Analysis on Bruker

About Bruker

(

Free Report)

Bruker Corporation, together with its subsidiaries, develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy & Supercon Technologies.

See Also

Before you consider Bruker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bruker wasn't on the list.

While Bruker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.