Exchange Traded Concepts LLC cut its stake in shares of Churchill Downs Incorporated (NASDAQ:CHDN - Free Report) by 21.0% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 29,705 shares of the company's stock after selling 7,915 shares during the quarter. Exchange Traded Concepts LLC's holdings in Churchill Downs were worth $4,016,000 at the end of the most recent reporting period.

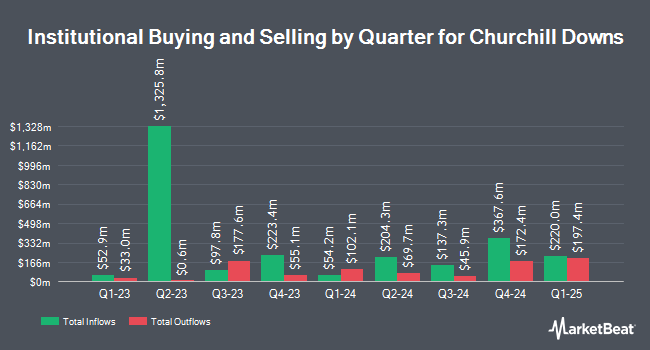

A number of other hedge funds also recently made changes to their positions in the stock. Goldman Sachs Group Inc. boosted its stake in Churchill Downs by 6.6% in the 4th quarter. Goldman Sachs Group Inc. now owns 151,377 shares of the company's stock worth $20,425,000 after purchasing an additional 9,354 shares during the period. Vanguard Group Inc. boosted its stake in Churchill Downs by 0.6% in the 4th quarter. Vanguard Group Inc. now owns 6,726,402 shares of the company's stock worth $907,593,000 after purchasing an additional 37,065 shares during the period. Park Avenue Securities LLC boosted its stake in Churchill Downs by 3.7% in the 1st quarter. Park Avenue Securities LLC now owns 8,394 shares of the company's stock worth $1,039,000 after purchasing an additional 301 shares during the period. Independence Bank of Kentucky boosted its position in shares of Churchill Downs by 80.5% during the 1st quarter. Independence Bank of Kentucky now owns 12,254 shares of the company's stock valued at $1,516,000 after acquiring an additional 5,464 shares during the last quarter. Finally, Guidance Capital Inc. boosted its position in shares of Churchill Downs by 2.5% during the 1st quarter. Guidance Capital Inc. now owns 11,768 shares of the company's stock valued at $1,438,000 after acquiring an additional 284 shares during the last quarter. 82.59% of the stock is currently owned by institutional investors.

Churchill Downs Trading Down 0.3 %

CHDN stock traded down $0.38 during midday trading on Monday, reaching $138.69. The company's stock had a trading volume of 388,911 shares, compared to its average volume of 429,269. The company has a debt-to-equity ratio of 4.65, a quick ratio of 0.57 and a current ratio of 0.57. The stock has a fifty day simple moving average of $137.31 and a two-hundred day simple moving average of $135.05. Churchill Downs Incorporated has a 1 year low of $106.45 and a 1 year high of $146.64. The firm has a market capitalization of $10.19 billion, a price-to-earnings ratio of 30.89, a PEG ratio of 2.06 and a beta of 0.97.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last released its earnings results on Wednesday, July 24th. The company reported $2.89 earnings per share for the quarter, topping analysts' consensus estimates of $2.71 by $0.18. Churchill Downs had a return on equity of 47.53% and a net margin of 15.61%. The business had revenue of $890.70 million for the quarter, compared to analyst estimates of $858.59 million. During the same quarter last year, the firm posted $2.24 earnings per share. The business's revenue was up 15.9% compared to the same quarter last year. On average, equities research analysts predict that Churchill Downs Incorporated will post 6.13 EPS for the current year.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on the company. StockNews.com upgraded Churchill Downs from a "sell" rating to a "hold" rating in a research report on Friday, August 2nd. Macquarie increased their target price on Churchill Downs from $154.00 to $162.00 and gave the company an "outperform" rating in a research report on Friday, July 26th. Wells Fargo & Company increased their target price on Churchill Downs from $150.00 to $161.00 and gave the company an "overweight" rating in a research report on Friday, July 26th. Bank of America upgraded Churchill Downs from a "neutral" rating to a "buy" rating and increased their target price for the company from $145.00 to $155.00 in a research report on Monday, August 12th. Finally, JMP Securities restated a "market outperform" rating and set a $166.00 price target on shares of Churchill Downs in a report on Monday. One research analyst has rated the stock with a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $158.33.

Read Our Latest Research Report on Churchill Downs

Churchill Downs Company Profile

(

Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Read More

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.