Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) had its price target upped by equities researchers at JPMorgan Chase & Co. from $180.00 to $210.00 in a research note issued on Monday, Benzinga reports. The firm presently has a "neutral" rating on the technology company's stock. JPMorgan Chase & Co.'s price target would indicate a potential upside of 0.98% from the stock's previous close.

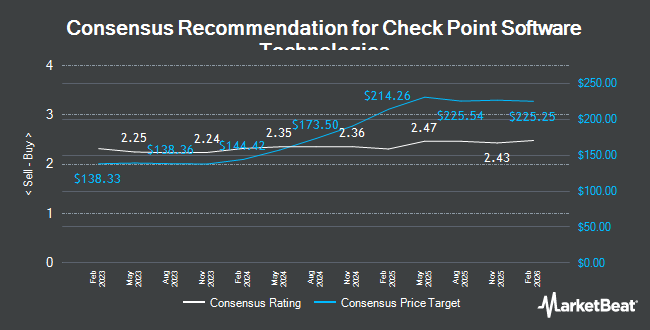

A number of other equities research analysts also recently commented on CHKP. Wedbush lifted their target price on Check Point Software Technologies from $200.00 to $230.00 and gave the stock an "outperform" rating in a report on Wednesday, October 9th. Royal Bank of Canada raised their target price on shares of Check Point Software Technologies from $165.00 to $187.00 and gave the stock a "sector perform" rating in a report on Thursday, July 25th. Needham & Company LLC restated a "hold" rating on shares of Check Point Software Technologies in a research note on Thursday, July 25th. Truist Financial upped their price objective on Check Point Software Technologies from $200.00 to $220.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. Finally, Barclays lifted their target price on shares of Check Point Software Technologies from $175.00 to $192.00 and gave the company an "equal weight" rating in a report on Thursday, July 25th. Fifteen research analysts have rated the stock with a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat, Check Point Software Technologies has a consensus rating of "Hold" and an average price target of $196.33.

Get Our Latest Research Report on Check Point Software Technologies

Check Point Software Technologies Trading Up 0.4 %

Shares of NASDAQ:CHKP traded up $0.80 on Monday, hitting $207.96. 1,065,550 shares of the company were exchanged, compared to its average volume of 676,739. The firm has a market capitalization of $23.48 billion, a P/E ratio of 28.88, a price-to-earnings-growth ratio of 3.17 and a beta of 0.62. Check Point Software Technologies has a 1-year low of $126.57 and a 1-year high of $210.70. The stock's 50 day moving average price is $195.73 and its 200 day moving average price is $174.56.

Institutional Investors Weigh In On Check Point Software Technologies

Large investors have recently modified their holdings of the business. New York State Common Retirement Fund raised its holdings in Check Point Software Technologies by 8.9% in the 3rd quarter. New York State Common Retirement Fund now owns 298,547 shares of the technology company's stock valued at $57,563,000 after acquiring an additional 24,421 shares during the last quarter. Principal Securities Inc. increased its holdings in shares of Check Point Software Technologies by 6.8% during the 3rd quarter. Principal Securities Inc. now owns 28,352 shares of the technology company's stock worth $5,467,000 after buying an additional 1,810 shares during the last quarter. Integrated Advisors Network LLC purchased a new position in Check Point Software Technologies in the third quarter worth approximately $210,000. Boston Financial Mangement LLC acquired a new stake in Check Point Software Technologies during the third quarter worth $231,000. Finally, abrdn plc raised its holdings in Check Point Software Technologies by 40.5% in the 3rd quarter. abrdn plc now owns 18,460 shares of the technology company's stock valued at $3,559,000 after buying an additional 5,321 shares during the period. Hedge funds and other institutional investors own 87.62% of the company's stock.

Check Point Software Technologies Company Profile

(

Get Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Recommended Stories

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.