Pinnacle Associates Ltd. trimmed its position in shares of Cognex Co. (NASDAQ:CGNX - Free Report) by 14.8% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 516,506 shares of the scientific and technical instruments company's stock after selling 89,410 shares during the period. Pinnacle Associates Ltd. owned 0.30% of Cognex worth $21,559,000 at the end of the most recent reporting period.

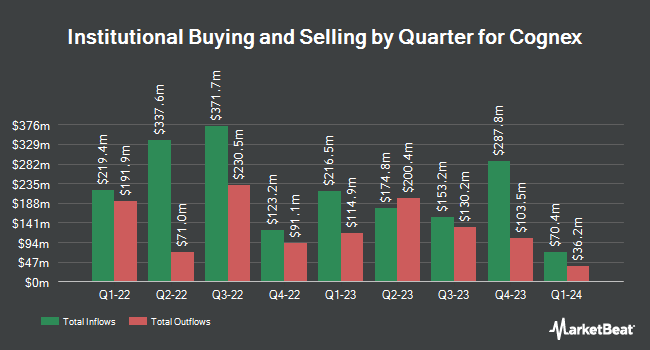

Other institutional investors and hedge funds have also recently modified their holdings of the company. Riverview Trust Co purchased a new stake in Cognex in the 3rd quarter worth $25,000. BI Asset Management Fondsmaeglerselskab A S raised its stake in Cognex by 303.1% during the 1st quarter. BI Asset Management Fondsmaeglerselskab A S now owns 770 shares of the scientific and technical instruments company's stock valued at $33,000 after purchasing an additional 579 shares during the period. GAMMA Investing LLC lifted its holdings in Cognex by 276.1% in the 2nd quarter. GAMMA Investing LLC now owns 1,087 shares of the scientific and technical instruments company's stock worth $51,000 after purchasing an additional 798 shares in the last quarter. Point72 Hong Kong Ltd bought a new position in Cognex in the 2nd quarter worth approximately $55,000. Finally, Signaturefd LLC grew its holdings in Cognex by 43.2% during the 2nd quarter. Signaturefd LLC now owns 1,704 shares of the scientific and technical instruments company's stock valued at $80,000 after buying an additional 514 shares in the last quarter. 88.12% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

CGNX has been the topic of several research analyst reports. Robert W. Baird lowered their target price on shares of Cognex from $46.00 to $42.00 and set a "neutral" rating on the stock in a report on Monday, August 5th. Stephens raised shares of Cognex from an "equal weight" rating to an "overweight" rating and increased their price objective for the company from $45.00 to $55.00 in a report on Wednesday, October 16th. StockNews.com upgraded Cognex from a "sell" rating to a "hold" rating in a research report on Friday, August 9th. The Goldman Sachs Group decreased their target price on Cognex from $45.00 to $39.00 and set a "sell" rating on the stock in a research report on Friday, August 2nd. Finally, Needham & Company LLC raised their price target on Cognex from $48.00 to $57.00 and gave the company a "buy" rating in a report on Monday, July 29th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $50.00.

View Our Latest Research Report on CGNX

Cognex Price Performance

Shares of CGNX traded down $0.14 during midday trading on Wednesday, hitting $40.46. The stock had a trading volume of 1,140,933 shares, compared to its average volume of 1,276,616. Cognex Co. has a 1 year low of $34.28 and a 1 year high of $53.13. The stock's 50 day moving average is $39.34 and its 200 day moving average is $42.95. The firm has a market cap of $6.95 billion, a PE ratio of 70.00 and a beta of 1.41.

Cognex (NASDAQ:CGNX - Get Free Report) last announced its quarterly earnings data on Wednesday, July 31st. The scientific and technical instruments company reported $0.17 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.14 by $0.03. The business had revenue of $239.00 million during the quarter, compared to the consensus estimate of $240.33 million. Cognex had a net margin of 9.29% and a return on equity of 4.97%. The firm's quarterly revenue was down 1.6% compared to the same quarter last year. During the same quarter last year, the firm earned $0.32 earnings per share. As a group, equities research analysts expect that Cognex Co. will post 0.44 earnings per share for the current fiscal year.

Cognex Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Investors of record on Thursday, November 14th will be paid a dividend of $0.08 per share. This is a positive change from Cognex's previous quarterly dividend of $0.08. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.79%. Cognex's dividend payout ratio (DPR) is currently 51.72%.

Insider Activity at Cognex

In other Cognex news, Director Dianne M. Parrotte bought 2,000 shares of the firm's stock in a transaction dated Wednesday, August 7th. The stock was acquired at an average cost of $38.62 per share, for a total transaction of $77,240.00. Following the completion of the transaction, the director now owns 11,340 shares in the company, valued at $437,950.80. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In related news, Director Dianne M. Parrotte bought 2,000 shares of Cognex stock in a transaction dated Wednesday, August 7th. The shares were acquired at an average cost of $38.62 per share, with a total value of $77,240.00. Following the completion of the transaction, the director now owns 11,340 shares in the company, valued at $437,950.80. The trade was a 0.00 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CFO Dennis Fehr purchased 6,570 shares of the stock in a transaction that occurred on Wednesday, September 4th. The stock was purchased at an average price of $38.04 per share, with a total value of $249,922.80. Following the acquisition, the chief financial officer now directly owns 6,570 shares of the company's stock, valued at $249,922.80. The disclosure for this purchase can be found here. 1.10% of the stock is owned by company insiders.

Cognex Company Profile

(

Free Report)

Cognex Corporation provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide. Its machine vision products are used to automate the manufacturing and tracking of discrete items, including mobile phones, electric vehicle batteries, and e-commerce packages by locating, identifying, inspecting, and measuring them during the manufacturing or distribution process.

Read More

Before you consider Cognex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognex wasn't on the list.

While Cognex currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.