abrdn plc raised its position in shares of The Carlyle Group Inc. (NASDAQ:CG - Free Report) by 58.5% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 71,044 shares of the financial services provider's stock after purchasing an additional 26,228 shares during the period. abrdn plc's holdings in The Carlyle Group were worth $3,059,000 as of its most recent filing with the Securities & Exchange Commission.

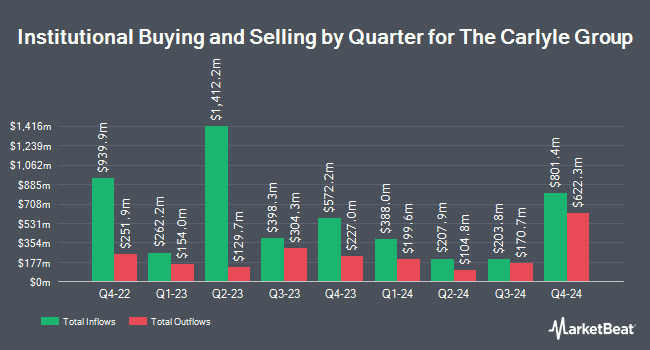

Other hedge funds and other institutional investors have also made changes to their positions in the company. Capital World Investors raised its stake in shares of The Carlyle Group by 0.4% during the 1st quarter. Capital World Investors now owns 20,053,012 shares of the financial services provider's stock worth $940,687,000 after acquiring an additional 79,681 shares in the last quarter. William Blair Investment Management LLC increased its position in shares of The Carlyle Group by 6.5% during the first quarter. William Blair Investment Management LLC now owns 11,819,403 shares of the financial services provider's stock worth $554,448,000 after purchasing an additional 721,608 shares in the last quarter. Ariel Investments LLC lifted its holdings in shares of The Carlyle Group by 1.1% during the 2nd quarter. Ariel Investments LLC now owns 4,937,725 shares of the financial services provider's stock valued at $198,250,000 after purchasing an additional 54,805 shares during the last quarter. Capital International Investors purchased a new position in The Carlyle Group during the 1st quarter worth $142,511,000. Finally, Bank of New York Mellon Corp increased its position in The Carlyle Group by 2.1% during the 2nd quarter. Bank of New York Mellon Corp now owns 2,727,870 shares of the financial services provider's stock valued at $109,524,000 after buying an additional 55,662 shares in the last quarter. Institutional investors own 55.88% of the company's stock.

Insiders Place Their Bets

In other news, major shareholder Carlyle Group Inc. sold 924,466 shares of The Carlyle Group stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $2.14, for a total value of $1,978,357.24. Following the sale, the insider now directly owns 3,643,231 shares of the company's stock, valued at $7,796,514.34. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. In the last three months, insiders sold 1,754,194 shares of company stock worth $6,809,705. Corporate insiders own 27.20% of the company's stock.

Analyst Ratings Changes

A number of brokerages have recently weighed in on CG. Morgan Stanley boosted their price target on The Carlyle Group from $46.00 to $50.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 10th. Evercore ISI raised their price target on shares of The Carlyle Group from $45.00 to $47.00 and gave the stock an "in-line" rating in a report on Monday, October 14th. TD Cowen boosted their price objective on shares of The Carlyle Group from $41.00 to $42.00 and gave the company a "hold" rating in a report on Tuesday, August 6th. UBS Group raised their target price on The Carlyle Group from $43.00 to $54.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 22nd. Finally, Wells Fargo & Company increased their price objective on The Carlyle Group from $42.00 to $48.00 and gave the company an "equal weight" rating in a report on Wednesday, October 9th. Nine analysts have rated the stock with a hold rating and six have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $51.33.

Read Our Latest Report on CG

The Carlyle Group Price Performance

Shares of The Carlyle Group stock traded down $0.86 on Monday, reaching $49.06. The company's stock had a trading volume of 1,204,456 shares, compared to its average volume of 2,299,791. The Carlyle Group Inc. has a 52-week low of $28.44 and a 52-week high of $52.73. The company has a market capitalization of $17.48 billion, a P/E ratio of -43.78, a PEG ratio of 1.27 and a beta of 1.70. The company has a quick ratio of 2.55, a current ratio of 2.55 and a debt-to-equity ratio of 1.75. The stock has a 50-day moving average price of $44.48 and a 200-day moving average price of $43.19.

The Carlyle Group (NASDAQ:CG - Get Free Report) last announced its earnings results on Monday, August 5th. The financial services provider reported $0.78 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.83 by ($0.05). The company had revenue of $1.07 billion during the quarter, compared to analyst estimates of $808.73 million. The Carlyle Group had a negative net margin of 11.67% and a positive return on equity of 24.30%. The firm's revenue for the quarter was up 131.5% compared to the same quarter last year. During the same quarter last year, the business earned $0.88 EPS. Analysts expect that The Carlyle Group Inc. will post 3.71 EPS for the current year.

About The Carlyle Group

(

Free Report)

The Carlyle Group Inc is an investment firm specializing in direct and fund of fund investments. Within direct investments, it specializes in management-led/ Leveraged buyouts, privatizations, divestitures, strategic minority equity investments, structured credit, global distressed and corporate opportunities, small and middle market, equity private placements, consolidations and buildups, senior debt, mezzanine and leveraged finance, and venture and growth capital financings, seed/startup, early venture, emerging growth, turnaround, mid venture, late venture, PIPES.

Featured Articles

Before you consider The Carlyle Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Carlyle Group wasn't on the list.

While The Carlyle Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.