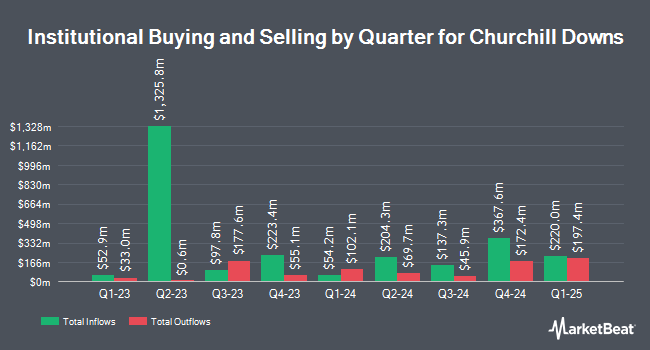

Artemis Investment Management LLP trimmed its position in Churchill Downs Incorporated (NASDAQ:CHDN - Free Report) by 2.3% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 339,194 shares of the company's stock after selling 7,880 shares during the period. Artemis Investment Management LLP owned approximately 0.46% of Churchill Downs worth $45,862,000 at the end of the most recent quarter.

Other hedge funds have also modified their holdings of the company. Jennison Associates LLC grew its holdings in shares of Churchill Downs by 5.6% in the 1st quarter. Jennison Associates LLC now owns 847,847 shares of the company's stock valued at $104,921,000 after acquiring an additional 44,773 shares in the last quarter. Westfield Capital Management Co. LP raised its stake in shares of Churchill Downs by 12.6% during the 1st quarter. Westfield Capital Management Co. LP now owns 423,521 shares of the company's stock worth $52,411,000 after purchasing an additional 47,269 shares in the last quarter. Balyasny Asset Management L.P. boosted its holdings in shares of Churchill Downs by 113.8% in the 4th quarter. Balyasny Asset Management L.P. now owns 463,555 shares of the company's stock valued at $62,547,000 after buying an additional 246,769 shares during the last quarter. Goldman Sachs Group Inc. grew its stake in shares of Churchill Downs by 6.6% in the fourth quarter. Goldman Sachs Group Inc. now owns 151,377 shares of the company's stock valued at $20,425,000 after buying an additional 9,354 shares in the last quarter. Finally, Harbor Capital Advisors Inc. grew its stake in shares of Churchill Downs by 259.3% in the second quarter. Harbor Capital Advisors Inc. now owns 19,857 shares of the company's stock valued at $2,772,000 after buying an additional 14,331 shares in the last quarter. 82.59% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of analysts have commented on the stock. StockNews.com upgraded shares of Churchill Downs from a "sell" rating to a "hold" rating in a research note on Friday, August 2nd. Macquarie lifted their price target on Churchill Downs from $154.00 to $162.00 and gave the stock an "outperform" rating in a report on Friday, July 26th. Mizuho boosted their price target on Churchill Downs from $143.00 to $157.00 and gave the stock an "outperform" rating in a research report on Friday, July 26th. Stifel Nicolaus raised their price objective on Churchill Downs from $153.00 to $160.00 and gave the company a "buy" rating in a research report on Monday, July 22nd. Finally, Truist Financial reissued a "buy" rating and set a $166.00 target price (up from $165.00) on shares of Churchill Downs in a report on Friday, July 26th. One research analyst has rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to data from MarketBeat, Churchill Downs has an average rating of "Moderate Buy" and a consensus price target of $156.90.

Read Our Latest Stock Report on Churchill Downs

Churchill Downs Stock Performance

CHDN traded up $1.60 during trading on Wednesday, hitting $140.63. The stock had a trading volume of 468,037 shares, compared to its average volume of 429,025. The company has a debt-to-equity ratio of 4.65, a current ratio of 0.57 and a quick ratio of 0.57. The company has a 50 day moving average price of $137.07 and a 200-day moving average price of $134.59. Churchill Downs Incorporated has a one year low of $106.45 and a one year high of $146.64. The firm has a market cap of $10.34 billion, a price-to-earnings ratio of 31.32, a P/E/G ratio of 2.01 and a beta of 0.97.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last released its quarterly earnings results on Wednesday, July 24th. The company reported $2.89 EPS for the quarter, beating the consensus estimate of $2.71 by $0.18. The business had revenue of $890.70 million for the quarter, compared to the consensus estimate of $858.59 million. Churchill Downs had a net margin of 15.61% and a return on equity of 47.53%. Churchill Downs's revenue was up 15.9% compared to the same quarter last year. During the same period in the prior year, the company posted $2.24 earnings per share. As a group, research analysts predict that Churchill Downs Incorporated will post 6.13 EPS for the current year.

Churchill Downs Profile

(

Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; and casino gaming.

Featured Articles

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.