Cadence Design Systems (NASDAQ:CDNS - Get Free Report)'s stock had its "neutral" rating restated by equities researchers at Rosenblatt Securities in a research note issued to investors on Tuesday, Benzinga reports. They presently have a $280.00 price objective on the software maker's stock. Rosenblatt Securities' target price would suggest a potential downside of 1.56% from the company's current price.

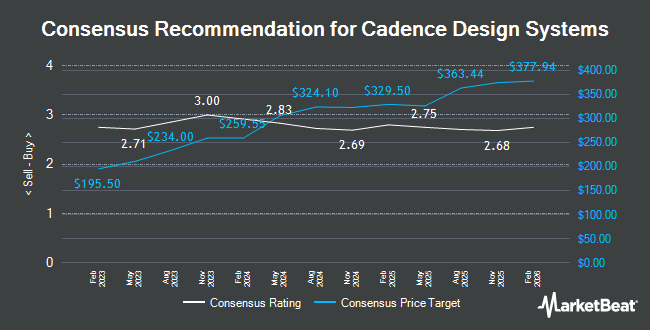

Several other analysts also recently weighed in on the stock. Oppenheimer began coverage on shares of Cadence Design Systems in a research note on Wednesday, September 25th. They set an "underperform" rating and a $225.00 price target for the company. Berenberg Bank initiated coverage on shares of Cadence Design Systems in a report on Tuesday, October 15th. They set a "buy" rating and a $320.00 price objective on the stock. Mizuho initiated coverage on shares of Cadence Design Systems in a report on Tuesday, October 22nd. They set an "outperform" rating and a $325.00 price objective on the stock. Piper Sandler raised shares of Cadence Design Systems from a "neutral" rating to an "overweight" rating and set a $318.00 price objective on the stock in a report on Tuesday, August 6th. Finally, Needham & Company LLC cut their price objective on shares of Cadence Design Systems from $320.00 to $315.00 and set a "buy" rating on the stock in a report on Tuesday. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and ten have issued a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $323.17.

View Our Latest Analysis on CDNS

Cadence Design Systems Trading Up 12.5 %

NASDAQ CDNS traded up $31.68 during trading on Tuesday, hitting $284.45. The stock had a trading volume of 5,895,408 shares, compared to its average volume of 1,761,541. The company has a debt-to-equity ratio of 0.23, a quick ratio of 1.32 and a current ratio of 1.43. The stock has a market capitalization of $77.49 billion, a price-to-earnings ratio of 74.08, a P/E/G ratio of 3.03 and a beta of 1.02. Cadence Design Systems has a one year low of $230.65 and a one year high of $328.99. The stock has a 50 day simple moving average of $266.90 and a 200 day simple moving average of $281.98.

Cadence Design Systems (NASDAQ:CDNS - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The software maker reported $1.64 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.44 by $0.20. The business had revenue of $1.22 billion during the quarter, compared to the consensus estimate of $1.18 billion. Cadence Design Systems had a net margin of 25.36% and a return on equity of 29.54%. The firm's quarterly revenue was up 18.8% compared to the same quarter last year. During the same quarter last year, the firm earned $1.01 earnings per share. Sell-side analysts predict that Cadence Design Systems will post 4.73 earnings per share for the current year.

Insider Activity

In related news, VP Paul Cunningham sold 650 shares of the business's stock in a transaction on Thursday, August 1st. The shares were sold at an average price of $266.24, for a total transaction of $173,056.00. Following the completion of the transaction, the vice president now directly owns 65,194 shares in the company, valued at $17,357,250.56. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In related news, VP Chin-Chi Teng sold 10,000 shares of the business's stock in a transaction on Thursday, August 15th. The shares were sold at an average price of $276.36, for a total transaction of $2,763,600.00. Following the completion of the transaction, the vice president now directly owns 95,408 shares in the company, valued at $26,366,954.88. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, VP Paul Cunningham sold 650 shares of the business's stock in a transaction on Thursday, August 1st. The shares were sold at an average price of $266.24, for a total transaction of $173,056.00. Following the transaction, the vice president now owns 65,194 shares of the company's stock, valued at $17,357,250.56. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 28,347 shares of company stock valued at $7,728,272 over the last ninety days. 1.99% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of the company. Vanguard Group Inc. raised its position in shares of Cadence Design Systems by 1.8% in the first quarter. Vanguard Group Inc. now owns 24,940,556 shares of the software maker's stock worth $7,763,496,000 after acquiring an additional 437,101 shares during the period. Jennison Associates LLC raised its position in shares of Cadence Design Systems by 6.9% in the first quarter. Jennison Associates LLC now owns 7,085,526 shares of the software maker's stock worth $2,205,582,000 after acquiring an additional 459,603 shares during the period. Van ECK Associates Corp raised its position in shares of Cadence Design Systems by 26.1% in the third quarter. Van ECK Associates Corp now owns 2,767,965 shares of the software maker's stock worth $689,472,000 after acquiring an additional 572,251 shares during the period. Legal & General Group Plc raised its position in shares of Cadence Design Systems by 1.8% during the 2nd quarter. Legal & General Group Plc now owns 2,509,136 shares of the software maker's stock worth $772,187,000 after purchasing an additional 43,654 shares during the last quarter. Finally, Nordea Investment Management AB raised its position in shares of Cadence Design Systems by 7.7% during the 1st quarter. Nordea Investment Management AB now owns 2,040,581 shares of the software maker's stock worth $636,172,000 after purchasing an additional 145,351 shares during the last quarter. Institutional investors and hedge funds own 84.85% of the company's stock.

About Cadence Design Systems

(

Get Free Report)

Cadence Design Systems, Inc provides software, hardware, services, and reusable integrated circuit (IC) design blocks worldwide. The company offers functional verification services, including emulation and prototyping hardware. Its functional verification offering consists of JasperGold, a formal verification platform; Xcelium, a parallel logic simulation platform; Palladium, an enterprise emulation platform; and Protium, a prototyping platform for chip verification.

Featured Articles

Before you consider Cadence Design Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cadence Design Systems wasn't on the list.

While Cadence Design Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report