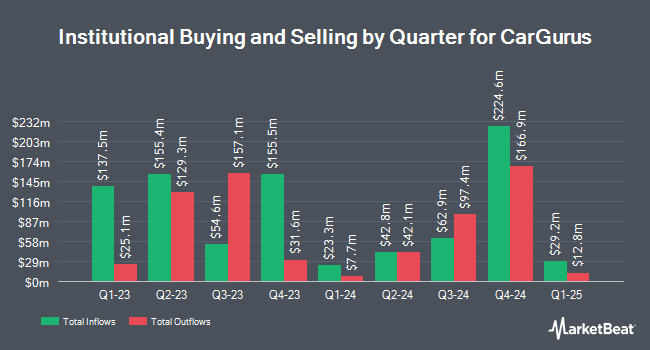

Raymond James & Associates trimmed its stake in CarGurus, Inc. (NASDAQ:CARG - Free Report) by 7.9% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 492,731 shares of the company's stock after selling 42,208 shares during the quarter. Raymond James & Associates owned 0.47% of CarGurus worth $14,797,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds have also made changes to their positions in the stock. Kathleen S. Wright Associates Inc. acquired a new position in CarGurus in the 3rd quarter worth about $30,000. CWM LLC lifted its stake in CarGurus by 54.1% in the second quarter. CWM LLC now owns 1,381 shares of the company's stock valued at $36,000 after acquiring an additional 485 shares during the last quarter. Nisa Investment Advisors LLC lifted its stake in CarGurus by 43.5% in the second quarter. Nisa Investment Advisors LLC now owns 1,579 shares of the company's stock valued at $41,000 after acquiring an additional 479 shares during the last quarter. GAMMA Investing LLC grew its position in CarGurus by 25.9% in the second quarter. GAMMA Investing LLC now owns 2,066 shares of the company's stock worth $54,000 after acquiring an additional 425 shares in the last quarter. Finally, Headlands Technologies LLC bought a new position in shares of CarGurus during the 1st quarter valued at $49,000. 86.90% of the stock is owned by hedge funds and other institutional investors.

CarGurus Stock Performance

Shares of NASDAQ:CARG traded down $0.62 on Friday, hitting $31.53. 377,030 shares of the company were exchanged, compared to its average volume of 835,104. The company's 50 day moving average price is $29.54 and its two-hundred day moving average price is $26.25. The firm has a market capitalization of $3.29 billion, a price-to-earnings ratio of 112.61, a PEG ratio of 1.48 and a beta of 1.56. CarGurus, Inc. has a one year low of $16.70 and a one year high of $32.36.

CarGurus (NASDAQ:CARG - Get Free Report) last posted its quarterly earnings results on Thursday, August 8th. The company reported $0.30 EPS for the quarter, beating the consensus estimate of $0.23 by $0.07. CarGurus had a positive return on equity of 11.06% and a negative net margin of 5.57%. The firm had revenue of $218.69 million during the quarter, compared to analysts' expectations of $214.85 million. Research analysts predict that CarGurus, Inc. will post 1.18 earnings per share for the current year.

Insider Buying and Selling

In other news, COO Samuel Zales sold 25,168 shares of the company's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $28.34, for a total value of $713,261.12. Following the sale, the chief operating officer now owns 480,583 shares of the company's stock, valued at approximately $13,619,722.22. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other CarGurus news, COO Samuel Zales sold 25,168 shares of the business's stock in a transaction dated Friday, August 16th. The stock was sold at an average price of $28.34, for a total transaction of $713,261.12. Following the completion of the sale, the chief operating officer now directly owns 480,583 shares of the company's stock, valued at approximately $13,619,722.22. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CMO Dafna Sarnoff sold 3,107 shares of the stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $28.42, for a total transaction of $88,300.94. Following the completion of the sale, the chief marketing officer now owns 128,952 shares in the company, valued at $3,664,815.84. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 61,065 shares of company stock valued at $1,823,794 over the last ninety days. 17.20% of the stock is owned by company insiders.

Analyst Ratings Changes

A number of analysts have weighed in on the company. Needham & Company LLC boosted their price target on CarGurus from $25.00 to $27.00 and gave the stock a "buy" rating in a research report on Friday, August 9th. Royal Bank of Canada boosted their target price on CarGurus from $27.00 to $30.00 and gave the stock an "outperform" rating in a report on Friday, August 9th. BTIG Research increased their price target on CarGurus from $30.00 to $35.00 and gave the company a "buy" rating in a report on Tuesday, October 22nd. DA Davidson restated a "neutral" rating and issued a $26.50 price objective on shares of CarGurus in a research note on Tuesday, September 10th. Finally, JPMorgan Chase & Co. raised their target price on shares of CarGurus from $29.00 to $32.00 and gave the company an "overweight" rating in a research note on Monday, August 12th. Three analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $30.59.

Get Our Latest Report on CARG

CarGurus Profile

(

Free Report)

CarGurus, Inc operates an online automotive platform for buying and selling vehicles in the United States and internationally. It operates through two segments, U.S. Marketplace and Digital Wholesale. The company provides an online automotive marketplace where customers can search for new and used car listings from its dealers and sell their car to dealers and other consumers; and paid listings subscriptions for enhanced access to its marketplace that connects dealers to a large audience of informed and engaged consumers.

Read More

Before you consider CarGurus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarGurus wasn't on the list.

While CarGurus currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.