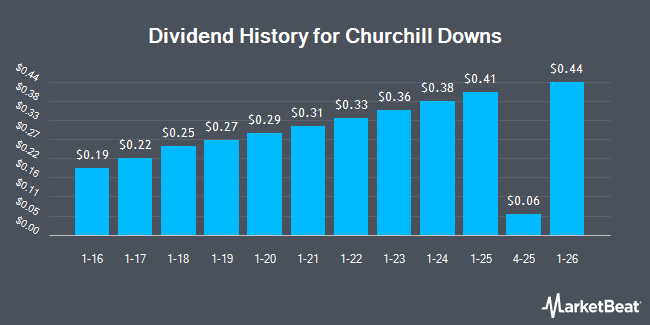

Churchill Downs Incorporated (NASDAQ:CHDN - Get Free Report) declared an annual dividend on Wednesday, October 23rd, Zacks reports. Shareholders of record on Friday, December 6th will be given a dividend of 0.409 per share on Friday, January 3rd. This represents a yield of 0.29%. The ex-dividend date is Friday, December 6th. This is an increase from Churchill Downs's previous annual dividend of $0.38.

Churchill Downs has raised its dividend payment by an average of 7.1% annually over the last three years and has raised its dividend annually for the last 13 consecutive years. Churchill Downs has a payout ratio of 5.3% indicating that its dividend is sufficiently covered by earnings. Research analysts expect Churchill Downs to earn $7.29 per share next year, which means the company should continue to be able to cover its $0.38 annual dividend with an expected future payout ratio of 5.2%.

Churchill Downs Trading Up 0.1 %

Shares of CHDN traded up $0.11 during trading on Friday, reaching $140.25. 945,297 shares of the company traded hands, compared to its average volume of 431,248. The stock has a 50-day simple moving average of $137.75 and a 200-day simple moving average of $135.71. The stock has a market cap of $10.31 billion, a PE ratio of 31.17, a price-to-earnings-growth ratio of 2.06 and a beta of 0.97. Churchill Downs has a twelve month low of $106.45 and a twelve month high of $146.64. The company has a quick ratio of 0.57, a current ratio of 0.57 and a debt-to-equity ratio of 4.65.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The company reported $0.97 earnings per share for the quarter, beating the consensus estimate of $0.96 by $0.01. Churchill Downs had a net margin of 15.61% and a return on equity of 47.53%. The firm had revenue of $628.50 million during the quarter, compared to the consensus estimate of $627.90 million. During the same quarter last year, the firm earned $0.87 EPS. The firm's revenue for the quarter was up 9.8% on a year-over-year basis. On average, analysts anticipate that Churchill Downs will post 6.13 earnings per share for the current year.

Analyst Ratings Changes

Several equities analysts have weighed in on CHDN shares. Wells Fargo & Company lifted their target price on Churchill Downs from $161.00 to $168.00 and gave the company an "overweight" rating in a research report on Thursday, October 17th. Truist Financial reaffirmed a "buy" rating and set a $165.00 target price (down from $166.00) on shares of Churchill Downs in a research note on Friday. Macquarie increased their target price on shares of Churchill Downs from $154.00 to $162.00 and gave the stock an "outperform" rating in a report on Friday, July 26th. Mizuho dropped their price target on shares of Churchill Downs from $157.00 to $151.00 and set an "outperform" rating for the company in a research note on Tuesday. Finally, StockNews.com upgraded Churchill Downs from a "sell" rating to a "hold" rating in a research note on Friday, August 2nd. One analyst has rated the stock with a hold rating and eight have assigned a buy rating to the stock. Based on data from MarketBeat.com, Churchill Downs has a consensus rating of "Moderate Buy" and a consensus price target of $160.88.

Read Our Latest Research Report on Churchill Downs

Churchill Downs Company Profile

(

Get Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Further Reading

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.