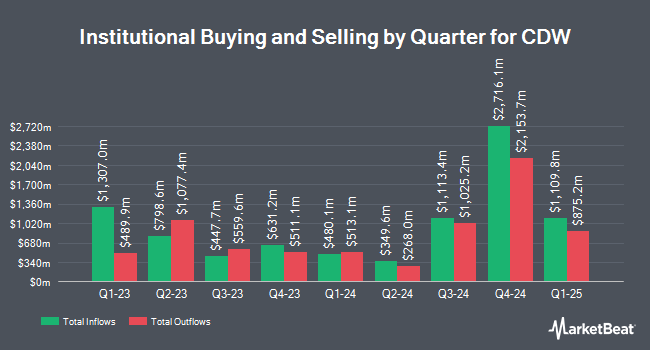

FCF Advisors LLC acquired a new stake in CDW Co. (NASDAQ:CDW - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor acquired 9,745 shares of the information technology services provider's stock, valued at approximately $2,205,000.

A number of other hedge funds have also modified their holdings of CDW. Tsfg LLC acquired a new stake in CDW during the 1st quarter worth $26,000. Rise Advisors LLC acquired a new stake in shares of CDW during the first quarter worth about $34,000. ORG Partners LLC purchased a new position in shares of CDW during the second quarter worth about $34,000. Quest Partners LLC acquired a new position in CDW in the 2nd quarter valued at about $35,000. Finally, Summit Securities Group LLC purchased a new stake in CDW during the 2nd quarter valued at approximately $40,000. 93.15% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other CDW news, insider Christine A. Leahy acquired 1,200 shares of the stock in a transaction that occurred on Thursday, August 1st. The shares were purchased at an average cost of $216.15 per share, with a total value of $259,380.00. Following the purchase, the insider now owns 102,200 shares in the company, valued at approximately $22,090,530. The trade was a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through the SEC website. In other CDW news, insider Sona Chawla sold 18,437 shares of the firm's stock in a transaction on Tuesday, July 16th. The stock was sold at an average price of $240.45, for a total transaction of $4,433,176.65. Following the completion of the transaction, the insider now owns 22,428 shares of the company's stock, valued at approximately $5,392,812.60. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, insider Christine A. Leahy acquired 1,200 shares of CDW stock in a transaction dated Thursday, August 1st. The stock was bought at an average price of $216.15 per share, for a total transaction of $259,380.00. Following the completion of the transaction, the insider now directly owns 102,200 shares of the company's stock, valued at approximately $22,090,530. This represents a 0.00 % increase in their ownership of the stock. The disclosure for this purchase can be found here. 0.90% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

CDW has been the topic of several analyst reports. Citigroup downgraded CDW from a "buy" rating to a "neutral" rating and lowered their target price for the company from $250.00 to $245.00 in a research note on Tuesday, October 1st. Barclays lowered their price objective on shares of CDW from $232.00 to $229.00 and set an "equal weight" rating on the stock in a research report on Thursday, August 1st. Finally, Stifel Nicolaus raised their target price on shares of CDW from $250.00 to $260.00 and gave the stock a "buy" rating in a research note on Wednesday, July 17th. Three analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to MarketBeat.com, CDW presently has a consensus rating of "Moderate Buy" and a consensus target price of $255.00.

View Our Latest Research Report on CDW

CDW Price Performance

CDW stock traded up $3.12 during midday trading on Tuesday, reaching $223.61. The company's stock had a trading volume of 668,781 shares, compared to its average volume of 814,963. The stock's 50 day simple moving average is $220.02 and its 200 day simple moving average is $227.85. The company has a debt-to-equity ratio of 2.03, a quick ratio of 1.02 and a current ratio of 1.13. The firm has a market capitalization of $30.05 billion, a PE ratio of 27.81, a P/E/G ratio of 3.40 and a beta of 1.03. CDW Co. has a fifty-two week low of $185.04 and a fifty-two week high of $263.37.

CDW (NASDAQ:CDW - Get Free Report) last issued its earnings results on Wednesday, July 31st. The information technology services provider reported $2.34 earnings per share for the quarter, missing the consensus estimate of $2.39 by ($0.05). CDW had a return on equity of 62.22% and a net margin of 5.29%. The company had revenue of $5.42 billion for the quarter, compared to analyst estimates of $5.43 billion. During the same quarter in the previous year, the company posted $2.43 earnings per share. The company's quarterly revenue was down 3.6% compared to the same quarter last year. On average, equities research analysts forecast that CDW Co. will post 9.4 earnings per share for the current year.

CDW Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, September 10th. Investors of record on Monday, August 26th were issued a dividend of $0.62 per share. The ex-dividend date of this dividend was Monday, August 26th. This represents a $2.48 annualized dividend and a yield of 1.11%. CDW's dividend payout ratio is presently 30.96%.

CDW Profile

(

Free Report)

CDW Corporation provides information technology (IT) solutions in the United States, the United Kingdom, and Canada. It operates through three segments: Corporate, Small Business, and Public. The company offers discrete hardware and software products and services, as well as integrated IT solutions, including on-premise and cloud capabilities across hybrid infrastructure, digital experience, and security.

Featured Articles

Before you consider CDW, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CDW wasn't on the list.

While CDW currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.