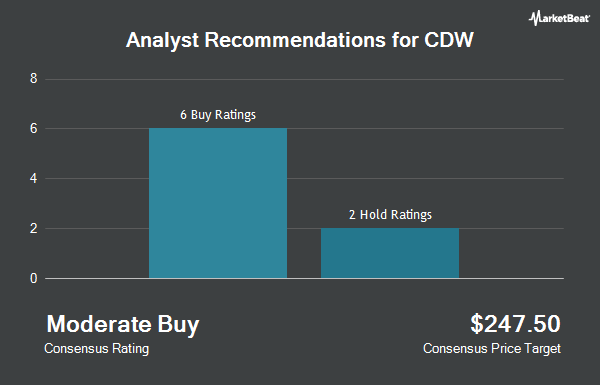

Shares of CDW Co. (NASDAQ:CDW - Get Free Report) have received a consensus recommendation of "Moderate Buy" from the seven research firms that are presently covering the stock, MarketBeat.com reports. Three analysts have rated the stock with a hold recommendation and four have given a buy recommendation to the company. The average 1 year target price among brokers that have covered the stock in the last year is $255.00.

CDW has been the topic of a number of research analyst reports. Barclays lowered their price target on CDW from $232.00 to $229.00 and set an "equal weight" rating on the stock in a report on Thursday, August 1st. Citigroup cut CDW from a "buy" rating to a "neutral" rating and lowered their price target for the stock from $250.00 to $245.00 in a report on Tuesday. Northcoast Research raised CDW from a "neutral" rating to a "buy" rating and set a $270.00 price target on the stock in a report on Friday, June 7th. Finally, Stifel Nicolaus upped their price objective on CDW from $250.00 to $260.00 and gave the stock a "buy" rating in a report on Wednesday, July 17th.

Read Our Latest Research Report on CDW

Insider Buying and Selling at CDW

In other news, insider Christine A. Leahy purchased 1,200 shares of the company's stock in a transaction dated Thursday, August 1st. The shares were acquired at an average price of $216.15 per share, with a total value of $259,380.00. Following the transaction, the insider now owns 102,200 shares of the company's stock, valued at $22,090,530. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. In other news, insider Christine A. Leahy purchased 1,200 shares of the company's stock in a transaction dated Thursday, August 1st. The shares were acquired at an average price of $216.15 per share, with a total value of $259,380.00. Following the transaction, the insider now owns 102,200 shares of the company's stock, valued at $22,090,530. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, insider Sona Chawla sold 18,437 shares of the stock in a transaction on Tuesday, July 16th. The stock was sold at an average price of $240.45, for a total value of $4,433,176.65. Following the transaction, the insider now directly owns 22,428 shares in the company, valued at approximately $5,392,812.60. The disclosure for this sale can be found here. 0.90% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On CDW

A number of hedge funds have recently made changes to their positions in CDW. Cambridge Investment Research Advisors Inc. lifted its stake in shares of CDW by 2.3% during the 4th quarter. Cambridge Investment Research Advisors Inc. now owns 5,965 shares of the information technology services provider's stock worth $1,356,000 after purchasing an additional 133 shares during the last quarter. CIBC Asset Management Inc lifted its stake in shares of CDW by 94.6% during the 4th quarter. CIBC Asset Management Inc now owns 37,523 shares of the information technology services provider's stock worth $8,530,000 after purchasing an additional 18,243 shares during the last quarter. CIBC Private Wealth Group LLC lifted its stake in shares of CDW by 2.2% during the 4th quarter. CIBC Private Wealth Group LLC now owns 16,333 shares of the information technology services provider's stock worth $3,713,000 after purchasing an additional 356 shares during the last quarter. Blueshift Asset Management LLC purchased a new stake in CDW in the fourth quarter valued at about $272,000. Finally, Goldman Sachs Group Inc. raised its stake in CDW by 9.9% in the fourth quarter. Goldman Sachs Group Inc. now owns 588,054 shares of the information technology services provider's stock valued at $133,677,000 after buying an additional 52,771 shares during the last quarter. 93.15% of the stock is currently owned by hedge funds and other institutional investors.

CDW Stock Performance

Shares of NASDAQ:CDW traded down $1.73 during mid-day trading on Thursday, reaching $217.62. 175,846 shares of the company traded hands, compared to its average volume of 818,727. The company's 50 day moving average price is $220.61 and its 200-day moving average price is $228.62. The firm has a market cap of $29.25 billion, a PE ratio of 27.31, a PEG ratio of 3.40 and a beta of 1.04. The company has a debt-to-equity ratio of 2.03, a current ratio of 1.13 and a quick ratio of 1.02. CDW has a 52 week low of $185.04 and a 52 week high of $263.37.

CDW (NASDAQ:CDW - Get Free Report) last announced its quarterly earnings data on Wednesday, July 31st. The information technology services provider reported $2.34 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.39 by ($0.05). CDW had a net margin of 5.29% and a return on equity of 62.22%. The company had revenue of $5.42 billion for the quarter, compared to the consensus estimate of $5.43 billion. During the same quarter last year, the firm posted $2.43 earnings per share. The company's revenue was down 3.6% compared to the same quarter last year. On average, equities analysts expect that CDW will post 9.4 EPS for the current fiscal year.

CDW Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, September 10th. Investors of record on Monday, August 26th were issued a dividend of $0.62 per share. The ex-dividend date of this dividend was Monday, August 26th. This represents a $2.48 annualized dividend and a yield of 1.14%. CDW's payout ratio is presently 30.96%.

CDW Company Profile

(

Get Free ReportCDW Corporation provides information technology (IT) solutions in the United States, the United Kingdom, and Canada. It operates through three segments: Corporate, Small Business, and Public. The company offers discrete hardware and software products and services, as well as integrated IT solutions, including on-premise and cloud capabilities across hybrid infrastructure, digital experience, and security.

Recommended Stories

Before you consider CDW, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CDW wasn't on the list.

While CDW currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.