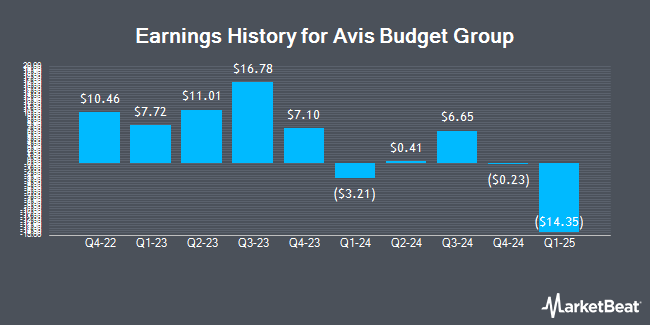

Avis Budget Group (NASDAQ:CAR - Get Free Report) posted its quarterly earnings results on Thursday. The business services provider reported $6.65 earnings per share (EPS) for the quarter, missing the consensus estimate of $8.55 by ($1.90), Briefing.com reports. Avis Budget Group had a negative return on equity of 230.71% and a net margin of 6.58%. The company had revenue of $3.48 billion during the quarter, compared to analysts' expectations of $3.53 billion. During the same period in the prior year, the firm earned $16.78 EPS. Avis Budget Group's revenue for the quarter was down 2.4% compared to the same quarter last year.

Avis Budget Group Price Performance

Shares of NASDAQ:CAR traded up $9.06 during trading on Friday, hitting $92.06. The company's stock had a trading volume of 2,490,384 shares, compared to its average volume of 721,214. Avis Budget Group has a 12 month low of $65.73 and a 12 month high of $204.77. The firm has a market cap of $3.28 billion, a price-to-earnings ratio of 4.51 and a beta of 2.13. The company has a 50-day moving average of $81.90 and a 200-day moving average of $96.90.

Wall Street Analyst Weigh In

CAR has been the subject of a number of analyst reports. Susquehanna reduced their price objective on shares of Avis Budget Group from $120.00 to $95.00 and set a "neutral" rating for the company in a research note on Friday, August 9th. Barclays started coverage on shares of Avis Budget Group in a research note on Thursday, September 19th. They set an "equal weight" rating and a $105.00 price objective for the company. Deutsche Bank Aktiengesellschaft decreased their price target on Avis Budget Group from $155.00 to $146.00 and set a "buy" rating for the company in a research note on Friday, August 30th. The Goldman Sachs Group dropped their price objective on Avis Budget Group from $105.00 to $90.00 and set a "neutral" rating on the stock in a research report on Friday, October 11th. Finally, StockNews.com lowered Avis Budget Group from a "hold" rating to a "sell" rating in a research report on Wednesday, August 14th. One research analyst has rated the stock with a sell rating, three have given a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $136.63.

View Our Latest Analysis on CAR

Avis Budget Group Company Profile

(

Get Free Report)

Avis Budget Group, Inc, together with its subsidiaries, provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia. It operates the Avis brand, that offers vehicle rental and other mobility solutions to the premium commercial and leisure segments of the travel industry; and the Zipcar brand, a car sharing network, as well as the Budget brand, a supplier of vehicle rental and other mobility solutions focused primarily on more value-conscious customers comprising Budget car rental, and Budget Truck, a local, and one-way truck and cargo van rental businesses with a fleet of approximately 19,000 vehicles, which are rented through a network of dealer-operated and company-operated locations that serve the light commercial and consumer sectors in the continental United States.

Featured Articles

Before you consider Avis Budget Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avis Budget Group wasn't on the list.

While Avis Budget Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.