Handelsbanken Fonder AB grew its holdings in shares of CDW Co. (NASDAQ:CDW - Free Report) by 17.0% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 65,889 shares of the information technology services provider's stock after acquiring an additional 9,596 shares during the period. Handelsbanken Fonder AB's holdings in CDW were worth $14,911,000 as of its most recent SEC filing.

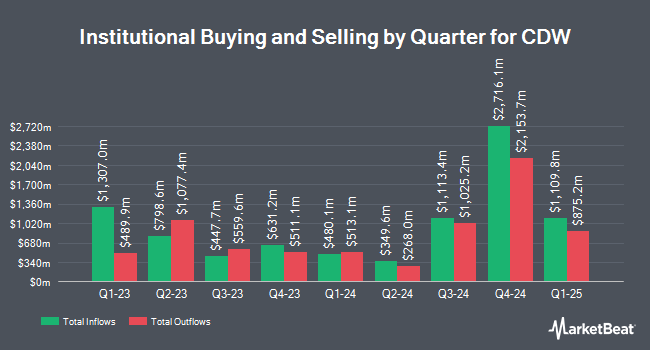

Other hedge funds and other institutional investors have also modified their holdings of the company. Vanguard Group Inc. grew its holdings in CDW by 4.6% during the 1st quarter. Vanguard Group Inc. now owns 16,407,542 shares of the information technology services provider's stock worth $4,196,721,000 after acquiring an additional 714,393 shares in the last quarter. Wellington Management Group LLP lifted its position in shares of CDW by 29.1% during the fourth quarter. Wellington Management Group LLP now owns 3,464,886 shares of the information technology services provider's stock worth $787,638,000 after purchasing an additional 781,421 shares during the last quarter. Mawer Investment Management Ltd. grew its stake in CDW by 0.9% in the first quarter. Mawer Investment Management Ltd. now owns 3,101,924 shares of the information technology services provider's stock worth $793,410,000 after purchasing an additional 27,753 shares in the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. increased its holdings in CDW by 3.7% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 1,431,573 shares of the information technology services provider's stock valued at $366,168,000 after buying an additional 51,450 shares during the last quarter. Finally, Dimensional Fund Advisors LP raised its stake in CDW by 11.0% during the second quarter. Dimensional Fund Advisors LP now owns 1,292,674 shares of the information technology services provider's stock valued at $289,357,000 after buying an additional 128,263 shares in the last quarter. 93.15% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In related news, insider Sona Chawla sold 18,437 shares of the firm's stock in a transaction that occurred on Tuesday, July 16th. The shares were sold at an average price of $240.45, for a total value of $4,433,176.65. Following the completion of the transaction, the insider now owns 22,428 shares of the company's stock, valued at approximately $5,392,812.60. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In related news, insider Christine A. Leahy purchased 1,200 shares of the firm's stock in a transaction that occurred on Thursday, August 1st. The stock was acquired at an average cost of $216.15 per share, for a total transaction of $259,380.00. Following the completion of the acquisition, the insider now owns 102,200 shares in the company, valued at $22,090,530. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Sona Chawla sold 18,437 shares of the company's stock in a transaction that occurred on Tuesday, July 16th. The shares were sold at an average price of $240.45, for a total transaction of $4,433,176.65. Following the completion of the transaction, the insider now owns 22,428 shares in the company, valued at approximately $5,392,812.60. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.90% of the stock is currently owned by company insiders.

CDW Stock Performance

Shares of CDW traded down $1.20 during mid-day trading on Monday, reaching $220.49. 416,739 shares of the company's stock traded hands, compared to its average volume of 815,720. The company has a debt-to-equity ratio of 2.03, a quick ratio of 1.02 and a current ratio of 1.13. The business's 50-day moving average price is $220.24 and its 200-day moving average price is $228.09. The stock has a market capitalization of $29.63 billion, a P/E ratio of 27.58, a price-to-earnings-growth ratio of 3.40 and a beta of 1.03. CDW Co. has a 12 month low of $185.04 and a 12 month high of $263.37.

CDW (NASDAQ:CDW - Get Free Report) last released its earnings results on Wednesday, July 31st. The information technology services provider reported $2.34 earnings per share for the quarter, missing analysts' consensus estimates of $2.39 by ($0.05). CDW had a return on equity of 62.22% and a net margin of 5.29%. The firm had revenue of $5.42 billion during the quarter, compared to analyst estimates of $5.43 billion. During the same quarter last year, the company earned $2.43 earnings per share. The business's revenue for the quarter was down 3.6% on a year-over-year basis. Equities analysts predict that CDW Co. will post 9.4 earnings per share for the current year.

CDW Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, September 10th. Shareholders of record on Monday, August 26th were given a $0.62 dividend. The ex-dividend date was Monday, August 26th. This represents a $2.48 annualized dividend and a yield of 1.12%. CDW's dividend payout ratio (DPR) is 30.96%.

Wall Street Analysts Forecast Growth

A number of brokerages have recently weighed in on CDW. Barclays lowered their price target on CDW from $232.00 to $229.00 and set an "equal weight" rating for the company in a report on Thursday, August 1st. Citigroup cut shares of CDW from a "buy" rating to a "neutral" rating and dropped their target price for the stock from $250.00 to $245.00 in a report on Tuesday, October 1st. Finally, Stifel Nicolaus lifted their price target on shares of CDW from $250.00 to $260.00 and gave the company a "buy" rating in a report on Wednesday, July 17th. Three equities research analysts have rated the stock with a hold rating and four have given a buy rating to the stock. Based on data from MarketBeat.com, CDW has a consensus rating of "Moderate Buy" and an average price target of $255.00.

View Our Latest Stock Analysis on CDW

CDW Company Profile

(

Free Report)

CDW Corporation provides information technology (IT) solutions in the United States, the United Kingdom, and Canada. It operates through three segments: Corporate, Small Business, and Public. The company offers discrete hardware and software products and services, as well as integrated IT solutions, including on-premise and cloud capabilities across hybrid infrastructure, digital experience, and security.

See Also

Before you consider CDW, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CDW wasn't on the list.

While CDW currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report