Cheesecake Factory (NASDAQ:CAKE - Get Free Report) had its price objective increased by Bank of America from $47.00 to $49.00 in a research note issued on Wednesday, Benzinga reports. The firm currently has a "neutral" rating on the restaurant operator's stock. Bank of America's target price would suggest a potential upside of 5.06% from the stock's previous close.

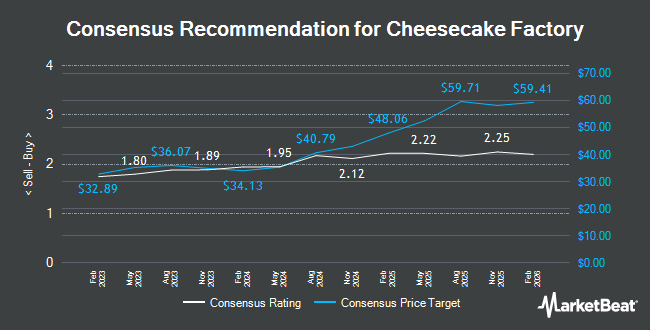

CAKE has been the subject of several other reports. Robert W. Baird increased their target price on Cheesecake Factory from $40.00 to $47.00 and gave the company a "neutral" rating in a research report on Wednesday. Barclays raised their price objective on shares of Cheesecake Factory from $38.00 to $44.00 and gave the company an "underweight" rating in a report on Wednesday. Wells Fargo & Company lifted their target price on shares of Cheesecake Factory from $38.00 to $45.00 and gave the stock an "equal weight" rating in a research report on Wednesday. Wedbush lifted their price target on shares of Cheesecake Factory from $48.00 to $52.00 and gave the stock an "outperform" rating in a report on Wednesday. Finally, JPMorgan Chase & Co. decreased their price objective on Cheesecake Factory from $40.00 to $38.00 and set an "underweight" rating for the company in a report on Tuesday, August 6th. Three investment analysts have rated the stock with a sell rating, six have assigned a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat.com, Cheesecake Factory currently has an average rating of "Hold" and an average price target of $44.17.

Check Out Our Latest Report on CAKE

Cheesecake Factory Price Performance

Shares of NASDAQ CAKE traded up $3.78 during mid-day trading on Wednesday, reaching $46.64. The company had a trading volume of 3,731,603 shares, compared to its average volume of 957,791. The company has a debt-to-equity ratio of 1.26, a quick ratio of 0.32 and a current ratio of 0.43. Cheesecake Factory has a one year low of $29.27 and a one year high of $49.75. The firm has a market cap of $2.38 billion, a price-to-earnings ratio of 19.51, a PEG ratio of 1.13 and a beta of 1.49. The business's 50-day simple moving average is $40.01 and its 200 day simple moving average is $38.36.

Cheesecake Factory (NASDAQ:CAKE - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The restaurant operator reported $0.58 EPS for the quarter, topping analysts' consensus estimates of $0.47 by $0.11. Cheesecake Factory had a return on equity of 43.62% and a net margin of 3.32%. The company had revenue of $865.50 million during the quarter, compared to analysts' expectations of $866.13 million. During the same quarter in the previous year, the firm earned $0.39 EPS. Cheesecake Factory's revenue was up 4.3% on a year-over-year basis. On average, research analysts predict that Cheesecake Factory will post 3.21 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Cheesecake Factory

A number of hedge funds have recently added to or reduced their stakes in the company. Duality Advisers LP bought a new position in shares of Cheesecake Factory in the first quarter valued at $1,829,000. Dimensional Fund Advisors LP lifted its holdings in shares of Cheesecake Factory by 3.6% in the second quarter. Dimensional Fund Advisors LP now owns 1,241,272 shares of the restaurant operator's stock valued at $48,772,000 after purchasing an additional 43,128 shares in the last quarter. Earnest Partners LLC grew its holdings in Cheesecake Factory by 2.8% during the second quarter. Earnest Partners LLC now owns 2,831,381 shares of the restaurant operator's stock worth $111,245,000 after buying an additional 76,578 shares in the last quarter. JCP Investment Management LLC bought a new stake in Cheesecake Factory during the second quarter worth $5,149,000. Finally, State Board of Administration of Florida Retirement System lifted its stake in Cheesecake Factory by 38.7% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 19,215 shares of the restaurant operator's stock valued at $673,000 after acquiring an additional 5,360 shares in the last quarter. Institutional investors and hedge funds own 94.48% of the company's stock.

Cheesecake Factory Company Profile

(

Get Free Report)

The Cheesecake Factory Incorporated operates and licenses restaurants in the United States and Canada. The company operates bakeries that produce cheesecakes and other baked products for its restaurants, international licensees, third-party bakery customers, external foodservice operators, retailers, and distributors.

Further Reading

Before you consider Cheesecake Factory, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cheesecake Factory wasn't on the list.

While Cheesecake Factory currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.